XRP remains locked in a persistent downtrend after another failed breakout attempt. The altcoin continues trading below key resistance, reflecting fading investor support.

Selling pressure has increased as confidence weakens, raising concerns that XRP may struggle to reverse its trend despite repeated recovery efforts.

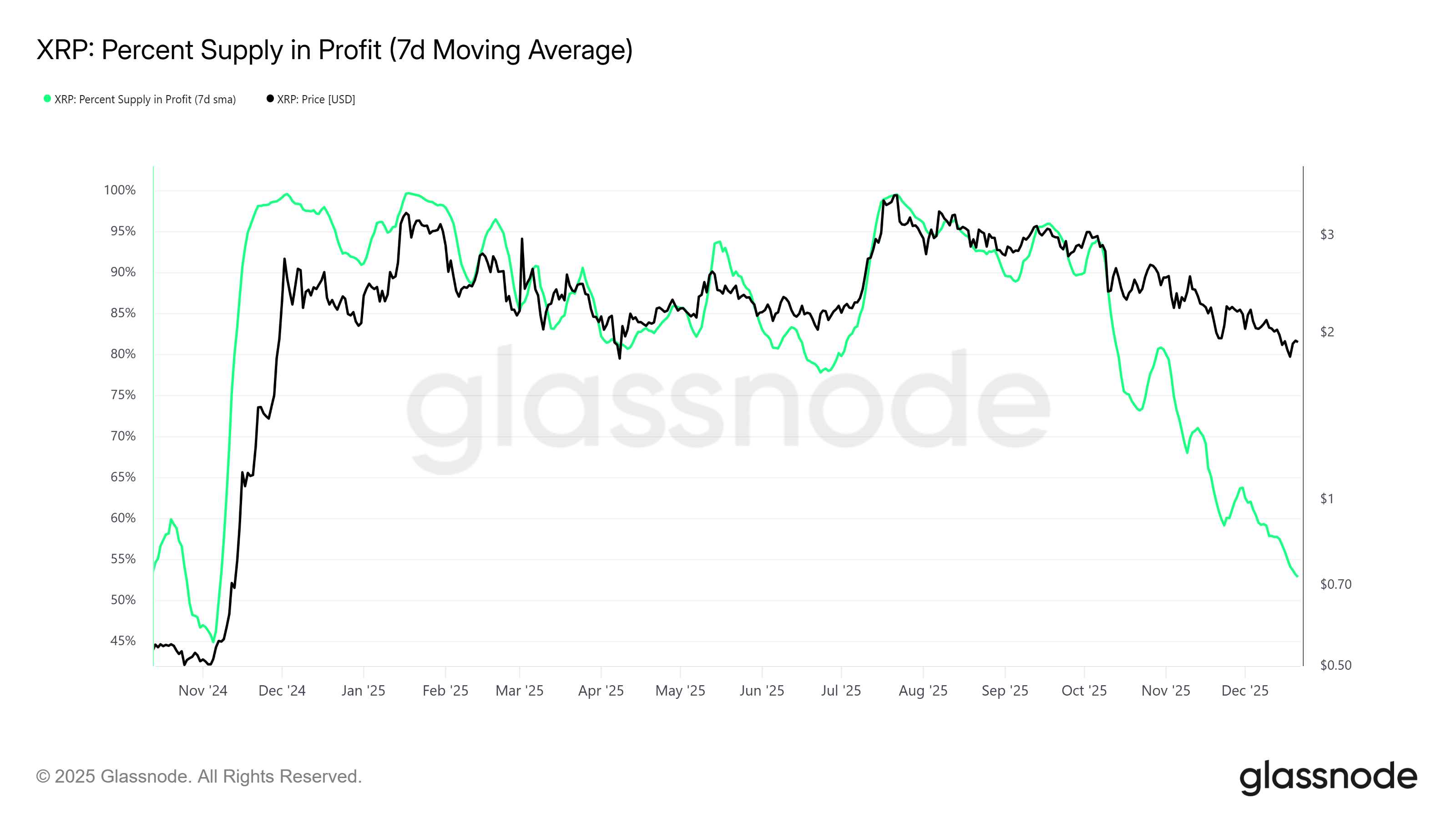

Almost 50% XRP Supply Is Underwater

On-chain data shows a sharp deterioration in profitability. The share of XRP supply in profit has dropped to 52% after weeks of steady decline. Nearly half of the circulating supply now sits at a loss, increasing the risk of panic-driven selling.

