Analyst Griffiths sets THETA target at $15, citing Fibonacci extensions and past cycle highs.

THETA’s monthly chart forms a cup-and-handle pattern, hinting at a potential long-term breakout.

THETA’s 2025 forecast spans $0.50–$25, driven by BTC halving hype and institutional adoption.

Theta Network (THETA) Overview

| Cryptocurrency | Theta Network |

| Ticker | THETA |

| Current Price | $1.32 |

| Price Change (30D) | -33.99% |

| Price Change (1Y) | +30.38% |

| Market Cap | $1.32 Billion |

| Circulating Supply | 1 Billion |

| All-Time High | $15.90 |

| All-Time Low | $0.03977 |

| Total Supply | 1 Billion |

What is Theta Network (THETA)?

Theta Network is a blockchain-powered platform revolutionizing AI, media, and entertainment through decentralized cloud computing. Unlike traditional centralized networks, Theta operates on a dual-layer system: the Theta Edge Network, which provides vast computing power for AI, video rendering, and streaming, and the Theta Blockchain, which enables payments, rewards, and smart contract functionalities.

By leveraging decentralized computing, Theta eliminates the inefficiencies of traditional content delivery networks (CDNs). Instead of relying on centralized servers, users can share their bandwidth and GPU power to enhance streaming quality while earning TFUEL tokens in return.

Major tech giants like Google and Samsung have joined as validator nodes, underscoring Theta’s industry credibility. At its heart, Theta’s ecosystem is powered by two native tokens: THETA, used for staking and governance, and TFUEL, which fuels transactions and micropayments. With a fixed supply of 1 billion THETA, scarcity drives its long-term value.

Building on this strong foundation, 2025 marks a transformative year for Theta as it prepares to launch its EdgeCloud hybrid edge computing platform. This upgrade will introduce AI-driven job orchestration, on-chain AI agents, and enhanced GPU processing.

Furthermore, partnerships in professional sports, esports, and academia will drive adoption, solidifying Theta as a leader in decentralized cloud services. With its expanding real-world utility and increasing demand for blockchain-powered AI solutions, THETA’s price could see significant upside, making it a compelling asset for investors and tech innovators.

Let’s dive into THETA’s future price trajectory in this CryptoTale price prediction.

Theta Network Price History

THETA’s price history has moved through distinct phases, from early accumulation to a parabolic rally, followed by a prolonged correction and consolidation. Initially, THETA traded at low levels with minimal volatility until late 2020, when its price staged a massive breakout.

By April 2021, THETA reached its all-time high of $15.90, surging over 43,800% from its early accumulation phase. Following this peak, THETA retraced nearly 96%, finding support in the $1.18–$0.72 range.

Source: TradingView

Multiple failed breakout attempts at the $4.38–$3.81 resistance zone resulted in continued consolidation. This phase saw THETA forming a symmetrical triangle pattern, a technical structure known for signaling an eventual breakout. A cup-and-handle formation also emerged within the price action, suggesting a likely uptrend pattern if the structure holds.

Assuming THETA bulls take control and stage a successful breakout, the next immediate target lies at the 23.6% Fibonacci retracement level of $3.77, aligning with historical resistance zones. A breakout above this level could push toward the 50% Fibonacci retracement level at $7.96, with the prospect of revisiting its previous highs.

However, bearish risks persist if THETA fails to break above the $4.38–$3.81 resistance range, leading to extended consolidation or a potential drop below the $1.18–$0.72 support zone.

Related: TRON Price Prediction 2025-35: Will It Hit $10 Soon?

THETA’s Bullish Breakout: Next Stop $15?

The THETA has broken out of a falling wedge pattern, reclaiming key support and signaling a possible bullish reversal. According to Moon Whales, this breakout sets the stage for further upside, with the following critical resistance at $1.75. The increasing trading volume supports this move, but a retest of $1.30 could offer an entry before the next leg up.

