In the past year, tokens have had the worst performance compared to other digital assets. Only the biggest token assets survived, while small-cap tokens marked the biggest losses.

Liquidity abandoned small-cap tokens, as they sank to new all-time lows in 2025. Token performance in the past year affected all narrative assets. Neither legacy tokens nor new launches could survive the selling and the lack of liquidity.

Altcoin season was not delayed in 2025, rather, it never happened as expected. For only a couple of brief periods, altcoins outperformed BTC. However, tokens failed to command long-term gains, and even the assets of utility projects sank to all-time lows.

During the past year, tokens had several notable runs, with highly active categories. By the last quarter, most of those narratives were crashing. Meme tokens were still the most notable trade in 2025, followed by AI agents, RWA tokens, Made in USA assets, and assets on the Solana ecosystem.

Altcoins are crashing below their 200-day moving average, as they have lost the confidence of investors. Tokens and altcoins also suffered deep losses after the October 10 market crash, and liquidity did not return to the token markets.

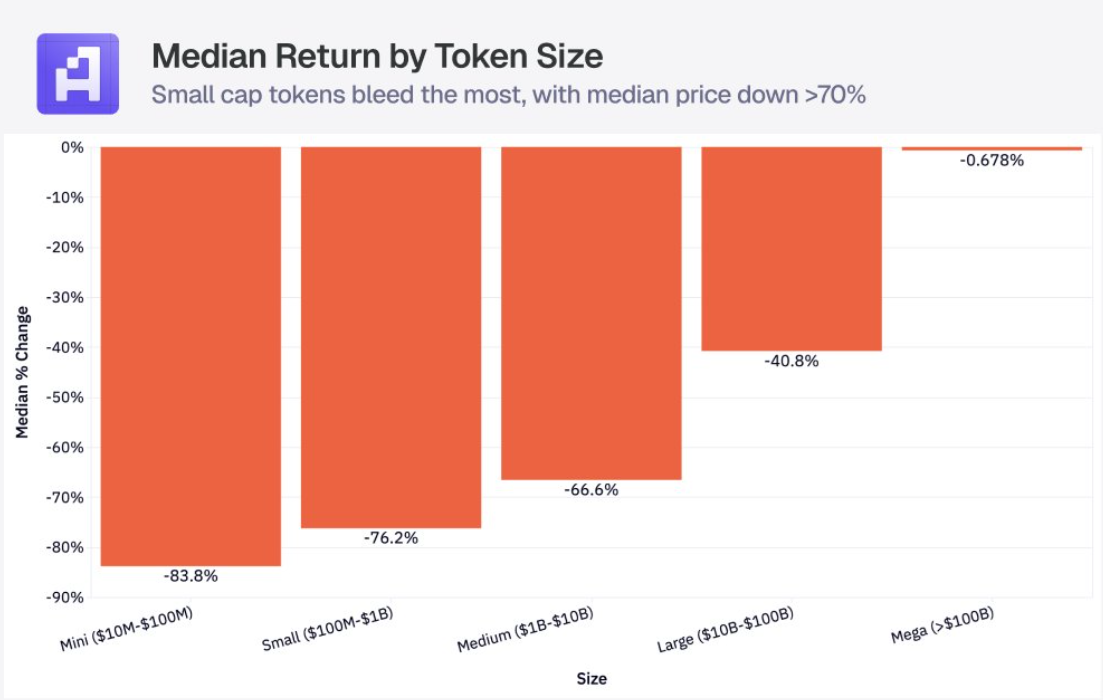

Small cap tokens lost over 83%

Small-cap tokens, defined as those valued between $10M and $100M, lost over 83% of their value, based on Artemis data.

Assets valued under $1B lost over 76% of their value. Only the top 5 tokens based on market capitalization managed to survive while almost breaking even. Narrative tokens underperformed, leaving only exchange tokens, as well as a handful of privacy assets with positive returns for 2025.

The token market also kept producing meme tokens, but most were wiped out almost instantly. Additionally, new tokens failed to reach higher valuations, showing a lack of market enthusiasm. After the strong altcoin season in January, meme tokens could no longer climb to $1B valuations, and few broke above $100M.

Toward the end of the year, new meme token traders are seeking extremely undervalued assets, which rarely break above $10M in market capitalization.

The market is back to Bitcoin season

Toward the end of the year, only 16 out of the top 100 altcoins outperformed BTC. The Altcoin season index has returned to Bitcoin season, as most of the liquidity is backing the leading coin.

Platform tokens, L1 and L2 assets, and other infrastructure projects failed to gain investor confidence. Outperforming tokens included tokenized gold, reflecting gold’s all-time price record. Other peak performers included privacy tokens ZEC, XMR, and DASH.

PIPPIN was the only outlier among AI agent tokens, although its performance is seen as potential market manipulation.

The slow altcoin season also affected new token launches. In December, only 101 tokens launched through community sales, raising just $1.3B. The amount raised is just a fraction of the raise in November, when token sales reached over $14B, based on Cryptorank data. IDO sales only raised $83M, with 44 campaigns for the past month.

Don’t just read crypto news. Understand it. Subscribe to our newsletter. It's free.