Solana price prediction chatter is heating up again as traders debate if the altcoin’s sharp correction opens the door to a renewed breakout – or a drawn-out consolidation.

With the current price hovering around $126.75, many are asking whether SOL still holds upside momentum or if the market sentiment has turned cold. Meanwhile, presale projects like Bitcoin Hyper are gaining traction as lower-risk entries amid market pullbacks.

Current Solana Price Action Paints a Mixed Picture

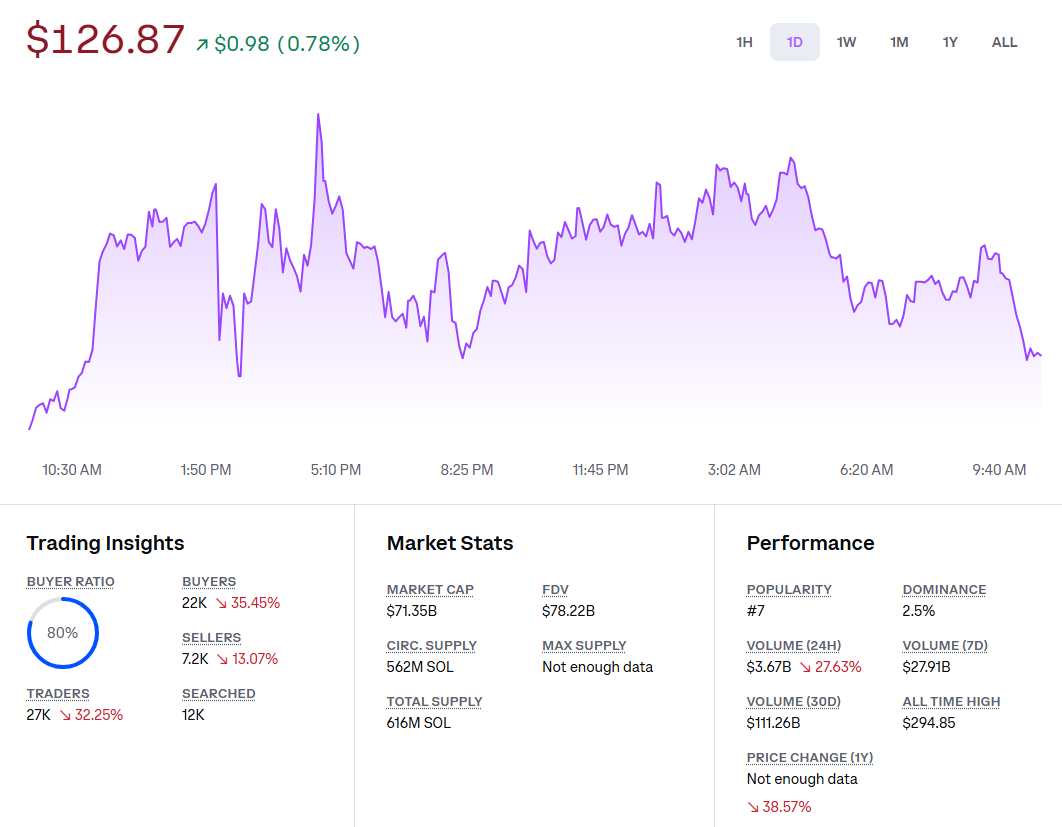

Solana’s price has ticked slightly upward in the past 24 hours, gaining 0.6% to settle near $126.75, bringing its market cap to $71.26 billion.

Despite this short-term stability, the weekly and monthly charts reveal clear weakness. SOL is down 8.47% over the past week and over 10.64% in the last month, underperforming most of the top ten cryptocurrencies.

Its 24-hour volume has dropped to $3.66 billion, a significant 27% fall, suggesting declining short-term interest.

Technical indicators also paint a bearish landscape: the 50-day and 200-day moving averages are trending downward, and sentiment indicators show 91% bearish bias. Analysts warn that traders are locking in profits from the previous rally, while speculative buyers are hesitant to re-enter without clearer momentum.

