Bitcoin price is approaching a key support level at $85,569, with a firm daily close below suggesting a deeper correction.

Bitcoin ETFs record a second consecutive day of outflows, while two wallets linked to Matrixport move 4,000 BTC onto exchanges.

Derivative traders remain idle and passive, suggesting weak conviction and a lack of near-term catalysts for BTC.

Bitcoin (BTC) remains under pressure, trading below $87,000 on Wednesday, nearing a key support level. A decisive daily close below this zone could open the door to a deeper correction. Meanwhile, the bearish outlook strengthens as spot Bitcoin Exchange Traded Funds (ETFs) record a second consecutive day of outflows, while wallets linked to Matrixport move 4,000 BTC onto exchanges. In addition, derivatives traders largely sit on the sidelines with BTC lacking a clear catalyst to spark a near-term recovery, keeping downside risks firmly in focus.

Institutional demand fades, adding downside risk

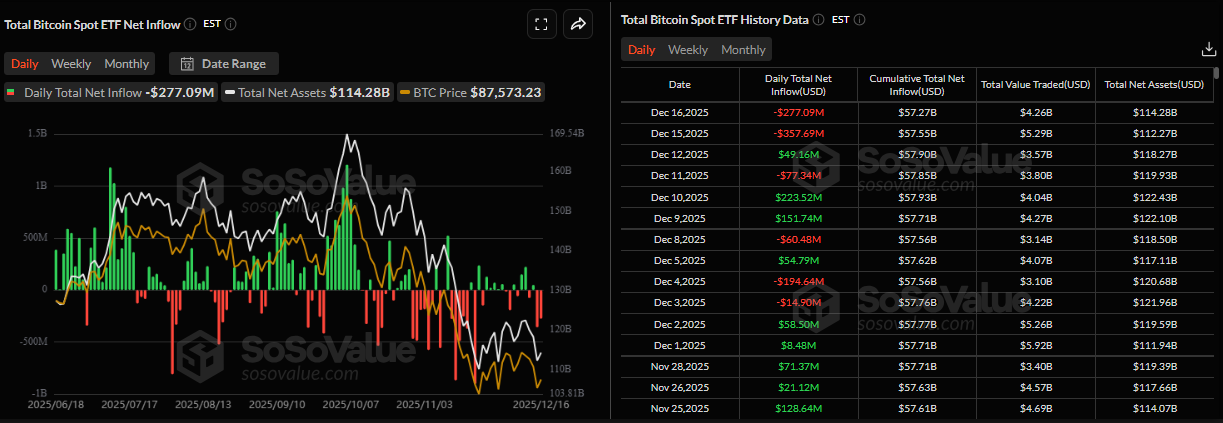

Institutional demand started the week on a negative note. SoSoValue data show that Spot Bitcoin ETFs recorded an outflow of $277.09 million on Tuesday, marking the second consecutive day of withdrawals so far this week. If these outflows continue and intensify, the Bitcoin price could see further correction.