#THETA has broken out from the falling wedge pattern and reclaimed key support, signaling a bullish reversal! If momentum sustains, the next target is the $1.75 supply zone. Volume uptick supports the move, but a retest of $1.30 could offer an entry before the next leg up. Keep… pic.twitter.com/mNVrvStImP

— Moon Whales (@Moon_Whales_) February 10, 2025

Meanwhile, Andrew Griffiths provides a broader outlook, identifying the $1.18–$1.36 range as a crucial demand zone, aligning with key liquidity levels. He suggests that THETA is undergoing a classic accumulation phase, having completed a descending wedge structure, which typically marks a cycle low.

If this structure holds, a macro impulse wave could form, pushing THETA toward $3.02, $5.91, and ultimately $15.88, in line with Fibonacci extensions. Andrew’s chart analysis further reinforces this bullish perspective, showing that THETA is at a pivotal juncture.

Source: X

While a deeper liquidity sweep toward the external demand zone remains possible, this level presents a prime accumulation opportunity for long-term traders. For those strategizing their positions, Griffiths recommends scaling in at current levels, adding on dips, and securing profits at key resistance points while allowing the broader wave structure to develop.

Yearly Highs and Lows of Theta Network

| Year | Theta Network Price | |

| High | Low | |

| 2024 | $3.8161 | $0.8811 |

| 2023 | $1.4475 | $0.5626 |

| 2022 | $5.2349 | $0.7081 |

| 2021 | $15.90 | $1.4564 |

| 2020 | $1.8960 | $0.0362 |

| 2019 | $0.2029 | $0.0428 |

| 2018 | $0.3141 | $0.0395 |

Theta Network Technical Analysis

The MACD indicator on THETA’s monthly chart shows an impending bearish momentum, with the MACD line at 0.0154, signal line at -0.0631, and histogram value at 0.0785, indicating weakening bullish sentiment. The flattening histogram bars indicate sustained downward pressure in THETA’s long-term trend, signaling that bearish momentum is strengthening.

Source: TradingView

This is further supported by the approaching MACD bearish crossover, where the MACD line is approaching the signal line from above. If the crossover completes, it could confirm bearish dominance, reinforcing the likelihood of extended downside movement.

Similarly, the RSI sits at 47.82, below the neutral 50 level, suggesting THETA is neither overbought nor oversold but leans on a mild-bearish sentiment. This RSI’s positioning hints at ample space for volatility in either direction. However, a move above 50.85, the RSI’s signal line, could signal renewed bullish strength, while a drop below 40 may confirm further downside risk.

