KEY TAKEAWAYS

After months of dormancy, DGB has surged 30%, testing the upper boundary of a falling wedge.

The Withdrawal Day could tighten exchange supply, potentially fueling a price squeeze.

Volume has surged, supporting the rally, though failure to hold above $0.007 may lead to a pullback.

Out of nowhere, DigiByte (DGB) is waking from its slumber.

The OG altcoin, initially created in 2014 to improve upon Bitcoin’s (BTC) speed and scalability, has seen its price spike by 30% in the last 24 hours.

A look at the DigiByte coin chart suggests that it appears poised to break through its resistance, reminiscent of the 2021 breakout.

One strong breakout and the multi-month bear channel could be a thing of the past.

The question now: is DGB’s price gearing up for a full send, or is this another fakeout?

DigByte Hits Monthly High

Earlier today, the DigiByte coin price surged to $0.0086, marking its highest level since Oct. 1.

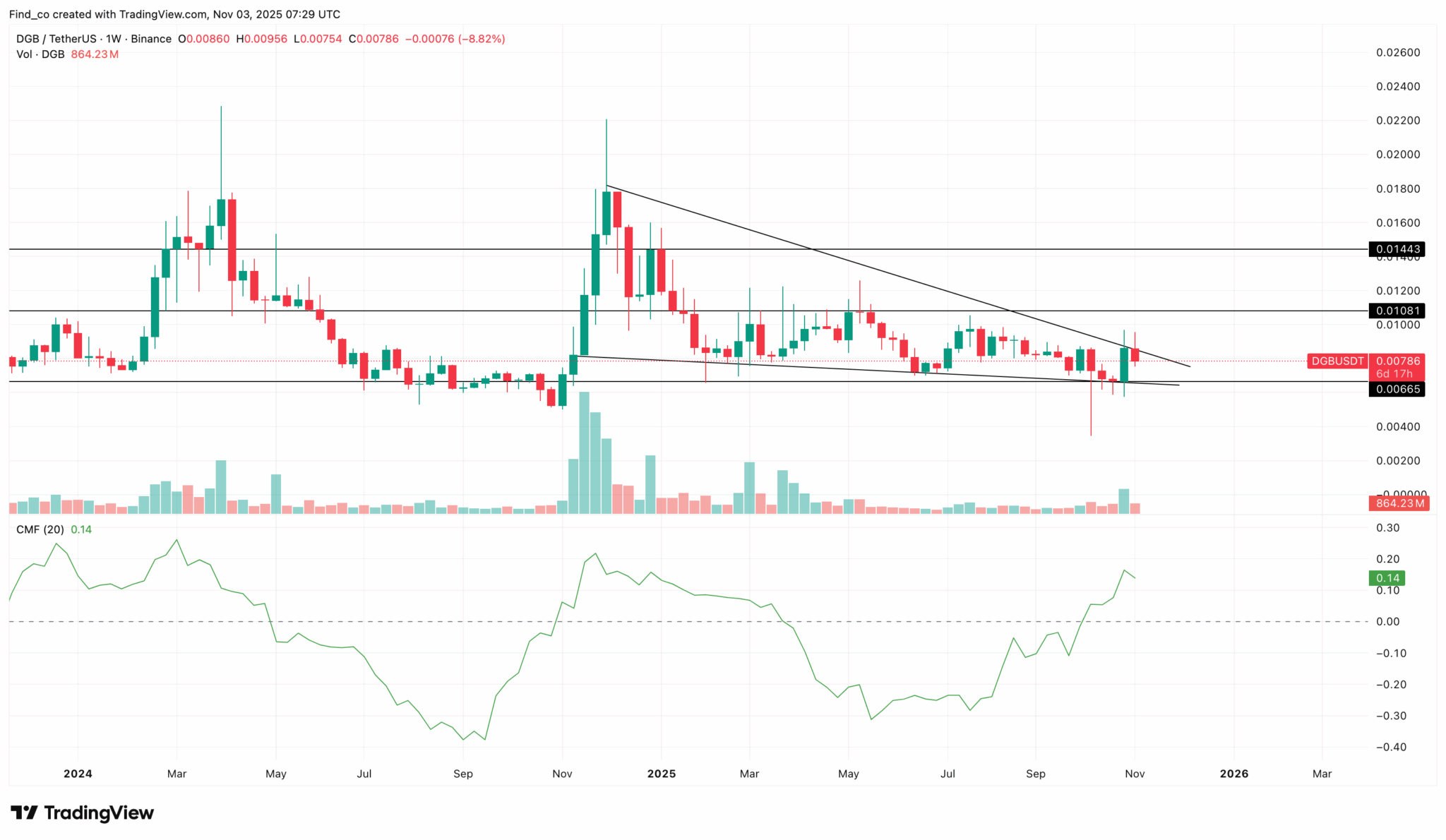

Following the move, the weekly DGB/USDT chart shows the coin is on the verge of breaching the upper trendline of a falling wedge.

This pattern has persisted since December 2024, producing a series of lower highs and lower lows.

While DGB’s price has since retraced slightly to $0.0078, the Chaikin Money Flow (CMF) has risen above the zero line.

If this momentum holds, DigiByte’s price could break above the $0.010 resistance, potentially confirming a bullish reversal.

Beyond the technical setup, market sentiment around “Withdrawal Day” is also boosting enthusiasm.

Community Event Fuels Volume Surge

The annual DigiByte Community Withdrawal Day, scheduled for Nov. 11, encourages holders to withdraw their DGB from centralized exchanges into self-custodial wallets.

Furthermore, if a significant number of holders participate, the exchange supply could decline, creating a short-term supply squeeze.

This reduction in available coins on exchanges might exert upward pressure on DGB’s price, especially if combined with rising on-chain activity.

Looking at on-chain data, Santiment reveals that DigiByte’s coin trading volume has surged to its highest level since last December.

Combined with the recent price increase, this surge implies growing market participation.

Rising volume alongside an upward price move typically signals strong conviction behind the rally.

If the volume continues to rise, it could reinforce DGB’s bullish momentum.

Therefore, the DGB’s price has a higher chance of a breakout above the $0.010 resistance, possibly paving the way for higher targets in the days leading up to Withdrawal Day.

DGB Price Prediction: Bullish

On examining the daily chart, the setup is similar to the weekly pattern, reinforcing the broader bullish outlook.

Within this timeframe, the DigiByte coin price has broken above the upper trendline of a falling wedge, indicating a potential trend reversal following a prolonged consolidation phase.

At the same time, the Moving Average Convergence Divergence (MACD) has formed a bullish crossover.

If this trend continues, DGB could breach resistance at $0.011, paving the way for a rally toward $0.013.

However, if selling pressure intensifies, the breakout could lose strength. In that scenario, DGB’s price may fall back below the lower trendline, potentially retesting support near $0.0070 before attempting another rebound.