Crypto in 2025 did not suffer from a breakdown in defenses across the board. Instead, the year exposed a different vulnerability: when things fail, they fail catastrophically.

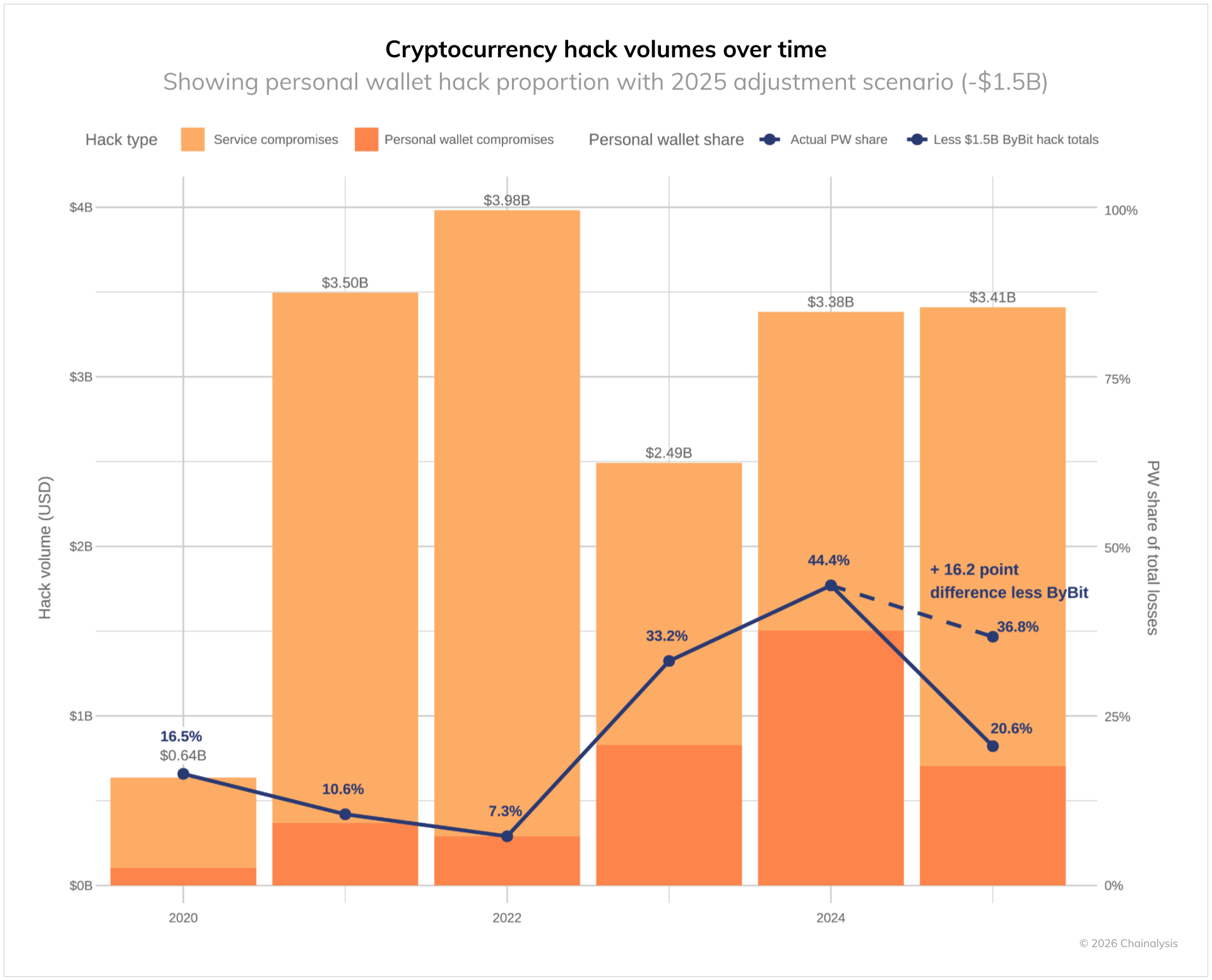

Losses surged past $3 billion, but the damage did not come from a steady drumbeat of exploits. It came from a handful of moments where attackers reached deep into concentrated pools of capital and walked away with sums large enough to distort the entire year’s statistics.

Key Takeaways

Crypto losses in 2025 were driven by a few catastrophic breaches rather than widespread security failures

Attackers shifted toward targeting concentrated pools of capital while also increasing low-value attacks on individuals

The industry’s main risk is no longer frequency of hacks, but the scale of damage when a single defense fails

The industry is no longer dealing with constant leakage. It is dealing with rare but devastating breaches.

Concentration Became the Weak Point

As crypto infrastructure matured, capital became more centralized in fewer, larger venues. That concentration created efficiency for users — and irresistible targets for attackers.

When one of these hubs was compromised in 2025, the impact dwarfed anything seen from routine hacks. A single breach was enough to eclipse hundreds of smaller incidents combined, making the year look historically bad even though most platforms remained untouched. This dynamic has changed how risk is measured. Security failures are no longer incremental. They are binary.

Hackers Ran Two Different Playbooks

Attackers did not rely on one strategy. They split their efforts.

On one side were long-planned, high-risk operations aimed at major custodians and exchanges, where a single success could yield generational payouts. On the other were opportunistic campaigns against individual users, exploiting weak personal security through phishing, malware, and key theft.

The second category produced far more victims but far less money per incident. The first produced very few victims — and most of the damage. Together, they reshaped the threat landscape.

Why DeFi Wasn’t the Main Target

In previous cycles, decentralized finance attracted attackers as soon as capital returned. That pattern broke in 2025.

Even as liquidity flowed back into DeFi, exploit activity failed to follow. The reason was not luck. Protocols had quietly become harder to attack, with stricter audits, slower deployment cycles, and better monitoring. For attackers weighing effort versus reward, other targets offered better odds.

Another shift came from who was attacking, not just how. Some of the most damaging operations showed signs of long-term preparation rather than quick opportunism.

Instead of exploiting code, attackers exploited trust — embedding themselves in companies, abusing vendor relationships, or waiting months to strike once access was secured. These operations were fewer, slower, and far more dangerous.

Why 2026 Is Hard to Predict

The lesson of 2025 is not that crypto is becoming less secure. It is that outcomes are becoming more uneven.

A year can now appear “safe” or “disastrous” based on whether one or two defenses fail at the wrong time. That makes forecasting difficult and comparisons misleading.

The real challenge ahead is not eliminating attacks altogether — it is reducing how much damage any single breach can inflict. Because in today’s crypto market, one failure is all it takes.