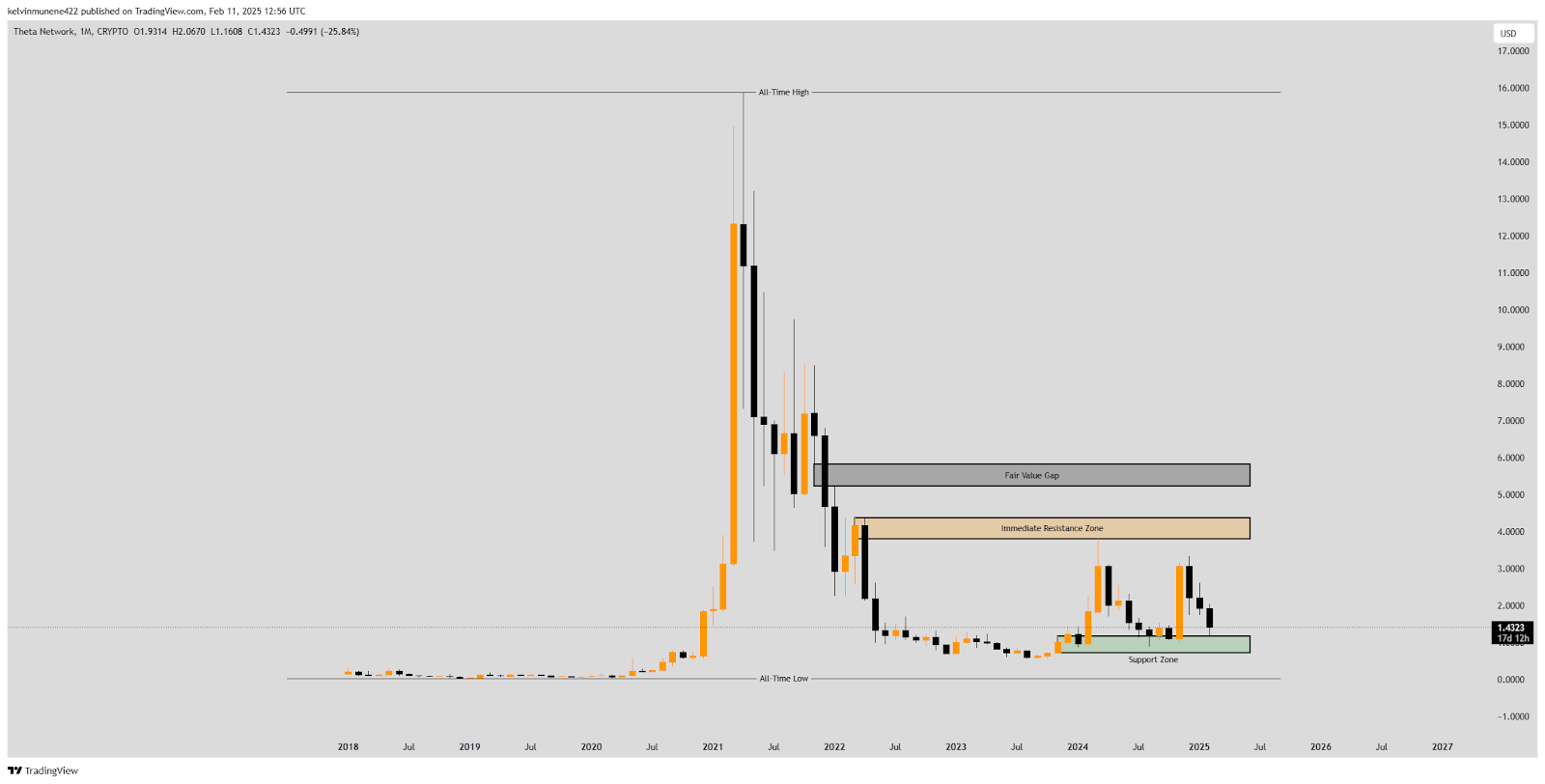

Theta Network (THETA) Price Forecast Based on Fair Value Gap

The Fair Value Gap on THETA’s monthly chart is between $5.82 and $5.23, marking an area of inefficiency where the token’s price moved too quickly without establishing strong support or resistance levels. Historically, assets tend to revisit such gaps to rebalance liquidity, making this zone a probable upside target if THETA breaks out from its current consolidation phase.

Source: TradingView

At press time, THETA trades at $1.43. A confirmed breakout above its immediate resistance could open the path for a rally into the FVG range. At the same time, failure to reclaim it could result in a prolonged consolidation, keeping THETA’s price suppressed below the FVG.

