Somnia crypto aims to make blockchain data function like a live feed, rather than a slow database. The company introduced Data Streams, a new infrastructure layer, on Tuesday, which lets applications subscribe to on-chain state and receive live updates as transactions occur. But what does it mean for SOMI price prediction in Q4 2025?

The feature, announced on October 21, is designed for developers working on fast-moving applications, such as trading, gaming, and prediction markets, areas where traditional RPC systems often struggle to keep up.

A public waitlist opened the same day, with phased rollouts expected in the coming months.

Today, most apps rely on indexers or APIs that constantly query the blockchain. Somnia’s approach flips that model.

Instead of pulling data repeatedly, Data Streams will push updates directly to clients the moment state changes occur. The company says this can lower costs and simplify infrastructure for builders.

What Is Somnia’s Data Streams and How Does It Work?

The first rollout will introduce subscription-based RPCs, followed by what Somnia calls “full on-chain reactivity” early next year.

In its technical documentation, Somnia claims its Layer-1 network offers sub-second finality and has achieved seven-figure transaction throughput in tests, setting the stage for real-time consumer use cases.

Mainnet is already live, and the team describes Data Streams as the next step toward a faster, web2-like developer experience in Web3.

Early marketing for Somnia’s new product focuses on simplicity. The product page says Data Streams “turns on-chain state into live application data,” offering straightforward APIs that let developers read, write, and subscribe to updates.

The site invites builders to “join the waitlist” as public access rolls out.

Somnia is also outlining where the tool could make a difference.

In prediction markets, event feeds could adjust odds and settle results instantly. In insurance, payouts can be triggered automatically once verified data meets preset thresholds.

These examples were included in the company’s launch materials, released on Tuesday.

In a recent post on X, Somnia stated that Data Streams aims to “bring web2 database performance to web3” and to remove “delays and complexity” from blockchain app development.

Somnia Data Streams launches soon!

A new technology that brings web2 database performance to web3, making it possible to build real-time blockchain applications that can serve millions of users.? pic.twitter.com/B6bhEIWJp1

— Somnia (@Somnia_Network) October 16, 2025

The message is consistent: Somnia wants developers to think of blockchain data as live, responsive, and easy to work with, not something trapped behind technical friction.

SOMI Price Prediction: Is SOMI/USDT Showing Signs of Accumulation After Weeks of Decline?

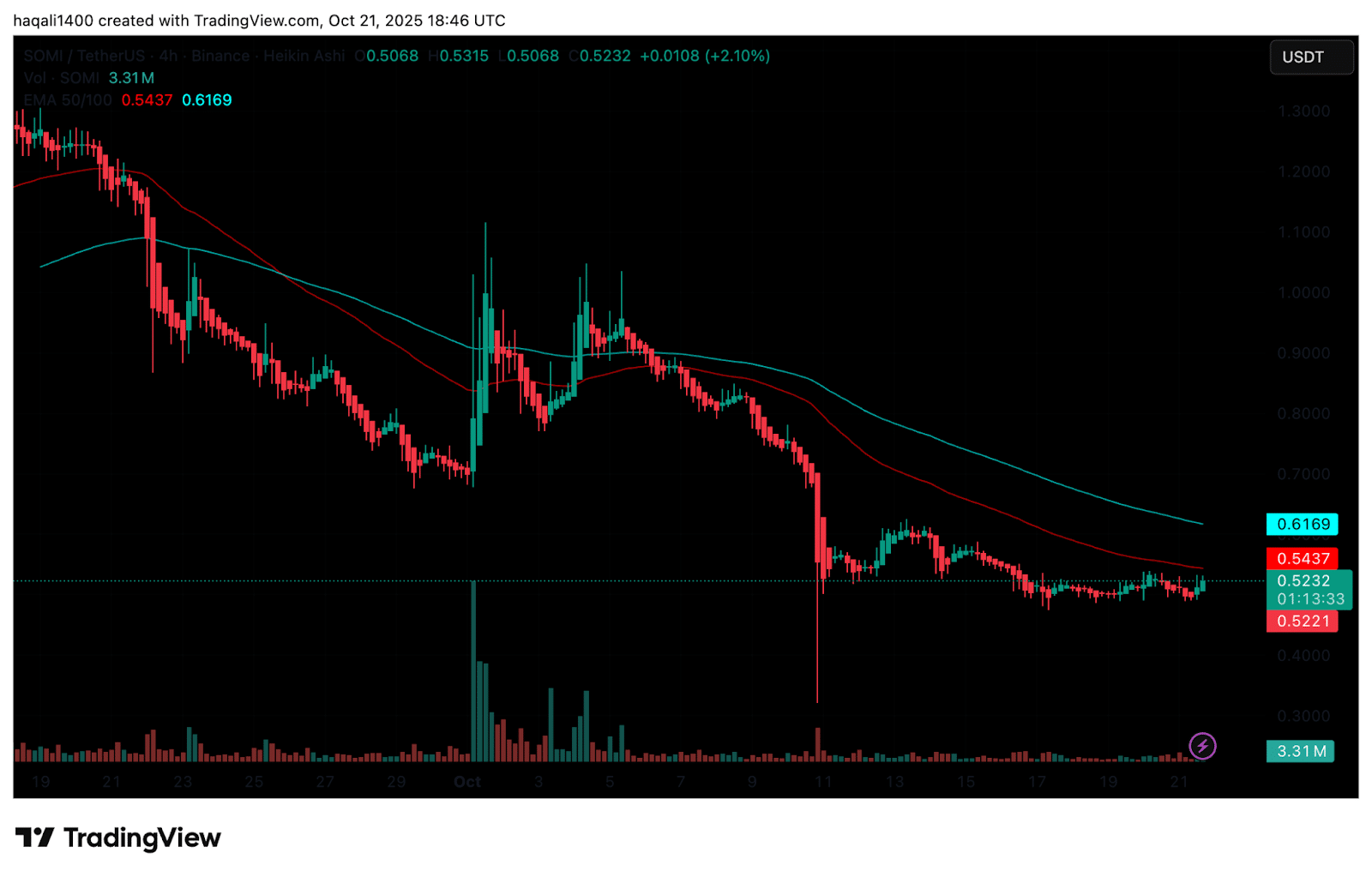

The decline of SOMI accelerated in early October, following a fall outside the range of $1.30 that it had left at the end of September, cutting across several areas of support.

The fall reached its lowest point of approximately $0.40 on October 11, and following that, there was a temporary recovery, resulting in some sideways action between $0.50 and $0.54.

The 50-period EMA is close to $0.54, whereas the 100-period EMA is close to $0.62. The price is also lower than that of both, which confirms that the sellers are still in control of the market.

(Source: SOMI USDT, Tradingview)

These levels have been responsive to resistance, and each recovery attempt has been rejected.

For momentum to shift upward, SOMI would need to close and hold above the $0.55–$0.60 area, backed by rising volume and stronger buying pressure.

A brief volume spike on October 3 signaled speculative entries, although sellers quickly regained control once the move faded.

Technically, SOMI still sits near the end of a markdown cycle but may be preparing for early accumulation if buyers continue to defend current levels.

A daily close above $0.55 could clear space for a move toward $0.62–$0.68. Failure to hold would likely send the price back to test support near $0.48–$0.50.

At press time, SOMI trades at $0.523, up about +2% on the day. The pair remains locked in a narrow range, waiting for either side to break the stalemate.

The next few sessions should indicate whether it can finally break out of this tight zone and establish a clear trend.