Gemini predicts a turbulent but potentially opportunistic path for both Bitcoin and gold in 2026, as long-term holders shift positions and macroeconomic factors reshape global markets.

While Bitcoin hovers near $87,000 today, data from Gemini and other analysts show conflicting signals heading into Q1 2026. Meanwhile, gold sits just under $4,330 per ounce, with forecasts suggesting a record-breaking year.

Amid ETF outflows, Fed uncertainty, and declining crypto liquidity, Gemini predicts are stirring debate on which asset class could lead in the next macro rotation. But a growing number of early investors are now pivoting toward Bitcoin Hyper, a rising digital asset with strong momentum as it nears a new price tier.

Bitcoin Faces Supply Overhang as Whales Continue Selling

Despite Bitcoin trading above $87,000, recent market activity shows structural weakness. Analysts point to continued pressure from long-term holders, who have begun reactivating wallets dormant for over two years.

According to K33 Research, 1.6 million BTC – worth nearly $140 billion – has entered circulation since early 2023. This marks the steepest wave of long-term holder distributions in five years.

Compass Point highlights that 60% of the total BTC supply is still held in wallets controlling over $85 million each. As selling accelerates, especially since July 2025, even minor demand dips trigger outsized moves. These large wallets, once seen as stable, are now seen as a drag on price action.

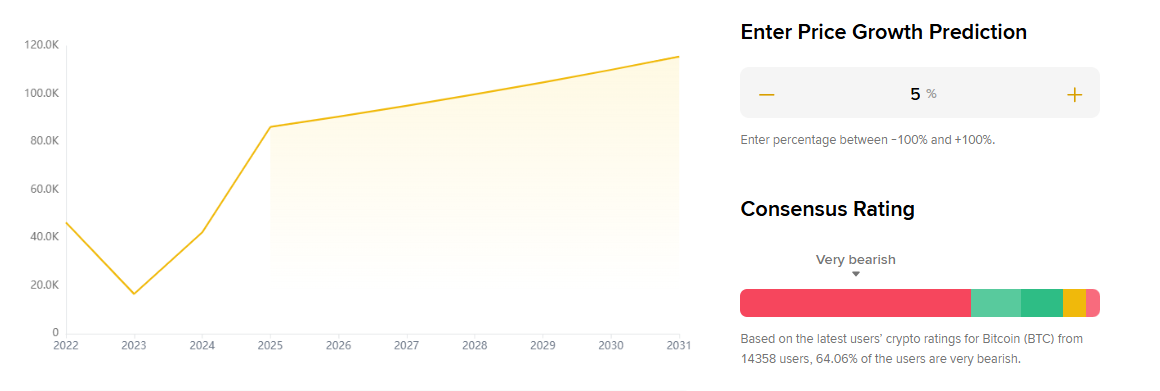

Gemini predicts a sluggish start to 2026 unless ETF inflows resume and long-term sellers stabilize. Short-term forecasts suggest BTC could reach $86,599.81 by mid-January 2026, a modest 5% rise if current levels hold. But the outlook remains fragile.

Gemini Predicts Bitcoin Recovery Will Depend on ETF Demand Rebound

Bitcoin’s recent selloff from its $126,000 high in October has been sharp, driven by “whale” activity and forced liquidations of leveraged positions. Analysts note that earlier in 2025, this was absorbed by strong ETF and institutional demand. That demand has now faded.

CryptoQuant reports that nearly $300 billion in previously dormant Bitcoin re-entered circulation in 2025. As this supply meets falling demand, markets are undergoing what Chris Newhouse of Ergonia calls a “slow bleed” – a grind lower fueled by steady spot selling rather than panicked capitulation.

Gemini predicts that ETF flows must return positive for prices to regain momentum. Derivatives activity has declined and retail participation remains weak, with many sidelined after recent volatility. Until these conditions shift, upside looks capped.

Still, not all signals are bearish. Some predict a bottom may form in early 2026 as macro uncertainty clears. Spot ETFs still only own 13% of the BTC supply, meaning there is potential for demand-side shocks to re-emerge if sentiment turns.

Gold’s 2026 Trajectory Looks Bullish as Demand Surges

While Bitcoin grapples with a changing supply structure, gold is entering 2026 with powerful tailwinds. Currently trading at $4,324/oz, the metal has held near record highs reached in October.

Gemini predicts that this trend will persist. In 2025, demand from institutional and central bank buyers pushed gold up over 55%, with quarterly demand exceeding 980 tonnes – a 50% increase over historical averages.