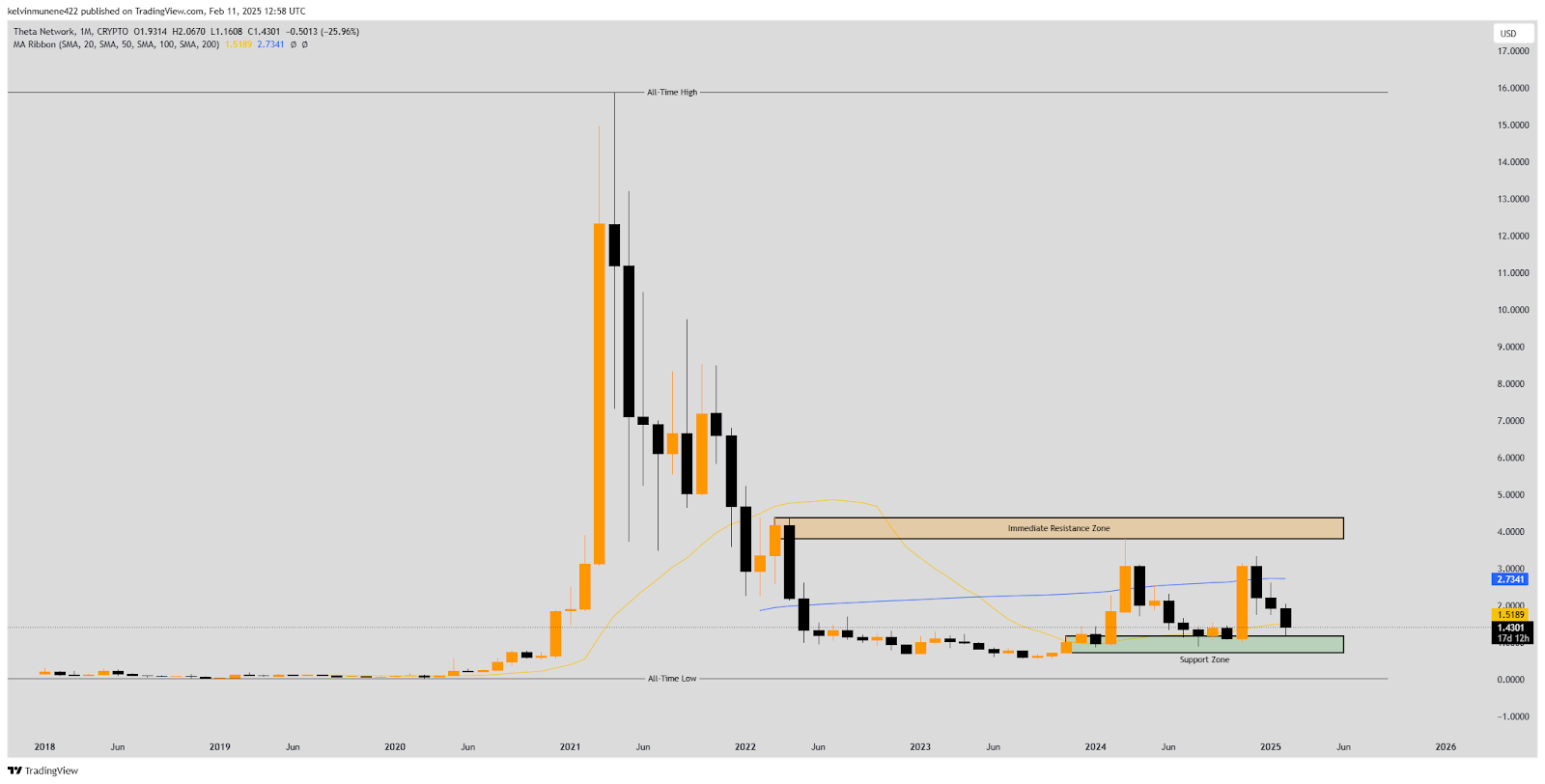

Theta Network (THETA) Price Forecast Based on MA Ribbon Analysis

The MA Ribbon on THETA’s monthly chart shows that the 20-month moving average (MA) at $1.5189 and the 50-month MA at $2.7341 act as dynamic resistance levels. The cryptocurrency’s price trades below these key moving averages, indicating continued bearish pressure and a lack of upward momentum.

Source: TradingView

Historically, price trades below these moving averages suggest strong resistance to bullish breakouts and a prolonged consolidation phase. In THETA’s case, a successful break above these regions could confirm a trend reversal in the long term. However, if the price fails to reclaim these moving averages, it may continue consolidating, delaying any potential upside move.

