KEY TAKEAWAYS

Its native coin, AR, reached a yearly high in August 2021 and has dropped since then.

The new AO supercomputer mainnet came out in February 2025.

Our Arweave price prediction says AR could fall as low as $2.73 this year.

Interested in buying or selling ARWEAVE AR coin? Read our review of the best exchanges to buy and sell ARWEAVE AR.

The storage coin Arweave broke past $40 in August 2024, thanks to interest after it acquired the Odysee social media app. Although the price of AR fell after that, it recovered in November, thanks to a flourishing crypto market.

However, it suffered a downturn, and not even the launch of its AO supercomputer mainnet could stop it from falling to around $9.15 on Feb. 12, 2025.

Let’s now examine our Arweave price prediction, made by CCN on Feb. 12, 2025. We’ll also examine Arweave’s price history and explain what it is and does.

Arweave Price Prediction

Let’s look at the AR price predictions made by CCN on Feb. 12, 2025. The projections will be made using the wave count method, adding and removing 20% to create the minimum and maximum targets.

| Minimum AR Price Prediction | Average AR Price Prediction | Maximum AR Price Prediction | |

|---|---|---|---|

| 2025 | $2.73 | $3.44 | $4.15 |

| 2026 | $2.15 | $2.70 | $3.25 |

| 2030 | $5.40 | $6.80 | $8.20 |

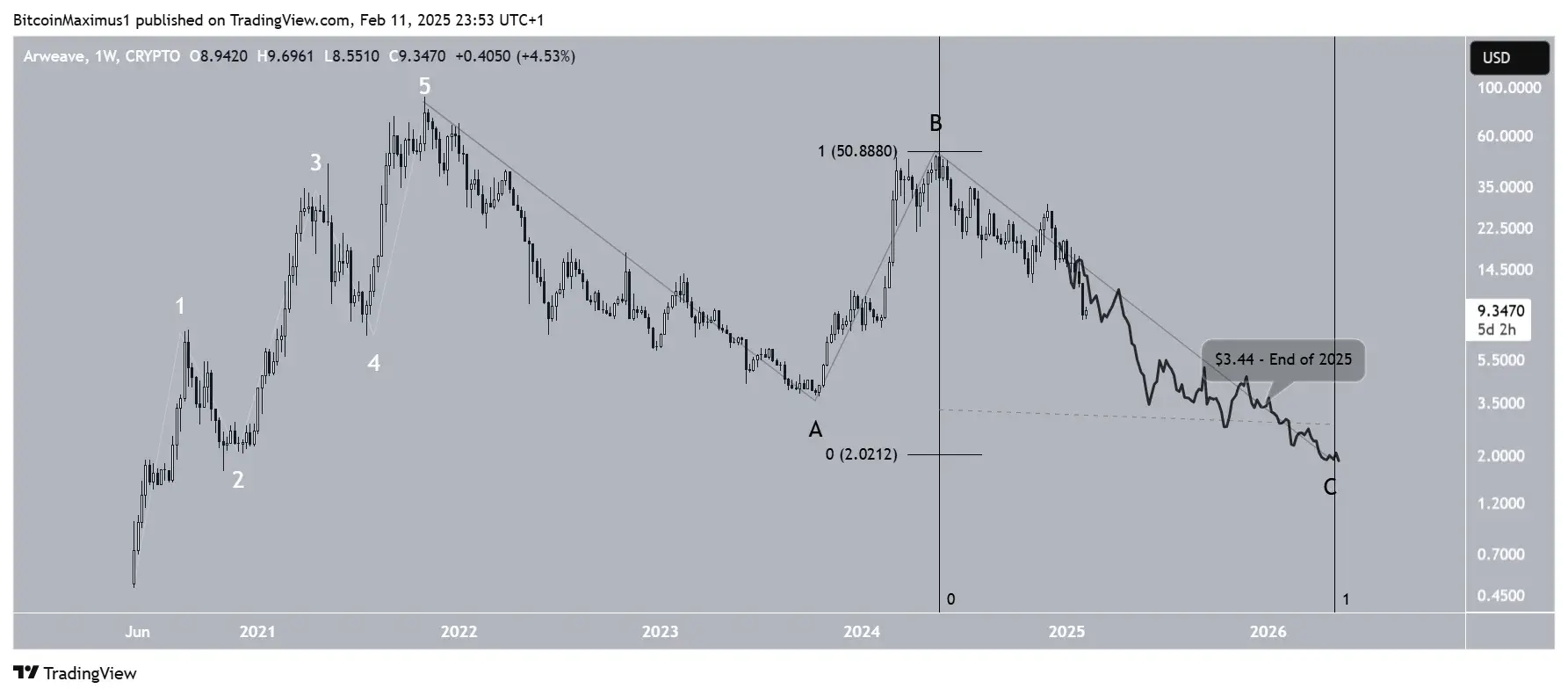

The most likely count shows that AR completed a five-wave upward movement (white) starting in June 2020 and ending with an all-time high price of $90.94. Since then, AR has fallen inside an A-B-C corrective structure and is currently in wave C.

Giving wave C the same length and duration as wave A leads to a low of $2.02 in April 2026. This could mark the end of the long-term correction, after which another upward movement is likely.

