Hedera’s HBAR continues to trade under pressure as a persistent downtrend limits upside attempts. Multiple breakout efforts have failed, keeping the altcoin from establishing higher levels.

The broader market environment has added strain, preventing HBAR from gaining traction despite brief stabilization near key support zones.

Hedera Is Facing Bearishness

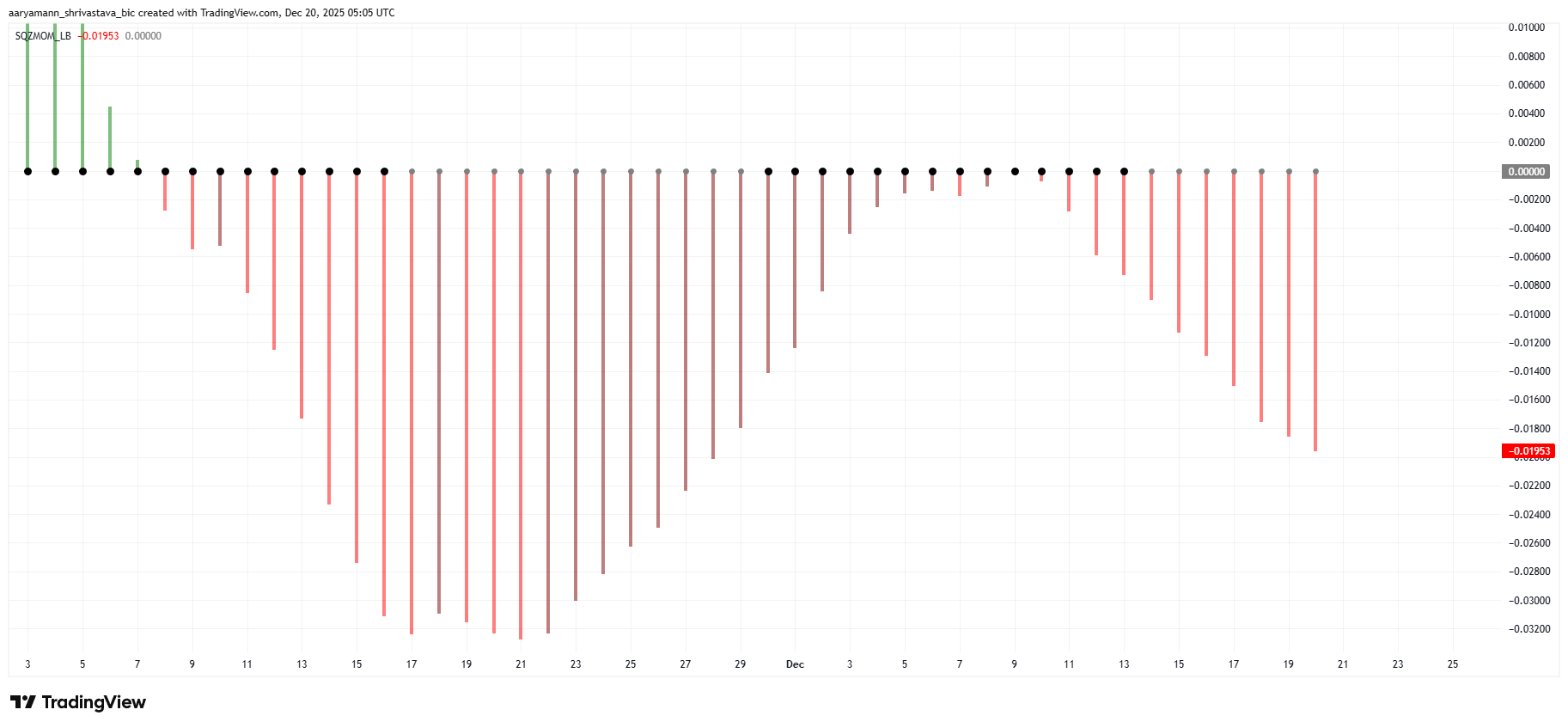

Technical indicators show growing bearish momentum. The Squeeze Momentum Indicator was released earlier last week, triggering heightened volatility. Instead of an upside move, the release resulted in a sharp price drop, reinforcing negative sentiment among short-term traders.

The indicator’s histogram continues to deepen in bearish territory. This pattern suggests selling pressure remains dominant. Strengthening downside momentum reduces the likelihood of HBAR price recovery, as traders hesitate to reenter positions amid weak technical confirmation.

