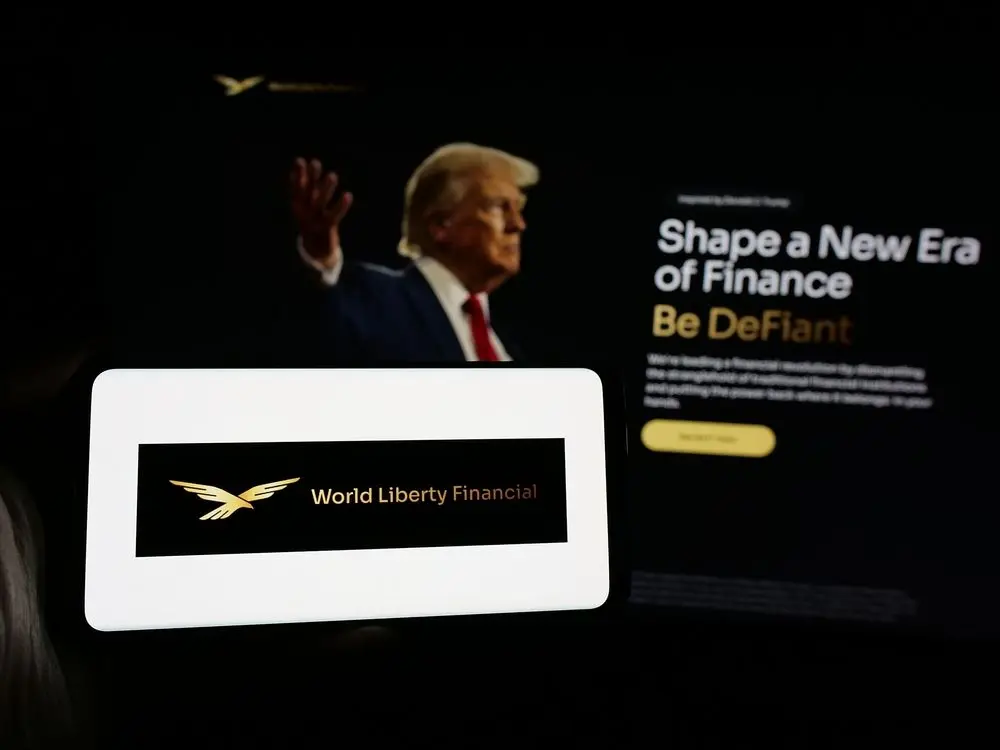

World Liberty Financial proposed using up to 5% of its WLFI token treasury to expand adoption of its USD1 stablecoin.

The Trump family-backed DeFi project seeks to deploy approximately $120 million worth of tokens through partnerships with centralized and decentralized platforms.

Early governance voting shows opposition slightly outpacing support for the advisory proposal.

What Happened

World Liberty Financial posted the governance proposal on December 17, calling for less than 5% of unlocked WLFI holdings to fund USD1 growth incentives.

The allocation would come from a treasury holding approximately 19.96 billion WLFI tokens valued near $2.4 billion.

USD1 launched in March 2025 and has grown to approximately $2.74 billion in market capitalization, making it the seventh-largest dollar-pegged stablecoin.

The project claims USD1 reached approximately $3 billion in total value locked within six months through trading activity and exchange integrations.

World Liberty Financial committed to publicly disclosing all partners receiving WLFI incentives on its website and governance channels.

The proposal does not specify which platforms would receive tokens but mentions "select high-profile CeFi and DeFi partnerships."

Recent activity includes a $10 million WLFI token buyback using USD1 and new trading pairs on Binance.

Read also: Taiwan Ranks 8th Globally In Government Bitcoin Holdings From Law Enforcement

Why It Matters

The governance vote remains open with three options: approve, reject, or abstain.

Early voting indicates more participants currently oppose the proposal than support it.

Community members have raised concerns about unlocking treasury tokens without clear vesting schedules, potentially creating sell pressure.

The project has not published a reserve audit since July 2025.

World Liberty Financial argues USD1 growth strengthens the broader WLFI ecosystem by expanding integrations and governance scope.

Any future treasury allocations beyond this initial 5% would require additional governance votes.

The advisory proposal represents a test of community support amid skepticism about token unlock mechanics.

Read next: SoFi Bank Becomes First US National Bank to Launch Public Blockchain Stablecoin