Galaxy Research is willing to put a big number on the board, $250,000 bitcoin by the end of 2027, while basically refusing to pretend 2026 will cooperate with clean forecasting. The firm’s 2026 outlook calls next year “too chaotic to predict,” even as it concedes that new all-time highs could still happen somewhere in the mess.

$250K Bitcoin By 2027, Turbulent 2026

“BTC will hit $250k by year-end 2027. 2026 is too chaotic to predict, though Bitcoin making new all-time highs in 2026 is still possible. Options markets are currently pricing about equal odds of $70k or $130k for month-end June 2026, and equal odds of $50k or $250k by year-end 2026.”

That options framing matters because it’s not a “we don’t know” shrug. It’s a quantifiable distribution of outcomes that, by Galaxy’s telling, looks unusually wide even by bitcoin standards. And it’s paired with a near-term threshold that reads like a risk manager’s note, not a moonshot memo.

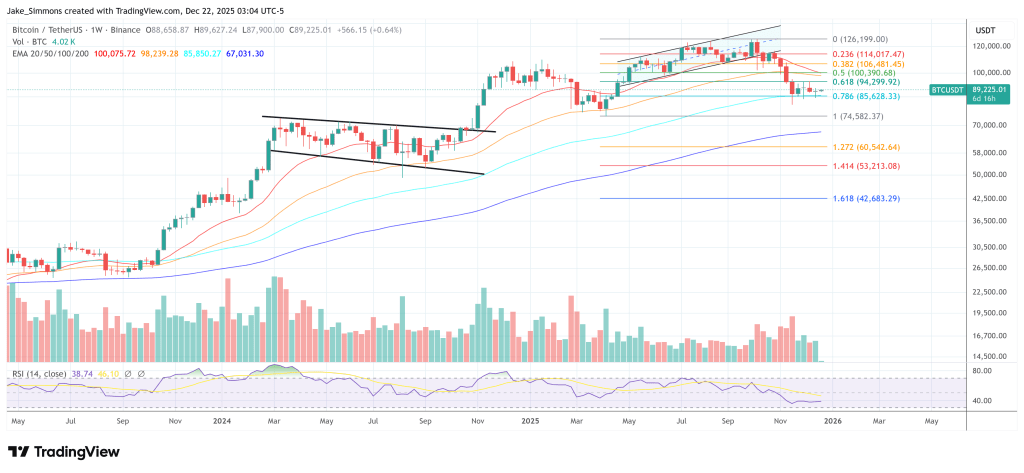

“At the time of writing, broader crypto is already deep in a bear market, and bitcoin has failed to firmly re-establish its bullish momentum. Until BTC firmly re-establishes itself above $100-$105k, we feel risk remains to the downside in the near term. Other factors in the broader financial markets also create uncertainty, such as the rate of AI capex deployment, monetary policy conditions, and the US midterm elections in November.”

If the price call is the headline, the more interesting subtext is that Galaxy thinks bitcoin is steadily turning into a more recognizable macro asset, not in the “digital gold” slogan sense, but in the way it trades and how its derivatives are being priced. The report points to a structural shift in longer-dated volatility, and it links some of that to the growth of institutional-style yield strategies that have been steadily eating into BTC’s historical vol premium.

“Over the course of the year, we have seen a structural decrease in the level of longer term BTC volatility – some of this move can be the introduction of larger overwriting/BTC yield generation programs. What is notable is that the BTC vol smile now prices puts in vol terms as more expensive than calls, which was not the case 6 months ago. This is to say, we are moving from a skew normally seen in developing, growth-y markets to markets seen in more traditional macro assets.”

That’s a subtle but consequential claim: the market is increasingly paying up for downside protection, and bitcoin’s “up only” convexity is being priced less like an emerging tech trade and more like something institutions hedge the way they hedge rates, FX, or equity beta. Galaxy’s view is that this process continues regardless of whether 2026 chops sideways, bleeds lower, or spikes and reverses.

“This maturation will likely continue, and whether or not bitcoin bleeds lower towards the 200-week moving average, the asset class’s maturation and institutional adoption are only increasing. 2026 could be a boring year for Bitcoin, and whether it finishes at $70k or $150k, our bullish outlook (over longer time periods) is only growing stronger. Increasing institutional access is combining with relaxing monetary policy and a market in desperate search for non-dollar hedge assets.”

Institutional Adoption Will Accelerate

The distribution story shows up again in Galaxy’s ETF expectations, a direct bet on the pipes getting wider, not just sentiment turning risk-on for a quarter.

“US spot crypto ETF net inflows will exceed $50 billion. 2025 already generated $23 billion of net inflows, and we expect that figure to accelerate in 2026 as institutional adoption deepens. With wirehouses lifting restrictions on advisor recommendations and major platforms such as the once-standoffish Vanguard adding crypto funds, BTC and ETH alone should surpass their 2025 flow levels as they make their way into more investor portfolios.”

And it extends into model portfolios, the kind of institutional “default inclusion” that tends to matter more than a single headline allocation. “The final step is inclusion in model portfolios, which typically requires higher fund assets under management (AUM) and sustained liquidity, but we expect BTC funds to clear those thresholds and enter models at a 1%-2% strategic weight.”

Galaxy’s 2026 message, then, is not that bitcoin is broken. It’s that the range of plausible outcomes is wide, and the market is pricing it that way. The 2027 message is the opposite: in the long run, they’re getting more confident, not less.

At press time, Bitcoin traded at $89,225.