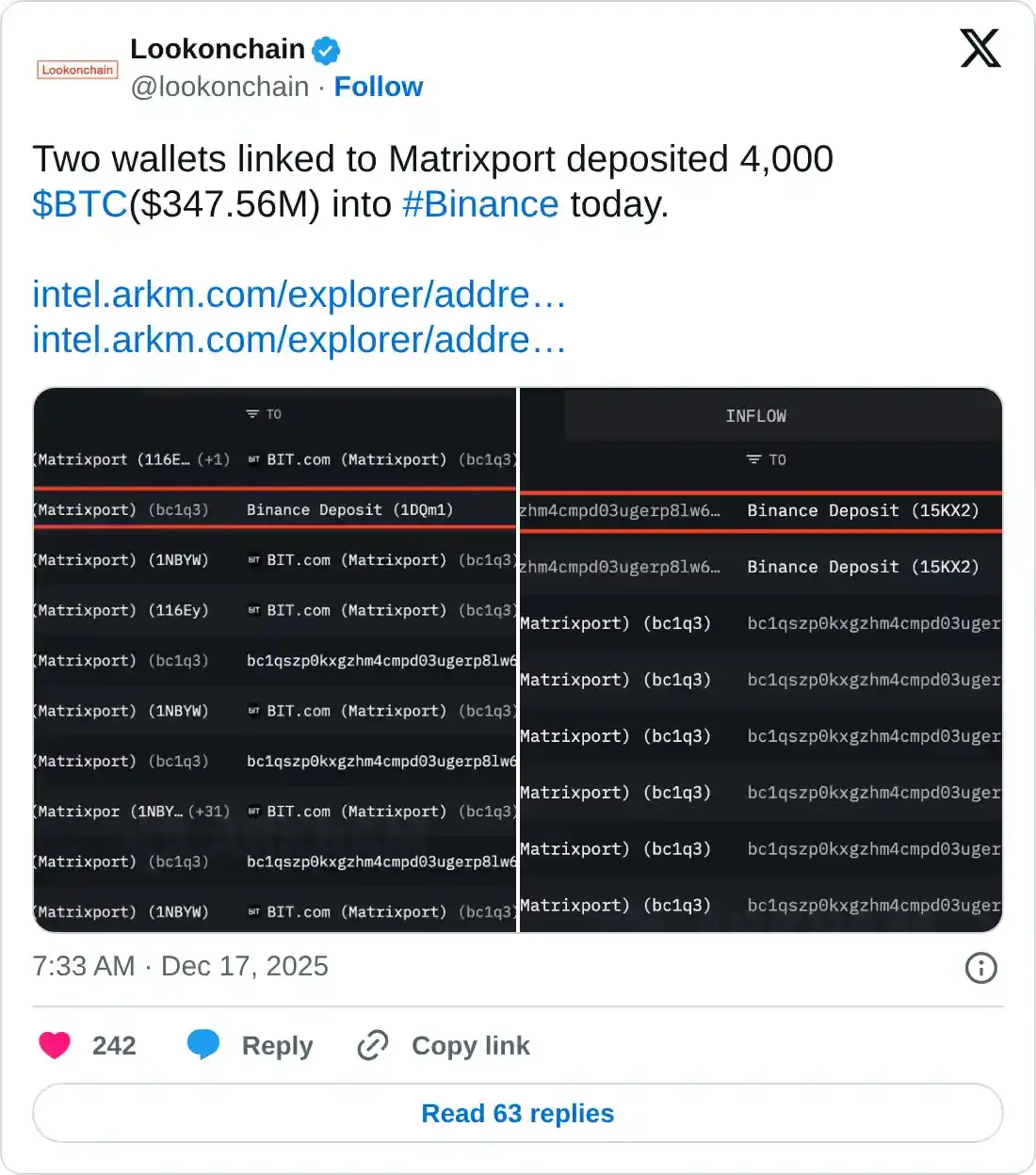

In addition, Lookonchain data indicate that two Matrixport-linked wallets deposited 4,000 BTC, valued at $347.56 million, into the Binance exchange on Wednesday. Traders should be cautious, as transferring such a large amount of Bitcoin to a centralized exchange often signals an intent to sell or distribute it and can create bearish sentiment, as market participants anticipate increased supply.

CME traders remain sidelined amid weak conviction

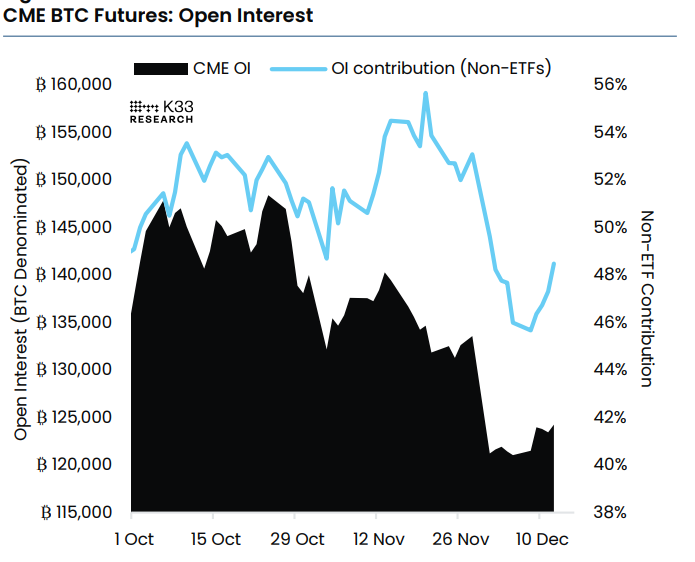

A K33 Research report published on Tuesday indicated that Chicago Mercantile Exchange (CME) traders remained idle and passive last week.

The report explained that Open Interest (OI) remains near annual lows at 124,000 BTC and that futures premiums remain compressed. Traders appear uninterested in adding BTC exposure amid continued underperformance relative to equities and as the year comes to a close. Moreover, the recent sluggish performance of BTC has led to new rounds of outflows from leveraged BTC ETFs, with BITX exposure declining toward the monthly open at below 35,000 BTC.

The current environment indicates institutional apathy rather than panic, with BTC’s price action entering a consolidation phase as major players wait for a clear catalyst before re-engaging.

Bitcoin Price Forecast: BTC could risk deeper correction

Bitcoin price was rejected from a descending trendline (drawn by connecting multiple highs since early October) on Friday and has declined nearly 7% since then, retesting the $85,569 support level on Monday. However, BTC rebounded slightly on Tuesday after finding support at $85,569. At the time of writing on Wednesday, BTC hovers at around $86,700.

If BTC continues its correction and closes below $85,569 on a daily basis, which aligns with the 78.6% Fibonacci retracement, it could extend the decline toward the psychological $80,000 level.

The Relative Strength Index (RSI) on the daily chart is at 39, below its neutral level of 50, indicating bearish momentum gaining traction. Moreover, the Moving Average Convergence Divergence (MACD) lines are converging, and a flip to a bearish crossover would further support the bearish outlook.

If BTC recovers, it could extend the advance toward the 61.8% Fibonacci retracement level at $94,253.