With Bitcoin dipping below $90K as risk tolerance declines, many crypto investors are looking towards Digitap as a hedge against turbulent market conditions.

As the US government prepares to release multiple economic data prints, Bitcoin has fallen below $90K. Investors are wary of how the broader market will perform if economic conditions fail to improve. This has led many crypto investors to shift towards coins that offer a margin of safety during uncertain market conditions.

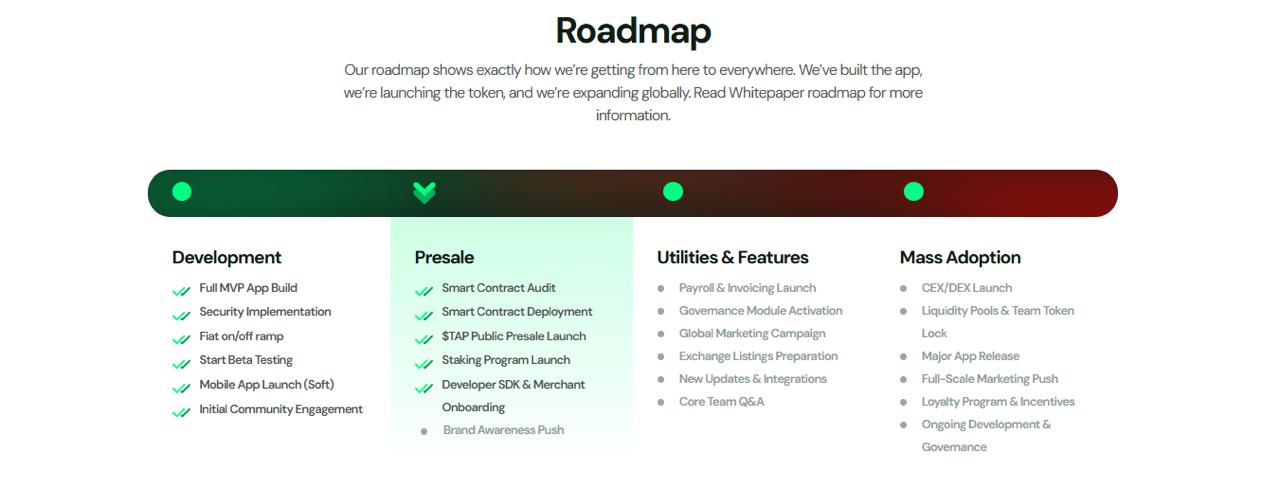

Many investors have switched to Digitap ($TAP). The coin has performed remarkably well since the October crash, seeing three price increases. With its focus on utility and built-in deflationary mechanics, investors believe Digitap could be one of the top cryptos to buy for parking capital in a bear market.

Uncertainty Fuels Bitcoin’s Bearish Sentiment

After briefly crossing the $90K resistance level last week, Bitcoin fell back below it on Sunday. Bitcoin’s liquidity issues persist, with many institutions avoiding the asset until the economic outlook for 2026 becomes clearer.

The next few weeks will be pivotal for Bitcoin’s price, as the US government plans to release a series of economic data releases that will provide insight into where interest rates could go next. Investors will be looking at the unemployment rate, weekly jobless claims, November inflation data, and December flash PMI readings (along with other metrics) to understand where Bitcoin’s price will move next.

Additionally, the Bank of Japan is expected to announce whether it will increase rates this week. While it is believed that an interest rate increase has been priced in, higher rates will impact yen-funded carry trades. This could potentially further reduce liquidity for riskier assets such as Bitcoin.

Major Freefall Expected if Bitcoin Breaks Major Support Level

Technical factors are another reason for Bitcoin’s bearish sentiment. Every single moving average metric, from the 10-day SMA to the 30-day EMA, is at or higher than the $90K level. With Bitcoin trading near $87K, the downward momentum is prompting large-scale investors to avoid building positions in the asset.

Bitcoin’s next significant support level is at $86K. Ali Martinez, a prominent cryptocurrency analyst, believes a deeper pullback will occur if Bitcoin fails to consolidate above $86,000. If Bitcoin falls below this level, the next significant support level for Bitcoin is at $70,000.

Amid this uncertainty, many investors are now looking to park funds in safe assets that remain stable during a crash. Digitap has emerged as a favorite, and many now believe it is the best altcoin to buy in the bear market.

Digitap Shows Remarkable Resilience During Crypto Crash

Savvy investors have begun seeking safe havens to weather turbulent market conditions. Digitap has emerged as a favorite, with many calling it one of the top cryptos to buy for the bear market.

Digitap focuses on providing utility first and being a cryptocurrency second. As the world’s first omnibank, it allows users access to both crypto and fiat banking through its multi-rail architecture. It enables users to convert Bitcoin to fiat and send money to any account through SWIFT faster than a wire transfer.

Digitap also has a Visa card that can be used to transact at 150 million merchants worldwide. With a privacy-first onboarding process, users have complete control over how much data is shared.

Digitap’s price has increased multiple times since the October crash. This price increase has been fueled by massive demand. Investors widely believe that utility tokens with real-world use will fare better in a market crash than tokens built on speculative hype. This has caused Digitap’s crypto presale to explode, raising over $2.5 million.

Digitap’s Deflationary Shield Could Make it the Best Crypto Presale for the Crash

Unlike most other crypto presales, Digitap is one of the few presales in the market that is already generating a consistent revenue stream. Furthermore, Digitap has a long-term sustainability approach, focusing on creating sustained upward price pressure for the token.

Digitap tokens have a limited supply of 2 billion, eliminating the risk of dilution. Additionally, 50% of all the profits from Digitap are used to burn $TAP and reward stakers. This should create scarcity for Digitap tokens even when the market is flat, and is one of the key reasons why some investors believe Digitap is the best altcoin to buy right now.

Savvy investors are trying to purchase as many tokens as possible at the current price of $0.0371, as demand could push the price up over the next few days. Digitap also currently has a 12-day Christmas bonus offer, which allows users to claim 2,500 additional $TAP. With an expected launch price of $0.14, early participants in Digitap’s crypto presale can potentially secure a 280% ROI.