If you’ve been looking for a DEXE price prediction, you’re in the right place. DeXe (DEXE) has caught the attention of many new crypto investors because of its recent price swings and growing presence in the market. The big question is whether DEXE can keep climbing or if the hype will fade.

At the moment, the current price of DEXE is $10.5. September was a busy month for the token. On September 6, it dropped to a monthly low of $6.85. Just two weeks later, on September 21, it spiked to a monthly high of $12.76. That’s an 85% move between the low and the high. Compared to today’s price, DEXE is up around 37% from its bottom, but still about 27% below its September peak.

This kind of fast rise and pullback shows how volatile crypto can be. Yet, for many investors, it’s also what makes DeXe exciting. In this guide, we’ll explain what DeXe is, why people are paying attention, and what analysts expect for its price in the coming years. We’ll look at predictions for 2025, 2026, 2030, and even 2050.

Don’t worry if you’re just starting out in crypto. We’ll keep things simple, clear, and beginner-friendly. By the end, you’ll have a better idea of whether DeXe is a project worth watching or investing in.

| Current DEXE Price | DEXE Price Prediction 2025 | DEXE Price Prediction 2030 |

| $10.5 | $15 | $60 |

DeXe (DEXE) Overview

DeXe (DEXE) is a decentralized protocol designed to help communities and organizations govern themselves in a fair and transparent way. It started as a social trading platform but has grown into a full DAO constructor. Today, it offers a backend with over 60 modular smart contracts and a frontend DApp that allows anyone to manage a DAO with no coding skills. This combination makes DeXe both powerful and beginner-friendly.

The project began on September 18, 2019. At first, the idea was simple: let users copy trades from successful investors in a decentralized way. In the first quarter of 2020, the platform launched with basic features. A few months later, on September 28, 2020, the team released the official DEXE token, which became the core of the ecosystem.

DeXe was created by a group of Ukrainian developers. The founding team includes Yuriy Hotoviy, co-founder of DeXe Network and CEO of Billtrade, Dmytro Kotliarov, a key contributor, and Vitalii Maistrenko, the technical director. To support growth, DeXe held an ICO in late 2020 and raised $1.8 million. The sale attracted several well-known crypto funds such as ZBS Capital, Quest Capital Group, BN Capital, Consensus Lab, and Nova Club.

The mission of DeXe, as stated in its whitepaper, is to create a system where every vote matters, collaboration is encouraged, and true decentralization is achieved. The vision is based on four main principles. First, real decentralization with automated and transparent execution of DAO proposals. Second, a meritocracy model, where influence is not determined only by token holdings but also by proven expertise. Third, strong incentive models that reward active participation. And finally, seamless infrastructure, built from years of research and an understanding of market needs.

DEXE Price Statistics

| Current Price | $10.5 |

| Market Cap | $902,621,822 |

| Volume (24h) | $30,478,038 |

| Market Rank | #85 |

| Circulating Supply | 83,733,647 DEXE |

| Total Supply | 96,504,599 DEXE |

| 1 Month High / Low | $12.76 / $6.85 |

| All-Time High | $32.38 Mar 8, 2021 |

DEXE Price Chart

CoinGecko, October 1, 2025

DeXe (DEXE) Price History Highlights

DeXe launched on September 28, 2020, as a governance token for its decentralized social trading and asset management platform. Since then, the token has shown the kind of sharp ups and downs typical of DeFi assets. Its price history is full of dramatic moves, from record highs to long bear phases.

2020 – A Difficult Start

DEXE entered the market on October 7, 2020, at $1.49. The early trading phase was tough. Within the first month, the token fell by 50%, reaching $0.77 in early November. The all-time low of $0.73 was recorded during this period. This drop reflected typical post-launch selling pressure and low awareness of the project at that time.

2021 – Boom and Crash

The year 2021 was a turning point. On March 8, DEXE hit its all-time high of $32.38, a staggering 4200% increase from its lowest level. This was part of the broader DeFi boom, often called “DeFi Summer 2.0.” By year’s end, DEXE was down 50% from its January price, despite reaching record highs mid-year.

2022 – Bear Market Pressure

Like the wider crypto sector, DEXE faced a harsh bear market in 2022. The token started at $5.87 and ended at $3.02, a 50% yearly drop. The lowest point was $2.47. This period was defined by fading interest in DeFi after the explosive growth of 2021.

2023 – Signs of Stability

In 2023, the market calmed down. DEXE traded between $1.92 and $3.25, closing the year at $2.43. That marked only a 17% decline, the most stable yearly performance since 2021. It signaled the project’s slow but steady consolidation.