The last time profitability reached similar levels was in November 2024. Historically, when XRP’s supply in profit falls below 50%, extended drawdowns often follow. While a deeper decline is not immediate, this pattern suggests elevated downside risk over the longer term.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

XRP Supply In Profit. Source: Glassnode

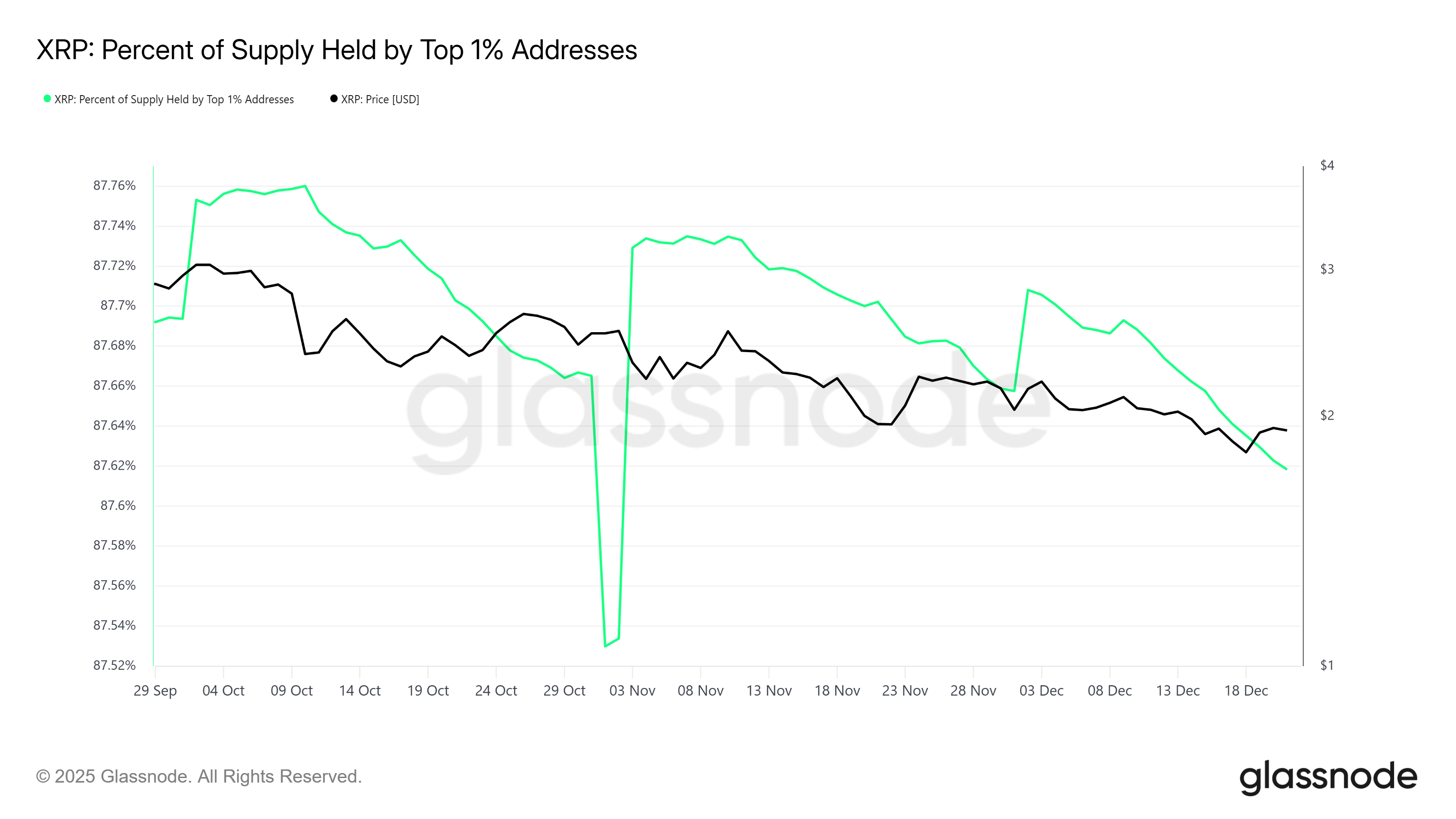

Macro data adds further pressure. Supply held by the top 1% of XRP addresses has declined slightly. These wallets now control 87.6% of the total supply, down from 87.7% at the start of the month.

Although the change appears small, these addresses include whales and institutional-scale holders. Even modest distribution from this group can influence price action. Their gradual selling signals caution and reinforces concerns about XRP’s ability to sustain a recovery without renewed demand.

XRP Supply Held By Top 1% Addresses. Source: Glassnode

XRP Price Needs A Christmas Miracle

XRP trades near $1.92 at the time of writing, sitting just below the $1.94 resistance. The price remains capped by a downtrend line active for more than six weeks. Given current conditions, XRP is likely to consolidate between $1.85 and $1.94 in the near term.

Bearish sentiment keeps XRP vulnerable to additional selling. A move toward $1.85 remains possible as traders react to declining profitability and whale distribution. However, a deeper breakdown appears limited unless broader market conditions deteriorate sharply.

XRP Price Analysis. Source: TradingView

A bullish alternative still exists. If XRP pushes above $1.94 and decisively breaks $2.00, it would escape the downtrend. Such a move would invalidate the bearish thesis and improve supply profitability. Increased profits could restore confidence and support a broader recovery attempt.