Future Price Forecast: Is $200 Still a Target?

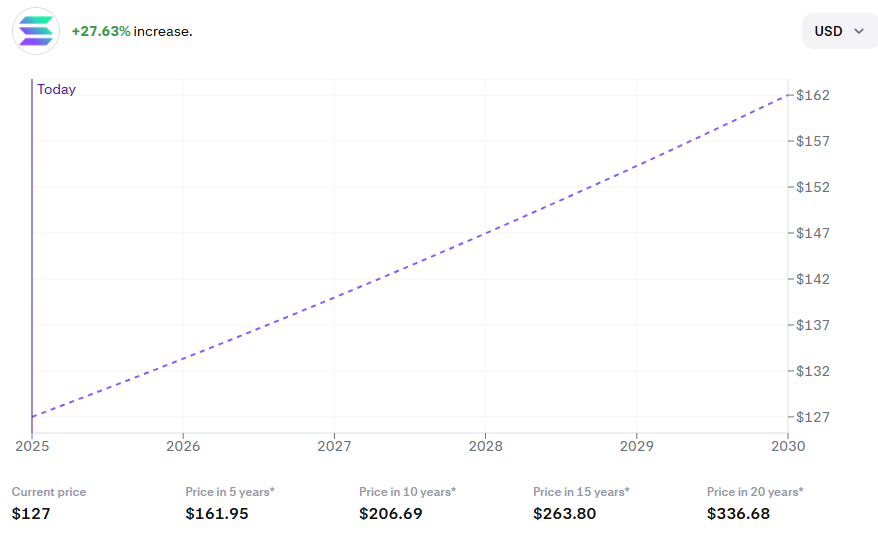

While short-term sentiment remains bearish, long-term Solana price predictions still suggest moderate but steady growth. If SOL appreciates by 5% annually, its price could reach $133.23 in 2026, $161.95 by 2030, and $206.69 by 2035.

A full decade out, the forecast lands around $263.80 by 2040, assuming fundamentals stay intact and no major security issues or network outages occur.

However, these projections rest on a smooth macro and crypto-specific recovery – something the current market volatility challenges. SOL’s all-time high near $260 now looks distant, especially as Solana faces mounting pressure from newer projects and shifting investor behavior.

Still, for long-term holders who entered under $50, the recent range around $125–$140 offers substantial breathing room. Others, however, are weighing alternatives with better short-term risk-reward setups.

Is the Explosion Still on the Table?

The phrase Solana price prediction continues to dominate search trends, but traders may need to recalibrate expectations. A return to $200+ could take longer than hoped, particularly as technical momentum fades and trading volume drops off.

That said, the fundamentals remain relatively strong – fast transactions, developer engagement, and deep integrations in the NFT and DeFi sectors.

Still, a short-term price explosion seems unlikely unless a broader altcoin rally kicks off. Instead, strategic plays are emerging elsewhere. Projects like Bitcoin Hyper offer a fresh cycle narrative, appealing to those who missed the early stages of Solana’s previous rise.

The next few weeks could decide whether SOL finds support around $125, or if it slips further into the low-$100s. Either way, the crypto market’s rotation into presales signals a shift in how traders define opportunity during periods of stalled growth.

Bitcoin Hyper Pulls Spotlight as Risk Rotates

As Solana struggles to recapture bullish momentum, funds are increasingly rotating into presales like Bitcoin Hyper – a project currently priced at $0.013435 with a raise cap of nearly $30 million. With just minutes left before the next price increase, early investors are rushing in to lock favorable entry points before the token’s next phase.

Unlike Solana, which is already a large-cap coin and subject to broader macro volatility, Bitcoin Hyper markets itself as a lower-entry, early-stage bet on utility-driven adoption.

Its presale progress shows nearly $29.5 million raised, indicating strong community demand even amid a wider altcoin pullback.

This trend underlines a broader strategy shift among retail traders: rather than re-entering at Solana’s mid-cycle levels, many are seeking asymmetric upside in micro-cap tokens with defined roadmaps, staking rewards, and locked liquidity.