2024 – Failed Recovery Attempt

The year started strong at $10.33, with a rally up to $16.47. However, optimism didn’t last. By December, the price slid back to $7.36, a 30% loss for the year and 55% down from its yearly high.

2025 – Current Challenges

This year opened at $17.42 and briefly touched $19.2. Since then, however, DEXE has faced consistent selling pressure. At the beginning of October 2025, the price is $10.5. That means a 40% decline from the start of the year and a 45% drop from its 2025 peak.

DeXe Price Prediction: 2025, 2026, 2030–2050

| Year | Minimum Price | Maximum Price | Average Price | Price Change |

| 2025 | $7.31 | $20.62 | $15 | +40% |

| 2026 | $14.4 | $23.48 | $20 | +90% |

| 2030 | $40.25 | $80.36 | $60 | +470% |

| 2040 | $117.24 | $6,652 | $3,000 | +28,500% |

| 2050 | $7,321 | $8,611 | $8,000 | +76,000% |

DeXe Price Prediction 2025

According to DigitalCoinPrice data, DeXe (DEXE) could trade between $8.43 (-20%) at the lowest and $20.62 (+95%) at the highest in 2025.

PricePrediction.net suggests a narrower range, with DeXe moving between $10 (-5%) and $10.94 (+5%).

Telegaon analysts expect stronger growth, forecasting a potential rise to $16.52 (+55%), though the token might also dip to $7.31 (-2302%).

DeXe Price Prediction 2026

In 2026, DigitalCoinPrice forecasts DEXE to reach a high of $23.48 (+125%) and a low of $20.16 (+90%).

PricePrediction.net projects a more moderate scenario, with a minimum of $14.4 (+35%) and a maximum of $17.61 (+70%).

Telegaon offers similar optimism, expecting a peak at $23.09 (+120%), with the lowest value near $16.67 (+60%).

DeXe Price Prediction 2030

Looking at 2030, DigitalCoinPrice predicts a possible maximum of $51.43 (+390%), while the minimum might stay at $44.56 (+325%).

PricePrediction.net is even more bullish, estimating a high of $80.36 (+665%) and a minimum of $70.62 (+575%).

Telegaon foresees a more balanced scenario, forecasting a maximum of $46.08 (+340%) and a low of $40.25 (+285%).

DeXe Price Prediction 2040

For 2040, PricePrediction.net expects massive long-term growth, projecting a minimum of $5,244 (+50,000%) and a maximum of $6,652 (+63,000%).

Telegaon provides a more conservative outlook, with DEXE trading between $117.24 (+1,000%) at the lowest and $141.36 (+1,250%) at the peak.

DeXe Price Prediction 2050

By 2050, PricePrediction.net analysts forecast exponential gains, suggesting a possible low of $7,321 (+69,500%) and a maximum of $8,611 (+82,000%).

DeXe (DEXE) Price Prediction: What Do Experts Say?

Experts have recently turned their focus to DeXe (DEXE) following a sharp rally in September 2025, which highlighted how powerful whale activity can be in shaping the token’s short-term performance.

According to AMBCrypto’s report from September 20, DEXE climbed 45% in just a few days, reaching a 3-month high of $12.68 before easing back. Analysts linked this move directly to heavy whale accumulation in both spot and futures markets, which dominated trading flows for an entire week.

Data from CryptoQuant confirmed this view, showing a strong positive buy-sell delta of 27,000.. This signaled that whales were accumulating, not selling. Analysts noted that this kind of focused whale activity usually builds a strong support base, which can fuel further upward momentum if it continues.

From a technical perspective, the rally came with clear signals. The Relative Strength Index (RSI) hit 91, well into overbought territory, while the Chaikin Money Flow (CMF) rose to 0.12, showing clear buyer dominance. Experts explained that these readings often indicate powerful momentum, but also raise caution since such levels can precede high volatility.

In terms of price targets, analysts see a mixed outlook. If whale demand remains strong, DEXE could break above the $15 resistance level in the near term. On the other hand, if momentum cools, retracement levels around $9.5 and $8.6 are viewed as key supports. Medium-term projections remain more optimistic, with some experts suggesting the token could retest older highs if institutional demand continues to grow.

Beyond technicals, fundamental catalysts also shaped expert sentiment. The September rally coincided with the launch of AgentBound Tokens and integration with TheONETradeAI, both seen as meaningful upgrades that expanded utility and attracted fresh retail and institutional interest. These developments gave analysts confidence that the rally was not just speculative but supported by real ecosystem growth.

