Nokia Oyj (HLSE:NOKIA) shares have caught the attention of investors recently after posting a modest lift this past week, adding to a steady stretch of gains seen over the past three months. The stock’s momentum offers a window into how the market currently values Nokia’s position in the global network technology sector.

Momentum is clearly building for Nokia Oyj, as the stock’s recent 90-day share price return of 42.81% signals renewed optimism, especially after a challenging 1-month stretch. In addition, the one-year total shareholder return stands at 36.29%, reflecting both improving sentiment and potential growth prospects ahead.

If you’re eyeing momentum in the tech sector, now is an opportune time to broaden your search and uncover See the full list for free.

With strong recent gains on the board, the big question for investors is clear: Is Nokia trading at a discount relative to its prospects, or is the market already pricing in the company’s expected recovery and earnings momentum?

Most Popular Narrative: 2.6% Undervalued

With Nokia’s most widely followed narrative assigning a fair value of €5.39, just above the last close of €5.25, fresh momentum is sparking debate over whether the rebound still has room to run.

Strong demand from hyperscalers (cloud/AI data centers) and U.S./European infrastructure stimulus is expanding Nokia's addressable market for high-capacity network equipment. This supports future top-line growth. Ongoing global build-out of fiber and advanced 5G/6G networks, accelerated by regulatory programs and large CSP capex, provides a multi-year runway for increased product and service revenues, particularly in Fixed and Optical Networks.

Read the complete narrative.

Want to peek inside the logic pushing this modest fair value bump? The forecast hinges on surprising revenue momentum, margin gains, and a profit outlook that challenges prevailing market caution. Curious what underlying numbers and bold assumptions are fueling the case for Nokia to outgrow its past?

Have a read of the narrative in full and understand what's behind the forecasts.

However, downside risks remain, as tough competition in mobile networks and currency volatility could still offset Nokia’s growth momentum if challenges persist.

Find out about the key risks to this Nokia Oyj narrative.

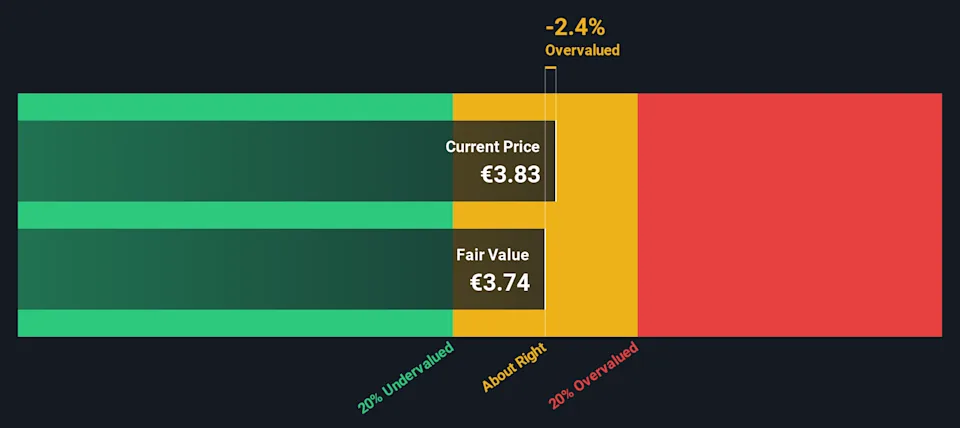

Another View: Discounted Cash Flow Perspective

While the fair value narrative points to slight undervaluation, our SWS DCF model offers a strikingly different take, suggesting that Nokia’s shares are actually trading above its intrinsic value (DCF fair value: €1.99). This implies investors may be paying a premium for future growth expectations and earnings momentum. Which version of value will the market ultimately side with?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Nokia Oyj for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 929 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Nokia Oyj Narrative

Not sure you agree with these valuations or want to dig deeper into the numbers on your own? You can craft your own perspective in just a few minutes. Do it your way

A great starting point for your Nokia Oyj research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Seize your edge and give your portfolio range. New ideas often mean new potential for growth or income. Don’t wait for the crowd to catch up; act now and see what you may be missing.

Tap into the momentum of high-potential trends by reviewing these 25 AI penny stocks shaping the AI and automation landscape for tomorrow’s tech leaders.

Grow your income stream as you browse these 15 dividend stocks with yields > 3%, featuring companies with yields above 3% and solid payout histories.

Take the lead on future innovation with these 27 quantum computing stocks driving advances in quantum computing, security, and scalable processing power.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.