The latest warning about Bitcoin’s cycle isn’t coming from price charts or halving models, but from the behavior of buyers themselves.

According to new on-chain analysis, the market may already be in a bear phase – not because sellers are panicking, but because demand is quietly drying up.

Key Takeaways

CryptoQuant says Bitcoin has already entered a bear phase driven by weakening demand, not panic selling.

Fading ETF inflows, slower growth among large holders, and falling derivatives funding point to a risk-off shift.

The firm sees $70,000 as a near-term downside zone, with $56,000 possible later if demand fails to recover.

The Cycle May Have Topped Without the Crowd Noticing

Data from CryptoQuant suggests that Bitcoin’s latest expansion phase has already consumed most of the buying power that fueled the rally since 2023. Rather than pointing to a single crash event, the firm argues that the cycle turned when demand growth slipped below its historical trend in early October 2025.

From CryptoQuant’s perspective, Bitcoin’s price cycles are driven less by supply mechanics and more by waves of demand. The most recent cycle, they say, was powered by three distinct forces: the launch of U.S. spot ETFs, political risk premiums tied to the U.S. election, and aggressive accumulation by corporate Bitcoin treasuries. With those forces now fading, price support is weakening beneath the surface.

Why This Doesn’t Look Like a Classic Crash

Instead of calling for a sudden collapse, CryptoQuant describes the current phase as a slow compression. When demand stops expanding, price can remain elevated for a time, but momentum eventually fades. That process, the firm says, is already visible.