J.P. Morgan expects gold to average $5,055/oz by Q4 2026, with upside to $5,400/oz in 2027. Retail forecasts are even more bullish. Monthly price predictions show a steady climb, with October 2026 targets reaching $7,205, marking a 66.6% increase over current levels. December 2026 could top $7,388, according to some models.

Bitcoin vs Gold: Which Will Lead in 2026?

The comparison now dominates institutional desks: Will Bitcoin regain momentum, or is gold set to take over as the primary inflation hedge? The answer likely hinges on liquidity and central bank policy.

Gemini predicts a possible rotation: if ETF appetite for crypto resumes, Bitcoin could rebound aggressively off oversold levels. But if economic uncertainty persists and Fed action lags, gold may continue attracting conservative capital flows.

Bitcoin bulls point to the fixed 21M supply cap and the upcoming 2026 halving cycle as catalysts. Yet without fresh inflows and a macro tailwind, these fundamentals may not be enough. Meanwhile, gold is benefiting from a diverse buyer base – retail, institutional, and central banks – providing more cushion.

Why Traders Are Watching Bitcoin Hyper Closely

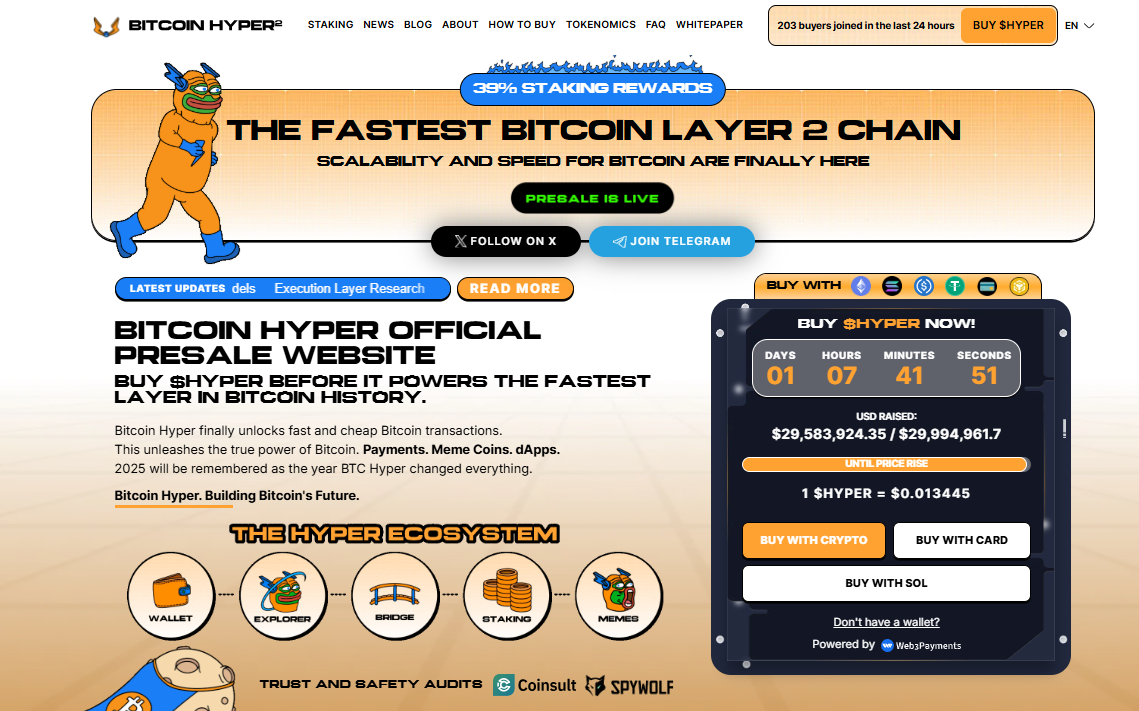

As Bitcoin struggles to reclaim upside, a growing segment of the market is shifting focus to Bitcoin Hyper, a presale token that has now raised $29.58 million out of $29.99 million, with less than 36 hours left until its next price jump.

Priced at just $0.013445 per token, Bitcoin Hyper presents a significantly lower entry point for investors looking to capitalize on early-stage upside. Unlike traditional BTC, Hyper offers flexible payment methods (crypto, card, SOL) and is engineered for rapid adoption through its Web3Payments layer.

While Gemini predictions suggest BTC may tread water in early 2026, Bitcoin Hyper is already pulling capital away from legacy coins. If current momentum continues, Bitcoin Hyper’s next pricing stage could lock out latecomers before broader market recovery even begins.