Japan’s 10-year government bond yields surged to 1.98% in December 2025, the highest level since the 1990s. It comes as markets braced for the Bank of Japan’s (BOJ) policy meeting on December 19.

The move has triggered a global rally in precious metals, with gold and silver surging 135% and 175%, respectively, since early 2023. Meanwhile, Bitcoin is under pressure as forced selling intensifies across Asian exchanges, highlighting a divergence in market reactions to Japan’s rate shift.

Japan’s Bond Yields Hit 1.98%

For decades, Japan maintained near-zero interest rates, anchoring global liquidity through the yen carry trade.

Investors borrowed yen at a low rate to fund higher-yielding assets worldwide, effectively exporting ultra-low interest rates.

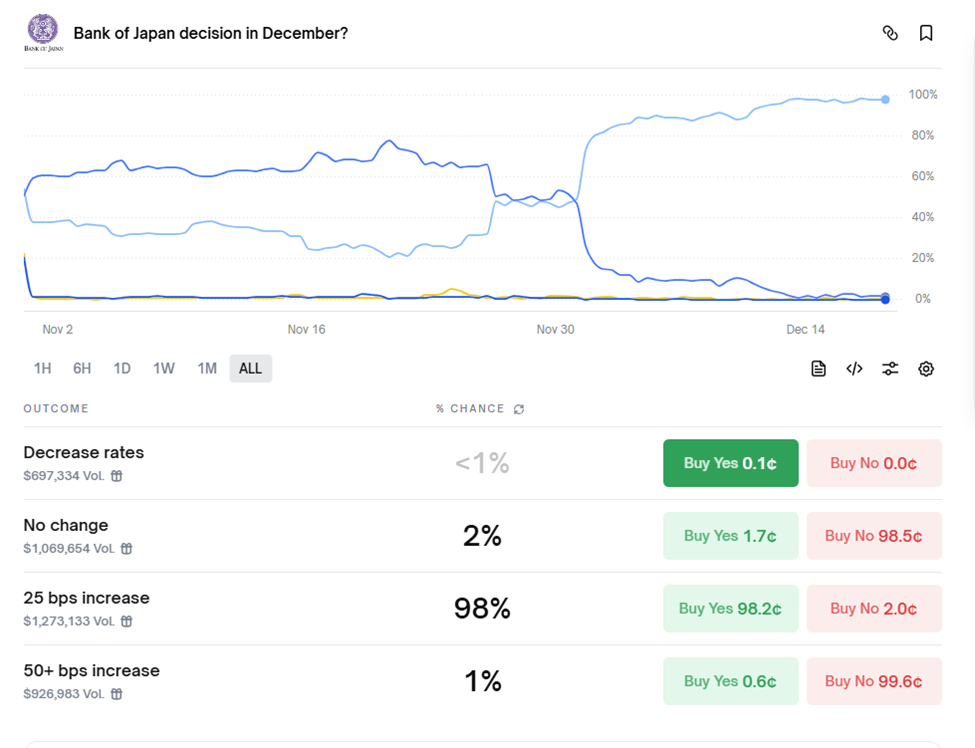

An expected 25-basis-point hike, raising the rate to 0.75%, may appear modest in absolute terms, but the pace of change matters more than the level.

BOJ Interest Rate Probabilities. Source: Polymarket

“Carry trade at risk: Nobody knows when the real consequences will materialize, but this continued shift will likely drain liquidity from markets, potentially causing a ripple effect through margin calls and other forced deleveraging,” warned Guilherme Tavares, CEO at i3 Invest.

Analysts see the BOJ move as more than a domestic adjustment.

“When Japan’s yields move, global capital pays attention. Gold and silver aren’t reacting to inflation headlines. They’re pricing sovereign balance sheet risk. Japan isn’t a sideshow anymore. It’s the fulcrum,” noted Simon Hou-Vangsaae Reseke.