So, while short-term bounces could occur, the AR price will likely reach new lows in 2025. A breakdown from the $9 horizontal area will confirm this bearish outlook.

The wave count method gives an AR price prediction of $3.44 for the end of 2025.

Next, we will use the daily rate of increase from launch to the projected $2.02 bottom in April 2026 to make an AR prediction for the end of 2026 and 2030.

Doing so leads to targets of $2.70 and $6.80, respectively.

Arweave Price Prediction 2025

The wave count method predicts an AR price range between $2.73 and $4.15 by the end 2025.

Arweave Price Prediction 2026

The wave count method combined with the rate of increase gives an AR price prediction range between $2.15 and $3.25 for the end of 2026.

Arweave Price Prediction 2030

The wave count method, combined with the rate of increase, gives an AR price prediction range between $5.40 and $8.20 for the end of 2030.

Arweave Price Analysis

Since its cycle high of $49.76 in May 2024, the AR price has fallen inside a descending parallel channel. This decline was extremely bearish because it invalidated a breakout from the $40 horizontal resistance area, the final one before a new all-time high.

During its descent, the AR price has lost over 80% of its value, culminating with a low of $8.46 in February 2024. The fall caused a breakdown from the descending parallel channel, a sign that the correction is becoming steeper.

However, the AR price bounced at the $9 horizontal area, preventing a decisive breakdown.

Arweave’s trend will likely depend on whether the price reclaims the channel or breaks down below the $9 horizontal support area instead. The lack of support below it could lead to a quick and sharp drop to $4.