AMBCrypto

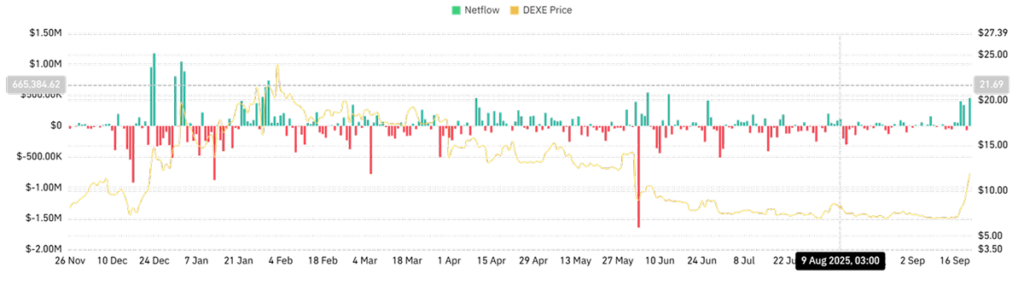

Still, risks remain. Data from CoinGlass showed that DEXE’s spot netflow surged to a 3-month high of $450,000, reflecting significant retail profit-taking. Analysts warned that if this selling pressure grows, it could weigh on prices and offset the impact of continued whale accumulation.

DEXE USDT Price Technical Analysis

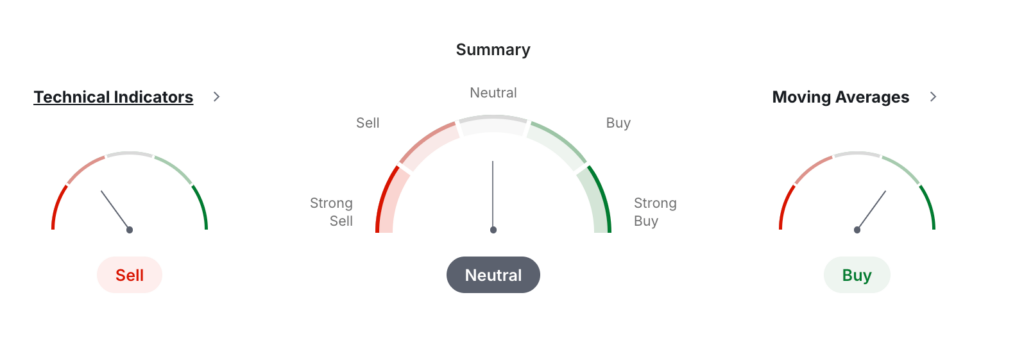

According to the latest monthly data from Investing.com, DeXe shows a mixed technical picture. The overall summary leans Neutral, with moving averages flashing Buy signals, while technical indicators point more toward Sell pressure. This split reflects the current uncertainty surrounding the token after sharp swings in recent months.

Investing, October 1, 2025

On the side of technical indicators, the breakdown shows 3 Buy signals, 2 Neutral, and 5 Sell signals. The Relative Strength Index (RSI 14) is at 49.89, which is neutral, indicating that the token is neither overbought nor oversold. The Stochastic (9,6) at 21.48 signals a sell, suggesting weak momentum. Interestingly, the Stochastic RSI (14) is at just 12.91, placing DEXE in an oversold zone, which may hint at possible upside if buyers step in. Meanwhile, the MACD (12,26) shows a buy signal, pointing to potential bullish momentum. The ADX (14) stands at 22.68, also signaling buy, reflecting a modest upward trend strength. However, other indicators like Williams %R at -77.53 and Bull/Bear Power at -2.29 suggest bearish pressure is still present.

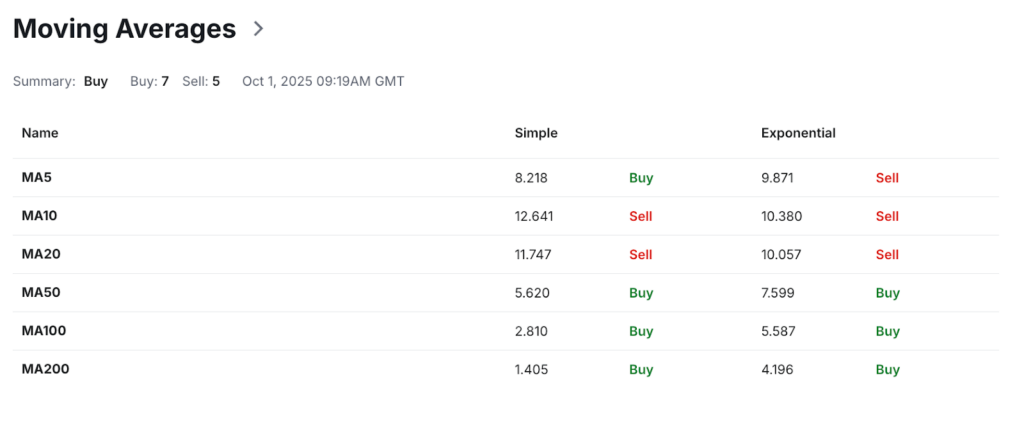

Looking at moving averages, the summary is more optimistic with 7 Buy signals against 5 Sell signals. For example, the MA50, MA100, and MA200 all show strong buy signals, reflecting long-term bullish momentum. Shorter-term averages are less supportive, with the MA5 and MA10 (exponential) signaling sell pressure. This divergence indicates that while the long-term outlook for DEXE remains positive, short-term traders still face downward resistance.