Gold and Silver Prices Surge Amid Rising Sovereign Risk

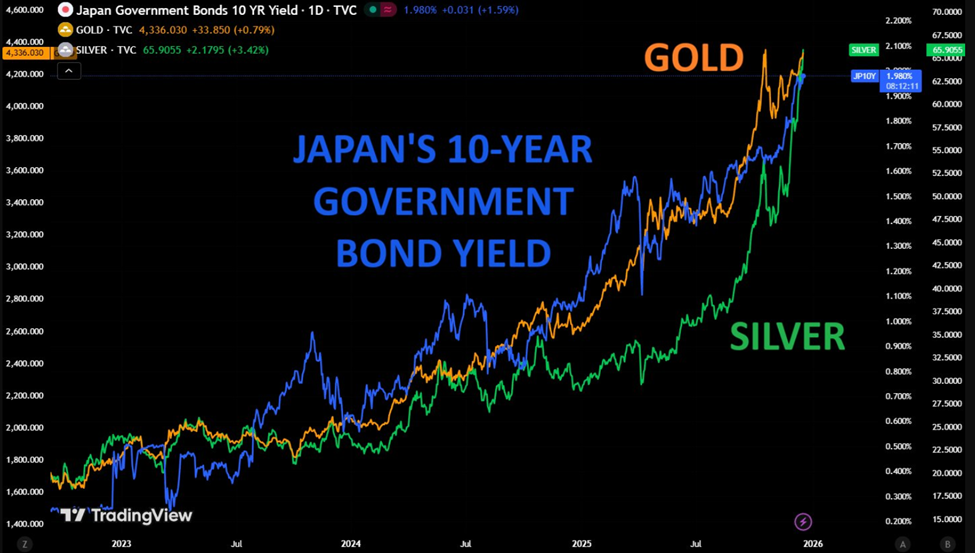

Precious metals have been closely tracking Japanese yields. According to Global Market Investor, gold and silver are moving almost perfectly in line with Japanese government bond yields. This suggests that precious metals are being used as a primary hedge against the rising cost of government debt.

Gold and Silver Prices Tracking Japan’s 10Y Bond. Source: Global Markets Investor on X

“It’s not the yield itself, it’s what the move represents — rising sovereign risk, tighter global liquidity, and uncertainty about currency credibility. Gold responds as protection, and silver follows with more volatility,” commented analyst EndGame Macro.

The silver market is showing signs of speculative mania. The China Silver Futures Fund recently traded 12% above the physical metal it tracks, indicating that demand for leveraged exposure is outpacing the underlying asset.

Investors are increasingly treating gold and silver as hedges against broader macro risks, rather than just inflation.

Bitcoin Faces Pressure as Carry Trades Unwind

Meanwhile, the Bitcoin price is feeling the strain of tightening yen liquidity.

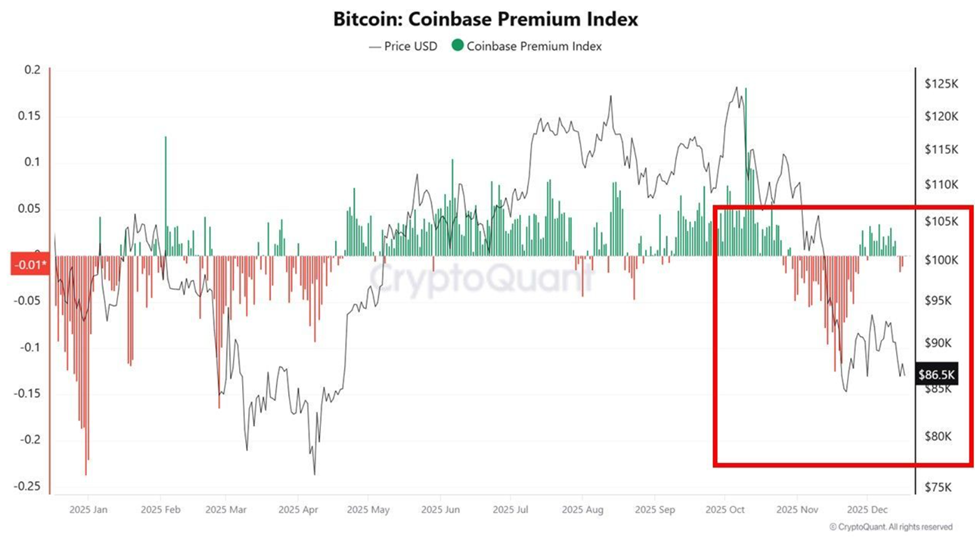

“Asia-based exchanges have seen persistent spot selling. Miner reserves are falling — forced selling, not choice…Long-term Asian holders appear to be distributing…Price stays heavy until forced supply is cleared,” wrote CryptoRus, citing XWIN Research Japan.

US institutions continue buying, with the Coinbase Premium positive, but forced liquidations in Asia and an 8% drop in Bitcoin hashrate have added downward pressure.

Bitcoin Price and Coinbase Premium. Source: CryptoQuant

Past BOJ rate shifts have coincided with significant BTC declines, and traders are watching closely for further downside toward $70,000.

The contrasting reactions of precious metals and Bitcoin highlight differences in risk positioning. Gold and silver are attracting safe-haven flows amid growing sovereign risk, while Bitcoin faces liquidation-driven price pressure.

Analysts note that future Fed rate cuts may offset the BOJ’s impacts, but the speed of the policy change is crucial.