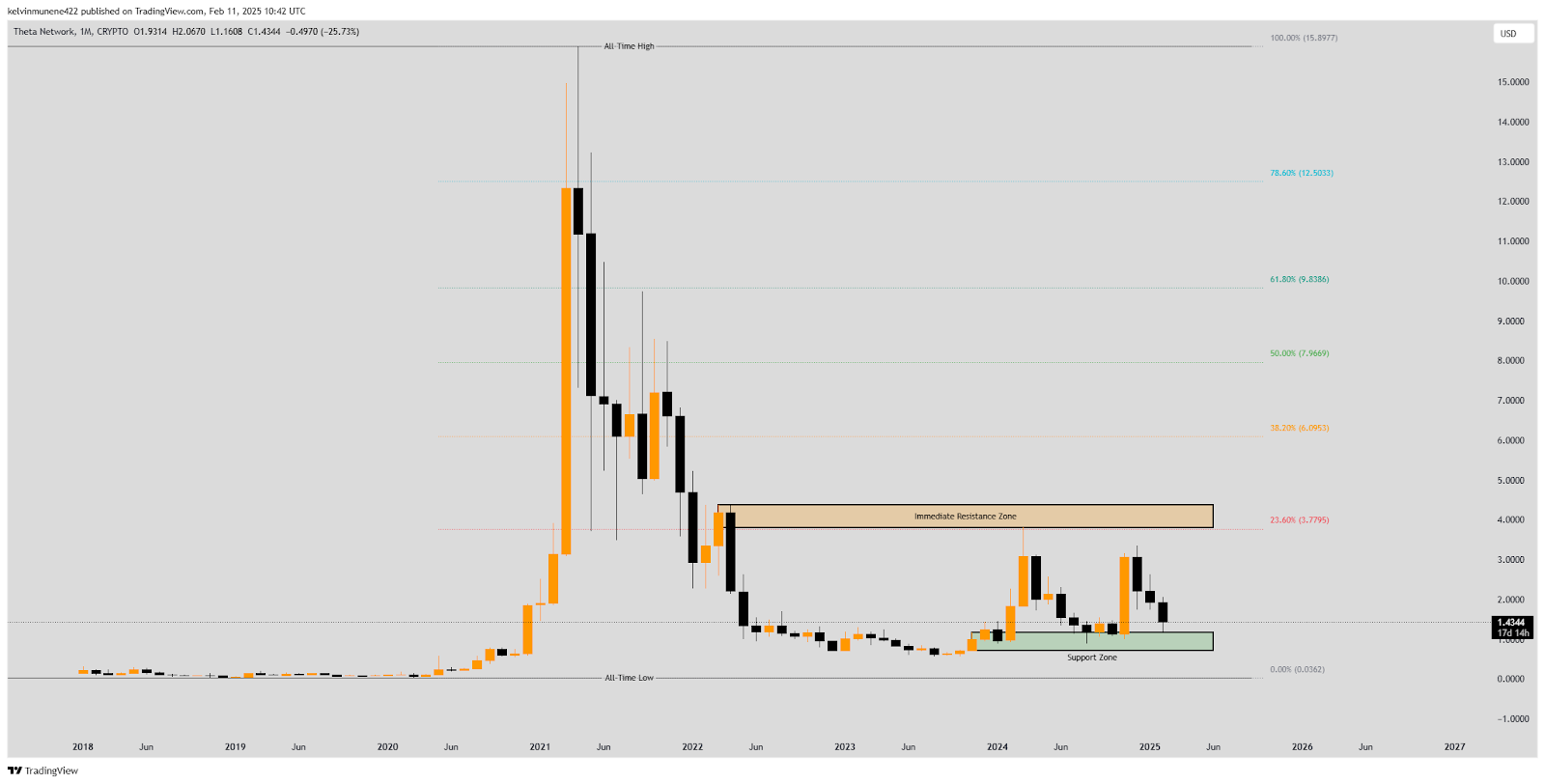

Theta Network (THETA) Price Forecast Based on Fib Analysis

According to the monthly chart, the THETA market favors the bears as the token trades below all key Fibonacci retracement levels. Assuming the bearish sentiment strengthens, the THETA cryptocurrency could target its all-time low, possibly exploring uncharted areas in extremely adverse conditions.