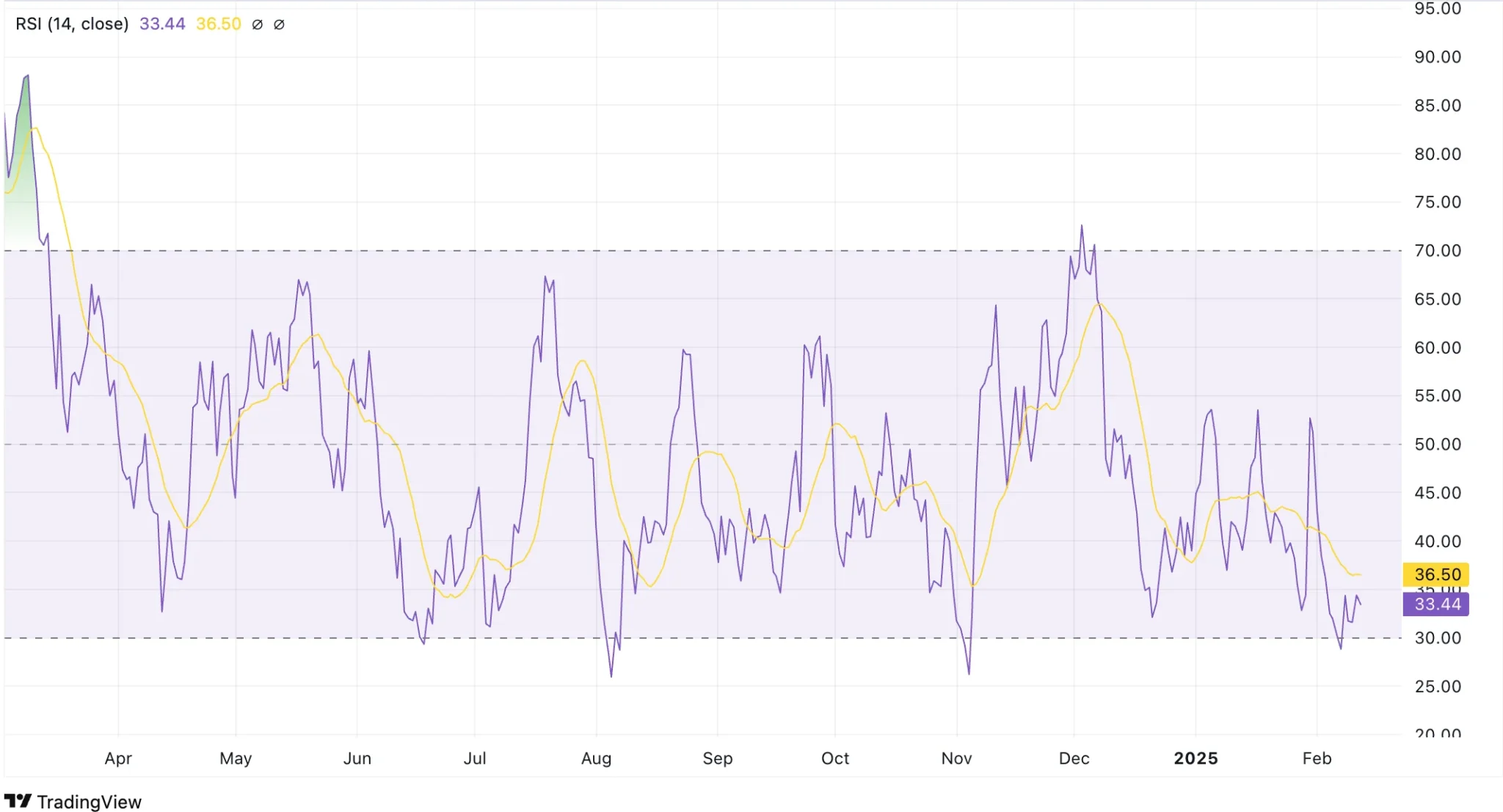

Technical indicators are bearish. The Relative Strength Index (RSI) and Moving Average Convergence/Divergence (MACD) are both decreasing and below their bearish thresholds.

The RSI has fallen below 50, while the MACD is negative and has made a bearish cross.

As a result, the weekly time frame leans bearish, though a breakdown below $9 is needed to confirm this.

Looking for a safe place to buy and sell ARWEAVE AR? See the leading platforms for buying and selling ARWEAVE AR

Short-Term Arweave Price Prediction

The AR price prediction for the next 24 hours is unclear, depending on whether the price reclaims its channel or falls below $9 instead.

Arweave Relative Strength Index (RSI): Is AR Overbought or Oversold?

The Relative Strength Index (RSI) is a momentum indicator traders use to determine whether an asset is overbought or oversold. Movements above and below the 50 line also indicate if the trend is bullish or bearish.

On Feb. 12, 2025, Arweave’s RSI was 33, indicating a bearish but not quite overbought sentiment.

Arweave Average True Range (ATR): AR Volatility

The Average True Range (ATR) measures market volatility by averaging the largest of three values: the current high minus the current low, the absolute value of the current high minus the previous close, and the absolute value of the current low minus the previous close over a period, typically 14 days. A rising ATR indicates increasing volatility, while a falling ATR indicates decreasing volatility. Since ATR values can be higher for higher-priced assets, normalize ATR by dividing it by the asset price to compare volatility across different price levels.

On Feb. 12, 2025, Arweave’s ATR was 1.5, suggesting relatively high volatility.

CCN Strength Index

The CCN Strength Index combines an array of advanced market signals to measure the strength of individual cryptocurrencies over the last 30 days.

Every day, it assigns a strength score, ranging from 0 to 100, to the top 500 assets by market capitalization on CoinMarketCap, focusing on both trend direction and the intensity of price movements.

