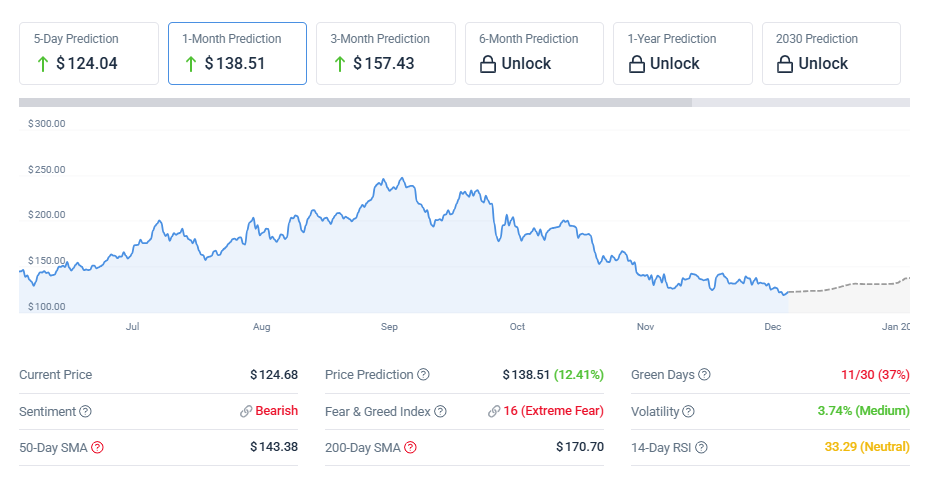

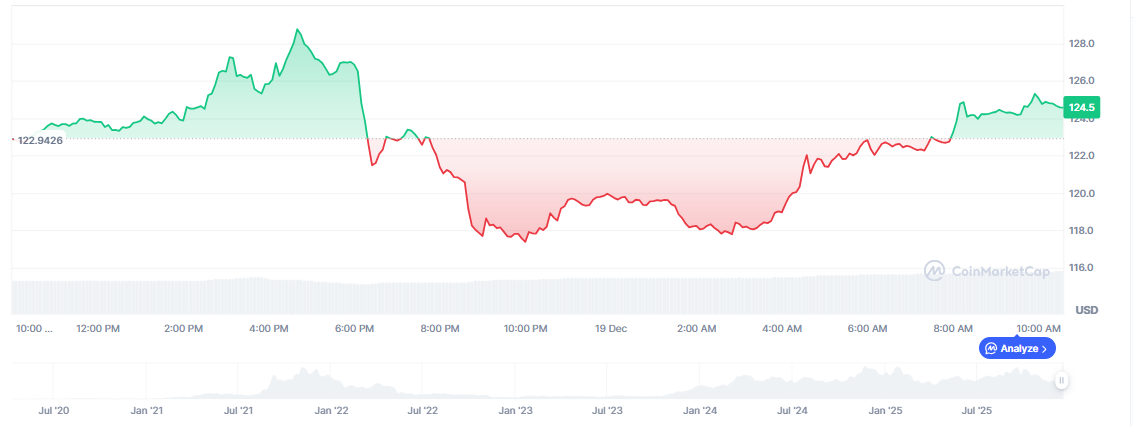

Solana price prediction models continue to shift toward downside scenarios as key technical indicators weaken and macro risk increases. The token is trading at $124.66 with a market cap of $70.08B, but broader signals point to a fading bullish setup.

Sentiment has turned bearish, only 37% of recent days have closed green, and the 14-day RSI at 33.29 suggests weak buying interest.

As capital rotates out of major altcoins, presales like Bitcoin Hyper are attracting attention with over $29.6M raised and a near-term price jump expected. Analysts warn that Solana must reclaim critical moving averages or risk a breakdown toward $110.

Technical Analysis: RSI, SMAs, and Bearish Momentum

The Solana price prediction outlook has weakened further due to technical breakdowns on multiple indicators. The 50-day SMA sits at $143.38, with price trading far below. The 200-day SMA at $170.70 shows long-term pressure building.

Meanwhile, the 14-day RSI is hovering at 33.29, close to oversold but not yet triggering significant buying support. Momentum has decoupled from early December optimism, as Solana fails to reclaim short-term resistance levels near $133–138.

The Fear & Greed Index sits at 16, marked as Extreme Fear, indicating a market dominated by risk-off behavior.

Analysts tracking Solana price prediction metrics warn that a drop below $120 will likely trigger a retest of $110. If that level breaks, the next projected support is around $95. The 20-day EMA has dropped to $133 and continues sloping downward.

Only a decisive push above $138 would flip the short-term trend back toward bullish. Until then, volume remains reactive rather than supportive, and the risk of cascading stop-loss liquidations is rising if another dip occurs.

