Cipher Mining (CIFR) continues to operate at a loss, with annual losses deepening by 10.3% per year for the past five years. Looking ahead, the company is expected to remain unprofitable for at least three more years; however, revenue is forecast to accelerate at 33.8% per year, outpacing the US market average of 10.5%. With no signs of improvement in net profit margins, the spotlight for investors remains firmly on Cipher Mining’s high revenue growth potential amid ongoing unprofitability and share price volatility.

Next up, we will see how these numbers compare with the prevailing narratives about Cipher Mining, including where the reality strengthens or disputes community and market expectations.

Margin Pressures Persist With High Power Costs

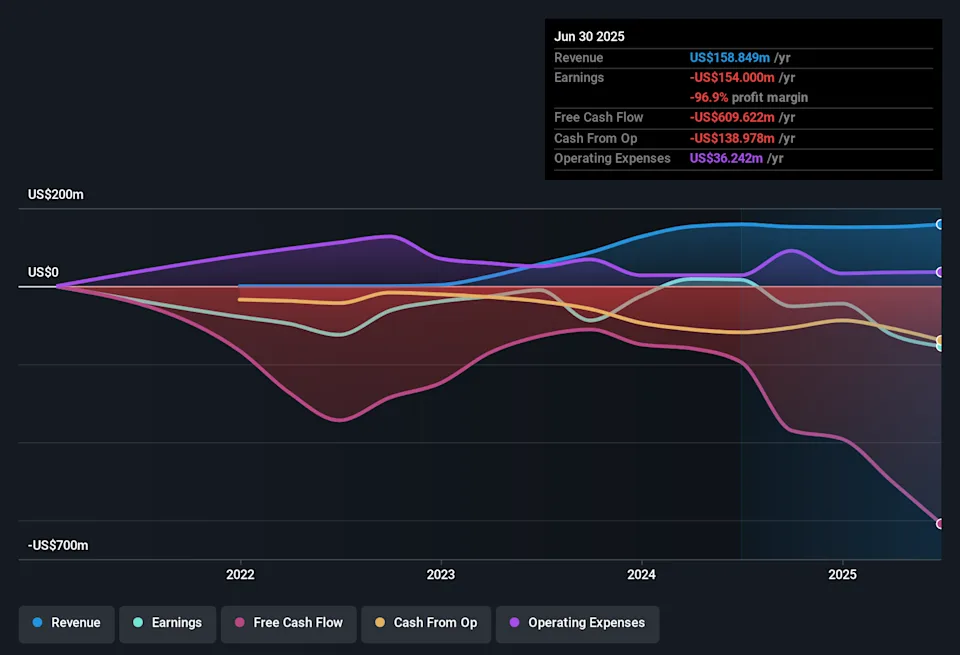

Operating margins remain deeply negative, with Cipher Mining’s profit margin at -96.9%, highlighting that almost all revenue is currently absorbed by operating costs and depreciation rather than dropping to the bottom line.

Consensus narrative underscores that while long-term, low-cost power agreements like Odessa’s five-year fixed price Power Purchase Agreement are intended to stabilize costs, variability at other sites and rising depreciation from ongoing infrastructure upgrades threaten to compress margins further.

Unfavorable shifts in energy markets or potential regulatory changes, such as carbon taxes, could materially increase operating costs and cast doubt on the ability to sustain targeted margin improvements.

Heavy reliance on constant hardware investment means any lag in efficiency upgrades or unexpected hikes in energy prices may prevent Cipher from closing the gap with competitors on profitability.

Rapid Expansion Fuels Capital Demands

To support growth, the number of shares outstanding is expected to rise by 7.0% annually for the next three years, pointing to ongoing dilution for existing shareholders as Cipher finances aggressive new projects and upgrades.

Analysts' consensus view spotlights the friction here: while the company expands production capacity through new deployments like Black Pearl Phase 1 and 2 and invests in next-generation miners, recurring capital expenditures could dilute near-term earnings per share and asset returns.

Bears highlight that new ventures into high-performance computing and the need for modular, flexible data center infrastructure run the risk of tying up capital in underperforming assets if demand or lease agreements fall short of expectations.

There remains a delicate balance between funding further expansion to capture future upside and overextending now, which may erode long-term shareholder value.

Valuation Premiums Reflect High Growth Bets

Cipher Mining trades at a price-to-book ratio of 11.9x, a steep premium to the broader US software industry average of 4x but lower than the peer group’s 15.9x. This indicates that investors are paying up for rapid revenue growth and future optionality rather than near-term profitability.

Analysts' consensus view shows this optimism is not unbridled. With the current share price at 22.75 and an analyst price target of 21.88, the market appears to have already priced in much of the expected growth, while potential rewards are balanced against material risks in execution and margin discipline.

Consensus narrative notes the price target requires Cipher to achieve $91.1 million in earnings and a 52.2x P/E by September 2028, which is considerably higher than today’s -20.7x and above the industry P/E of 36.6x.

Bears argue that missing these aggressive targets or encountering persistent volatility in Bitcoin or energy costs could make the current valuation hard to justify, even with industry-leading revenue gains.

For a full breakdown of how these figures shape the broader investment story, see the analysts’ narrative for Cipher Mining’s most likely scenarios.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Cipher Mining on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a unique take on the data? Share your insights and shape your perspective into a personal narrative in just a few minutes. Do it your way

A great starting point for your Cipher Mining research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

See What Else Is Out There

Cipher Mining’s persistent losses, thin margins, and premium valuation raise concerns for investors seeking more consistent profitability and financial discipline.

If dependable results appeal to you, use our stable growth stocks screener (2094 results) to discover companies that deliver steadier earnings and revenue from quarter to quarter.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.