HBAR Squeeze Momentum Indicator. Source: TradingView

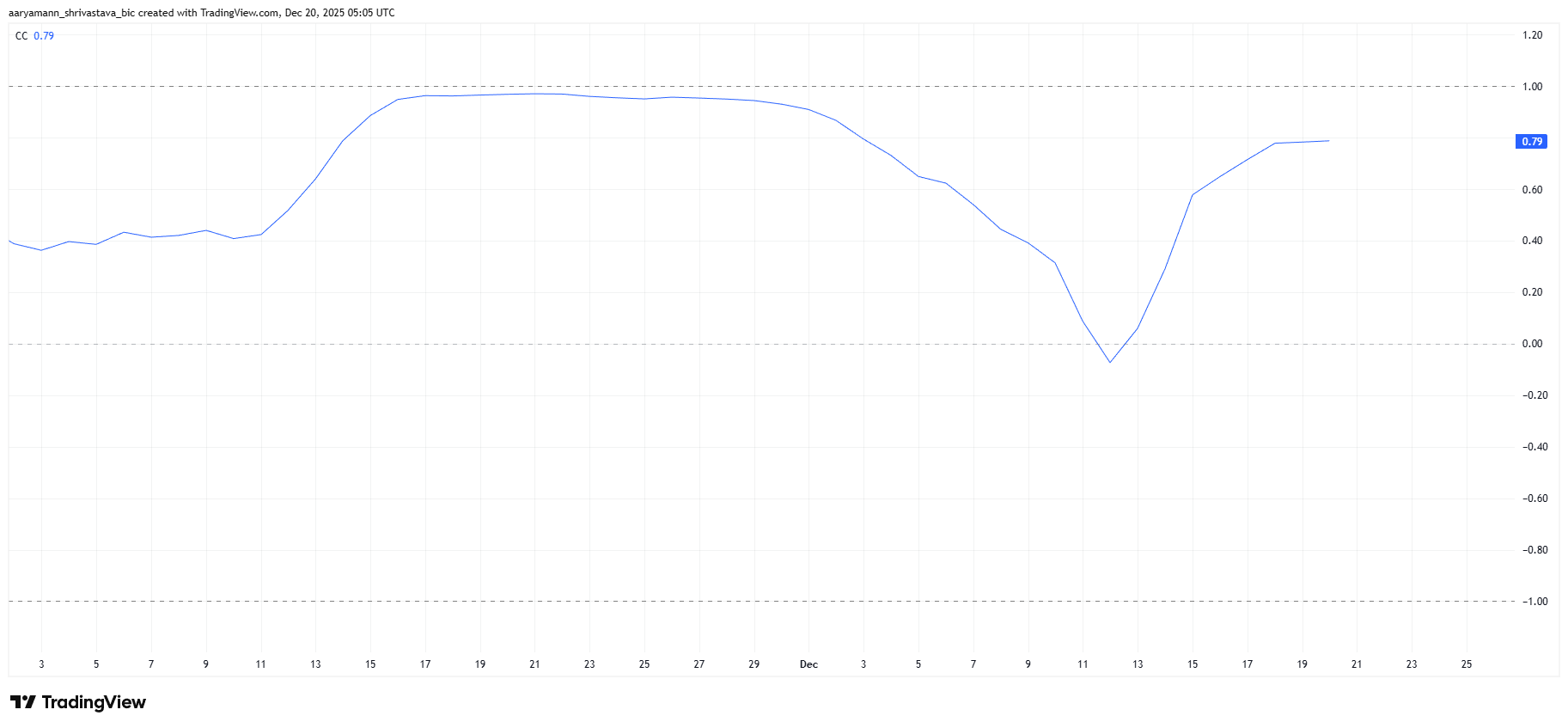

HBAR’s macro outlook is closely tied to Bitcoin’s performance. The altcoin currently shows a strong correlation of 0.79 with BTC. This relationship indicates HBAR is largely mirroring Bitcoin’s price movements rather than acting independently.

Bitcoin’s struggle to recover has therefore weighed heavily on HBAR. When BTC lacks momentum, correlated assets often face similar constraints. Unless Bitcoin stages a sustained rebound, HBAR’s ability to break its downtrend remains limited by broader market weakness.

HBAR Correlation With Bitcoin. Source: TradingView

HBAR Price Could Note Further Decline

HBAR trades near $0.111 at the time of writing, holding slightly above the $0.110 support. The token dropped 24.5% earlier last week after failing to escape its month-long downtrend. Current price action suggests cautious stabilization rather than reversal.

Given prevailing conditions, HBAR may continue to struggle below the $0.120 level. Persistent bearish momentum could drag the price toward $0.099. A move to this zone would extend losses and reinforce the downtrend that has dominated recent trading sessions.

HBAR Price Analysis. Source: TradingView

A bullish alternative depends on renewed investor inflows. Increased buying interest could help HBAR reclaim $0.120 and break free from its downward structure. A sustained push toward $0.125 would invalidate the bearish thesis and signal improving confidence among market participants.