MSCI Treasury Rule Creates External Pressure on Altcoins

A separate but related catalyst putting pressure on altcoins like Solana is the ongoing fallout from the MSCI crypto treasury rule. If crypto treasury companies are excluded from key MSCI indices, it could trigger up to $15 billion in forced selloffs.

Within that, Strategy Index components could lose $2.8 billion alone. This potential outflow has raised institutional concern and prompted further flight to liquidity, hurting price predictions across the altcoin board.

The result is increasing correlation between policy headlines and short-term price dips, especially in tokens with high circulating supply and exchange exposure like Solana.

Long-Term Forecast: Predictable Growth Still Possible

Despite near-term weakness, long-term Solana price prediction models based on linear growth still show upside. Projections assuming a 5% annual increase place Solana at $131.05 in 2026, rising to $159.29 in 2030, and reaching $259.47 by 2040.

These figures are contingent on ecosystem health, regulatory stability, and continued adoption of Solana in DeFi, gaming, and enterprise tokenization. While none of these outcomes are guaranteed, they show why some investors remain long-term holders even during high-volatility phases.

However, current on-chain behavior suggests few are willing to buy at these levels until technical strength returns.

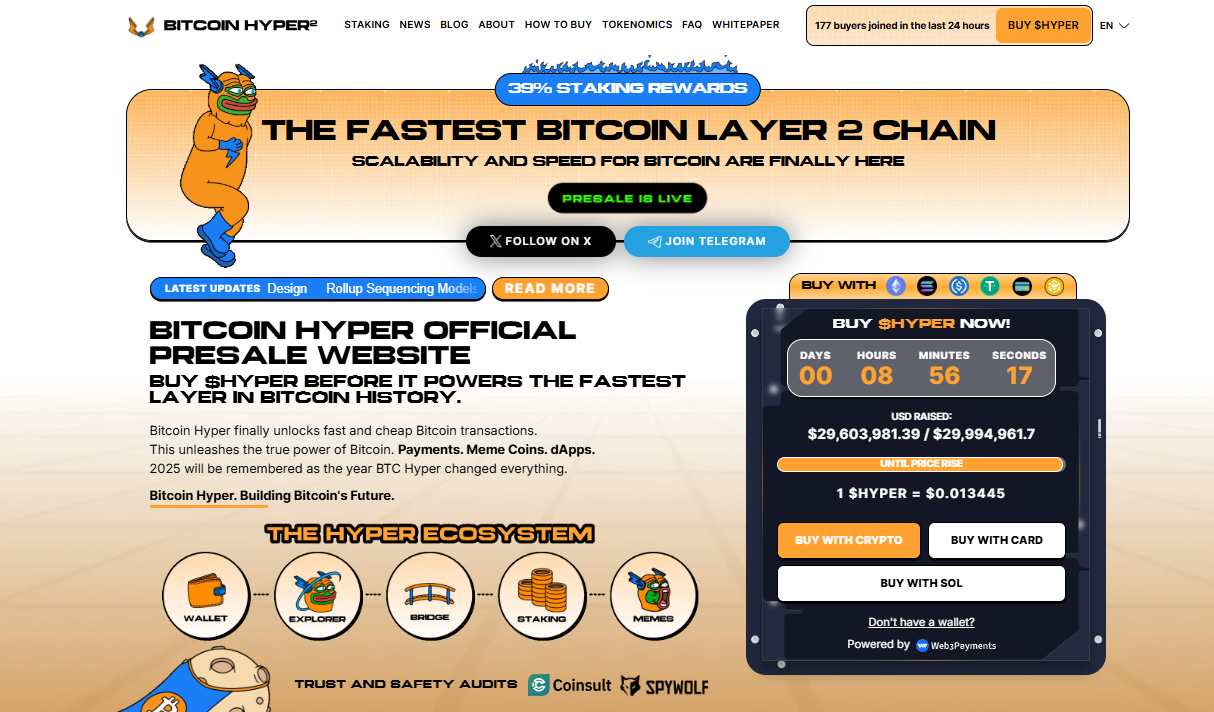

Bitcoin Hyper Presale Surges as Traders Rotate Capital

As Solana stumbles, new capital is shifting into high-growth presales like Bitcoin Hyper, which just passed $29.6 million raised with a live countdown to its next price increase.

At a current price of $0.013445, the token offers entry via crypto or card, and notably also accepts SOL, allowing frustrated Solana holders to reposition. The token’s momentum is being driven by its staking incentives, supply mechanics, and limited presale window, which has prompted early-stage buyers to act fast.

With sentiment souring around major caps, funnel activity into Bitcoin Hyper has risen sharply – positioning it as one of the most talked-about alt launches going into Q1 2026.