Source: TradingView

However, to the upside, the 23.6% retracement at $3.77 aligns with the immediate resistance zone, making it a critical breakout level. A break above this zone could push the THETA token toward the 38.2% retracement at $6.09 and the 50% retracement at $7.96, which serves as mid-term upside targets.

Moreover, the 61.8% retracement at $9.83, often considered the “golden ratio,” remains a key level that aligns with previous high-volume areas. A confirmed breakout above this range could propel THETA toward $12.50 (78.6% retracement) before targeting its all-time high of $15.90.

Theta Network (THETA) Price Prediction 2025

According to CryptoTale’s projections, THETA is expected to reach new highs, fueled by post-BTC halving hype. With increased institutional adoption, Theta’s EdgeCloud expansion, and AI-powered decentralized computing demand, THETA could trade between $0.50 and $25, surpassing previous ATH levels before facing market correction pressures.

Theta Network (THETA) Price Prediction 2026

Following the euphoric rally in 2025, CryptoTale’s forecast suggests THETA will enter a correction phase, retracing significantly due to profit-taking and overvaluation. The token could decline toward the $8—$15 range as the crypto market enters a post-peak recession and cooling phase.

Theta Network (THETA) Price Prediction 2027

THETA may experience further downside as the market completes its depression phase, potentially bottoming out between $5.50 and $10.50, reflecting historical bear cycle patterns. This phase often presents prime accumulation opportunities before the market starts recovering ahead of the next BTC halving.

Theta Network (THETA) Price Prediction 2028

With the upcoming BTC halving, THETA is expected to recover, gradually increasing investor confidence. As per CryptoTale’s analysis, renewed liquidity and capital inflows could push THETA between $25 and $50 as confidence in the crypto market matures.

Theta Network (THETA) Price Prediction 2029

As the crypto market enters another post-halving bull cycle, CryptoTale forecasts THETA could break previous mid-range resistances, surging between $45 and $90 as demand for decentralized cloud computing, AI, and Web3 media solutions grows.

Theta Network (THETA) Price Prediction 2030

Following a similar pattern to 2026, the market will likely undergo a significant correction, with THETA expected to decline to $30-$65 as overvaluation concerns and macroeconomic conditions trigger a price pullback across the crypto sector.

Theta Network (THETA) Price Prediction 2031

In line with previous cycle behavior, CryptoTale’s prediction places THETA in the accumulation phase, ranging between $25 and $50, as it consolidates before gradually recovering ahead of the 2032 BTC halving event.

Theta Network (THETA) Price Prediction 2032

With another BTC halving, historical data suggests THETA could start another rally, climbing toward $75-$150 as market optimism, institutional inflows, and broader adoption drive a strong uptrend across the crypto space.

Theta Network (THETA) Price Prediction 2033

Per CryptoTale’s historical analysis, THETA could see exponential gains, breaking past resistance levels to trade between $100 and $250, following past BTC halving-driven growth phases and increased global adoption of decentralized video and AI services.

Theta Network (THETA) Price Prediction 2034

With regulatory easing and market stabilization, THETA could surge between $200 and $350, fueled by institutional adoption and Web3 expansion. Increased decentralized computing demand may push Theta to new highs before the next cycle reset.

Theta Network (THETA) Price Prediction 2035

As the market completes another bull cycle, THETA may establish new highs between $300 and $500, contingent on continued adoption, AI-driven infrastructure advancements, and Web3’s mass-scale entertainment and decentralized computing integration.