0 to 24: Assets exhibit significant weakness, showing signs of sustained downtrend behavior.

25 to 35: The price tends to move within stable bounds with minimal volatility.

36 to 49: Assets begin a stable uptrend but without strong surges.

50 to 59: Consistent growth with moderate price advances, building momentum.

60+: Sharp price movements and high demand indicate stronger volatility and trend shifts.

The index dynamically adapts to rapid changes. For example, an asset experiencing a 100% increase within a short timeframe would see a sharp jump in its score to reflect the intensity of the rise.

However, should that asset stabilize at this new price level, the score will gradually taper down and align with the dampened momentum as the movement normalizes. The same principle applies to rapid declines: a sudden drop will spike the score downward, but as volatility decreases, the score will slowly adjust back up.

On Feb. 12, 2025, Arweave scored 41.8 on the CCN Index, suggesting moderate momentum.

Arweave Price Performance Comparisons

| Current Price | One Year Ago | Price Change | |

| Arweave | $9.15 | $9.01 | +1.55% |

| THORChain | $1.35 | $5.44 | -75.1% |

| Immutable | $0.7835 | $3.13 | -74.9% |

| Filecoin | $3.30 | $5.49 | -39.8% |

Best Days and Months to Buy Arweave

We looked at Arweave’s price history and found the lowest points on certain days, months, quarters, and even weeks in the year, suggesting the best times to buy AR.

| Day of the Week | Wednesday |

| Week | 35 |

| Month | August |

| Quarter | First |

AR Price History

Let’s look at some key dates in the Arweave price history. While past performance should never be taken as an indicator of future results, knowing what the token has done in the past can help give us some much-needed context when it comes to making an AR price prediction.

| Time Period | Arweave Price |

|---|---|

| Last week (Feb. 5, 2025) | $11.04 |

| Last month (Jan. 12, 2025) | $15.93 |

| Three months ago (Nov. 12, 2024) | $20.44 |

| One year ago (Feb. 12, 2024) | $9.01 |

| Launch price (May 27, 2020) | $0.4854 |

| All-time high (Nov. 5, 2021) | $90.94 |

| All-time low (May 27, 2020) | $0.4854 |

Arweave Market Cap

The market capitalization, or market cap, is the sum of the total AR in circulation multiplied by its price.

On Feb. 12, 2025, Arweave’s market cap was $505 million, making it the 105th-largest crypto by that metric.

Arweave Supply and Distribution Fact Box

| Supply and distribution | Figures |

|---|---|

| Maximum Supply | 66,000,000 |

| Circulating supply (as of Feb. 12, 2025) | 65,652,466 (99.47% of maximum supply) |

From the Arweave Whitepaper

In its technical documentation or whitepaper, Arweave describes the Arweave protocol as a new mechanism design-based approach to achieving a sustainable and permanent ledger of knowledge and history.

Arweave (AR) Explained

Arweave is a blockchain designed to help people store their data. The system, originally called Archain, was released in 2018. British computer scientists Sam Williams and William Jones founded it, and the AR coin powers it.

How Arweave Works

Arweave uses a consensus mechanism called Proof-of-Access (PoA). People who want to verify transactions and add blocks to the blockchain must check that a group of transactions contains a marker taken from an earlier group. If the marker is present, the transactions can be verified, and blocks can be added.

People who hold the AR coin can vote on changes to the Archain platform. The system’s miners – people who verify transactions – get AR as a reward. People can also buy, sell, and trade it on exchanges.

Is Arweave a Good Investment?

It is hard to say. AR has performed poorly recently, dropping from around $30 in early December. That said, Arweave allows people to store their data permanently, giving the platform a definite purpose. Also, the launch of the AO supercomputer mainnet could attract interest.

As always with crypto, you should do your own research before deciding whether or not to invest in AR.

Will Arweave go up or down?

No one can really tell right now. While the Arweave crypto price predictions are largely positive, price predictions have a well-earned reputation for being wrong. Keep in mind that prices can and do go down and up.

Should I invest in Arweave?

Before deciding whether to invest in Arweave, you will have to research AR and other similar coins and tokens, such as Filecoin (FIL) or Sia (SC). Either way, you must also ensure you never invest more money than you can afford to lose.