In its latest report, asset manager and exchange-traded fund (ETF) issuer, Bitwise, has shared an optimistic 2026 outlook for the crypto market, anticipating significant growth, while predicting new all-time highs for Bitcoin (BTC), Ethereum (ETH), and Solana (SOL).

Megatrends In Crypto?

Bitwise begins by asserting that Bitcoin is poised to break free from its traditional four-year price cycle, setting the stage for new records. Several factors contribute to this bullish forecast.

The dynamics of past cycles, including the Bitcoin Halving, interest rate fluctuations, and market booms and busts fueled by leverage, are expected to be less impactful in the coming years.

Notably, the entry of large institutions like Citi, Morgan Stanley, Wells Fargo, and Merrill Lynch into the crypto space is anticipated to accelerate institutional allocations toward spot ETFs and enhance on-chain developments by 2026.

As a result, Bitcoin is projected to become less volatile, even indicating that it has demonstrated lower volatility than tech giant Nvidia throughout 2025.

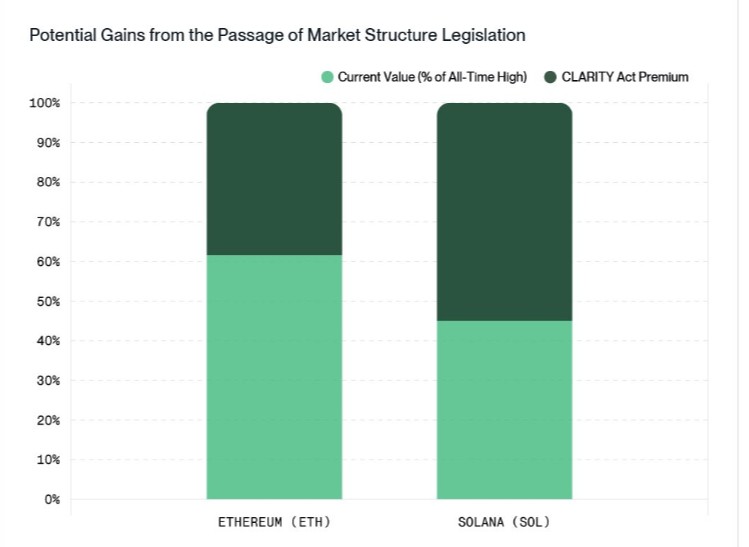

The report also expresses strong optimism for Ethereum and Solana, particularly contingent upon the passing of the CLARITY Act. Bitwise believes that the growth of stablecoins and tokenization represents significant “megatrends,” with both Ethereum and Solana positioned to be the primary beneficiaries of this trend.

ETFs To Acquire New Market Supply

Institutional demand is forecasted to surge, with ETFs expected to acquire more than 100% of the new supply of Bitcoin, Ethereum, and Solana. By 2026, Bitwise expects that most institutional investors will have access to crypto ETFs.

As Bitwise projects the new supply hitting the market, estimates indicate roughly 166,000 Bitcoin valued at $15.3 billion, 960,000 Ethereum around $3.0 billion, and 23 million Solana coins amounting to $3.2 billion. However, the firm anticipates that ETFs will likely purchase even more than these figures suggest.

The report further highlights that crypto equities are expected to outperform traditional tech stocks. While tech shares have surged by 140% over the past three years, crypto equities have significantly outpaced them.

The Bitwise Crypto Innovators 30 Index, which tracks companies providing crucial infrastructure and services for crypto assets, has rocketed by 585% during the same time frame. Bitwise believes this momentum will persist into 2026, driven by potential revenue growth, mergers and acquisitions, and a favorable regulatory landscape.

Stablecoins As Scapegoats For Economic Woes

As stablecoins gain traction, Bitwise cautions that they may become scapegoats for destabilizing emerging market currencies. Currently valued at nearly $300 billion, the market for stablecoins, which include tokenized versions of the US dollar like USDT and USDC, is predicted to reach $500 billion by the end of 2026.

With this rise, it’s anticipated that one or two countries may blame stablecoins for their financial troubles, despite the reality that people would not turn to stablecoins if their local currencies were stable.

Additionally, Bitwise forecasts the launch of over 100 crypto-linked ETFs in the United States, following the SEC’s issuance of new listing standards that enable these funds to enter the market under a unified regulatory framework. This regulatory clarity sets the stage for what Bitwise dubs “ETF-palooza” in 2026.

Lastly, the firm predicts that half of Ivy League endowments will likely invest in cryptocurrencies, and that on-chain vault assets under management will double in the coming years.

At the time of writing, Bitcoin was trading at $86,165, having recorded major losses of 2% and almost 7% over the past 24 hours and seven days respectively. Currently, the leading crypto is trading 31.8% below its all-time high of $126,000.

Featured image from DALL-E, chart from TradingView.com