Pivot points add another layer to the analysis. The classic pivot point is at $9.71, placing immediate resistance at $12.64 and support at $6.55. Under the Fibonacci model, the first support is at $7.39, while resistance levels line up at $12.05 and $13.48. The Camarilla levels suggest tighter trading ranges, with strong support at $8.91 and resistance at $10.59.

Overall, the monthly technical outlook suggests that DeXe is currently in a neutral consolidation phase. Long-term indicators remain bullish, but near-term selling signals mean traders should watch for either a break above $12.6 or a slide toward $8.6. The next move will likely depend on whether buyer momentum can outweigh profit-taking pressure.

What Does the DeXe Price Depend On?

The price of DeXe (DEXE) is shaped by several key factors that combine market sentiment, technical dynamics, and real-world adoption. Like most cryptocurrencies, it reacts strongly to short-term speculation but also has long-term drivers connected to its ecosystem.

One of the biggest influences is market demand and supply. When more traders buy and hold DEXE, the price tends to rise. On the other hand, profit-taking or lack of interest can lead to steep declines. Because DeXe is a governance token, the level of community participation also matters.

Another factor is whale activity. Large holders can push the price up quickly through accumulation, as seen in September 2024, or create strong corrections when selling. Retail traders often follow these moves, adding to volatility.

Fundamental developments play a major role as well. Whenever DeXe introduces new features, integrations, or partnerships, the token attracts more attention. For example, the release of AgentBound Tokens and AI-driven tools like TheONETradeAI boosted both visibility and utility. This shows that actual product growth can support price appreciation beyond speculation.

Regulatory conditions are also critical. Since DeXe operates in the decentralized finance sector, any new laws affecting DAOs or DeFi protocols could influence demand. Favorable regulation may boost confidence, while restrictive policies could limit adoption.

Global crypto market cycles affect DEXE too. In bullish markets, investors look for tokens with strong fundamentals, and DeXe often benefits from this trend. In bearish conditions, however, even good projects struggle as liquidity leaves the market.

To summarize, the price of DeXe is influenced by:

Demand and supply dynamics

Whale accumulation or selling

New features and partnerships

Regulatory news and compliance

Overall crypto market trends

DeXe (DEXE) Features

DeXe stands out in the DeFi space thanks to its advanced smart contract architecture, flexible governance models, and strong focus on security.

At its core, the protocol is built on over 60 modular smart contracts, forming a scalable framework for decentralized governance. This three-tier design includes core contracts, factory contracts, and governance contracts. The system is supported by a ContractsRegistry, which serves as a central hub for managing upgrades, while CoreProperties ensure universal settings remain consistent across every DAO. Because the library is open source, independent teams can freely adopt and implement parts of the protocol, making DeXe highly adaptable.

Governance lies at the heart of DeXe. Each DAO created within the ecosystem uses four main contracts:

GovPool

GovUserKeeper

GovValidator

GovSettings

This setup enables flexible decision-making with different voting models, including ERC20 tokens, ERC721 NFTs, ERC721Enumerable, and ERC721Power standards. To enhance fairness, DeXe uses a two-stage validation process where members first approve a proposal, followed by a validator review. It also employs a non-linear voting system that limits the dominance of large stakeholders, ensuring power is not concentrated in just a few wallets.

A unique feature of DeXe is its delegation system, which empowers experts to play a larger role. Through the use of ERC721Expert NFTs, subject-matter specialists can gain magnified voting power and directly manage treasury delegations. Vote Power contracts dynamically adjust influence based on expert status and delegated assets. To maintain engagement, the system provides activity-based rewards for active delegates, encouraging consistent participation.

Security has been a top priority since DeXe’s creation. The protocol has been audited by firms such as Cyfrin, CertiK, Ambisafe, and Hacken, and has undergone more than 1,000 unit, integration, and simulation tests with full coverage. Specific measures like the GovUserKeeper contract protect user funds during voting, while the validator review layer blocks malicious proposals before they can cause harm.