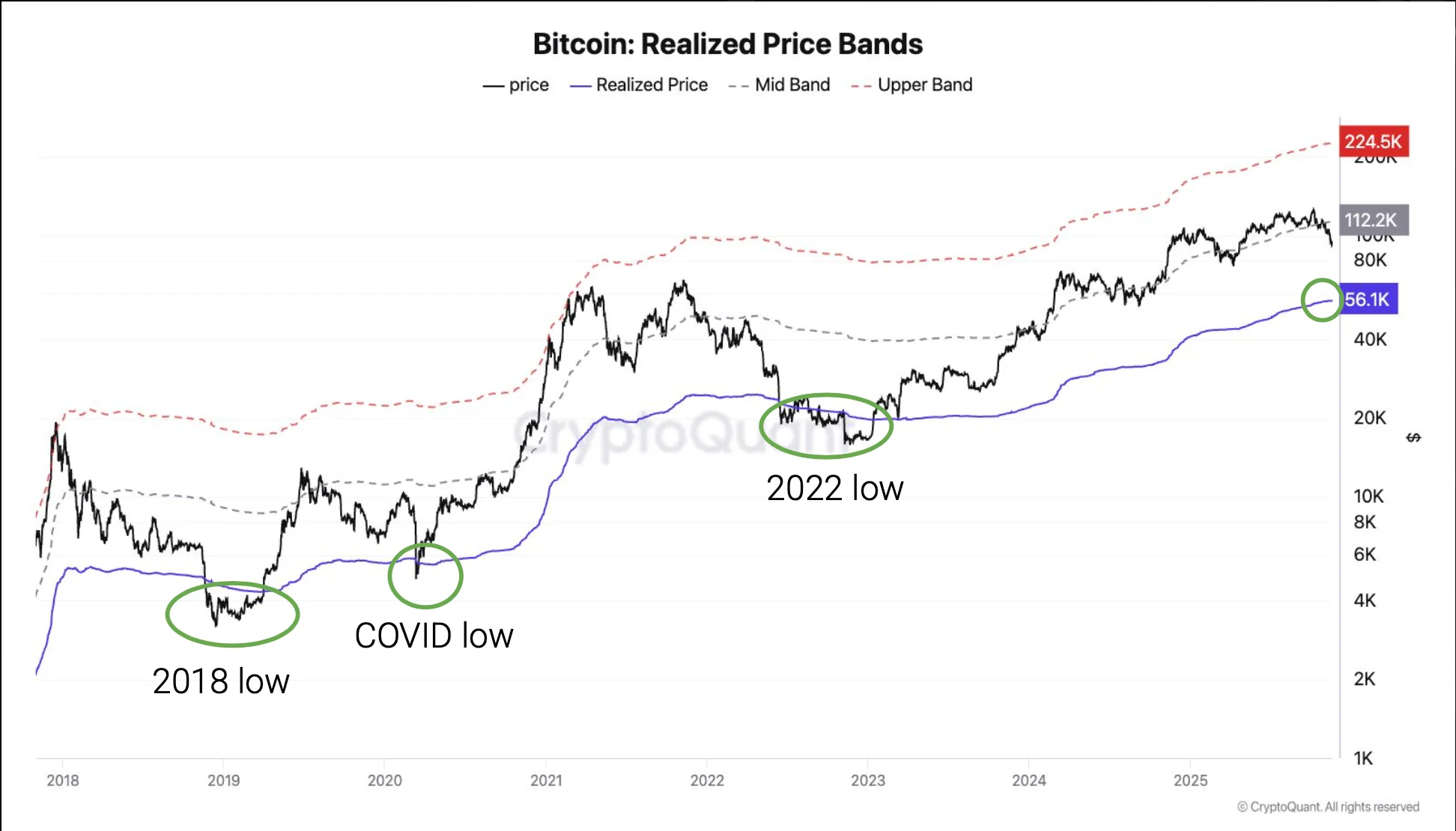

Based on historical behavior, Bitcoin often gravitates toward the realized price during bear markets. That level currently sits near $56,000. A move to that zone would imply a drawdown of roughly 55% from the recent peak – still severe, but smaller than any previous cycle low. Before that, CryptoQuant sees an intermediate floor near $70,000, which could be tested within months if demand fails to recover.

Institutional Flows Are No Longer Helping

One of the clearest shifts has occurred in the ETF market. After acting as a major engine of demand earlier in the cycle, U.S. spot Bitcoin ETFs became net sellers in the final quarter of 2025. Combined holdings dropped by around 24,000 BTC, a stark reversal from the heavy accumulation seen a year earlier.

Large holder behavior is also changing. Wallets holding between 100 and 1,000 BTC – a group that includes ETFs and treasury-focused firms – are growing more slowly than normal. CryptoQuant compares this pattern to late 2021, when similar stagnation preceded the 2022 bear market.

Derivatives and Long-Term Signals Are Turning Defensive

Leverage metrics are reinforcing the message. Funding rates in perpetual futures, averaged over a full year, have fallen to their lowest levels since late 2023. Historically, sustained declines in funding reflect reduced appetite for leveraged long exposure – a condition more consistent with bear markets than bull runs.

At the same time, Bitcoin has slipped below its 365-day moving average, a long-term trend line that has often separated expansion phases from contraction phases. CryptoQuant views sustained weakness below this level as confirmation that the market regime has changed.

When the Pressure Could Show Up in Price

CryptoQuant’s head of research, Julio Moreno, said the bear phase effectively began in mid-November, shortly after the massive liquidation event on Oct. 10. Since then, demand indicators have continued to deteriorate rather than stabilize.

Moreno estimates that a move toward $70,000 could unfold over the next three to six months. A deeper slide toward $56,000 would likely be slower, potentially stretching into the second half of 2026 if no new demand catalysts emerge.

A View That Clashes With Wall Street Optimism

This outlook sharply contrasts with several bullish forecasts still circulating among major financial institutions. Citigroup continues to project much higher prices over the next year, while JPMorgan maintains an upside case based on Bitcoin’s comparison to gold.

Others have turned more cautious. Standard Chartered recently lowered its long-term targets, while Bitwise still believes new all-time highs are possible in 2026.

CryptoQuant’s argument cuts across all of those forecasts. In their framework, the key question is not how optimistic projections sound, but whether demand is expanding or contracting. Right now, the data points firmly toward contraction.

If that trend persists, Bitcoin’s next major move may not be driven by headlines or narratives, but by the simple absence of new buyers willing to step in at current prices.