The recent Bitcoin price decline has already triggered a major sell-off wave across the crypto market, and it doesn’t seem to be letting up anytime soon. While trading below $90,000, there are a number of implications for the pioneer cryptocurrency depending on the next move. The tug-of-war between the bulls and the bears makes either direction possible, and with major levels lying at risk, a crypto analyst has analyzed what the consequences of each move could be.

How Bitcoin Price Could Play Out Either Way

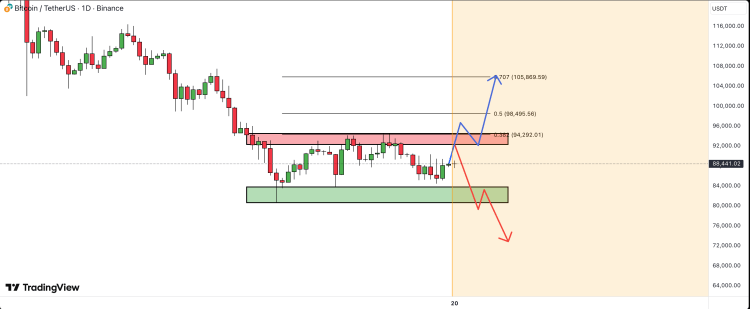

Crypto analyst HAMED_AZ analyzes the Bitcoin price chart, pointing out the current trend and what could lead to either a recovery or a crash. First, the crypto analyst outlines that the bitcoin price is now in a corrective phase. This began with the all-time high record of $126,000, and since then, the cryptocurrency has lost more than $35,000 of its value.

The corrective phase also places the cryptocurrency inside a tight range, holding it between $84,000 and $94,000. Both of these levels have served as major support and resistance in the past, making them the points to beat that will determine the next move.

A continuation of trading inside this range ensures that the Bitcoin price does not see any major move. The main move will happen when either of these support or resistance levels is broken, depending on which camp is able to pull the momentum in their favor.

Bull Or Bear Case To Watch Out For

The first case is if the Bitcoin bulls are able to crush the resistance that has been mounting at $94,000 over the last week. Since the expectations for an upward move are high, if it does play out this way, then it would push the Bitcoin price toward retesting this resistance level.

If the breakout is confirmed and the resistance fails, then the crypto analyst believes that the Bitcoin price will once again cross above the psychological level of $100,000. The main target lies as high as $108,000 before the momentum runs out.

However, there is still the possibility of the bears taking control if they are able to push the price below the $84,000 support. This level acted as the major support in the last downtrend, so it has become the level to hold. Failure to secure this level would trigger a crash that could send the Bitcoin price as low as $72,000.