Digital-asset firm Galaxy Digital’s Head of Firmwide Research has predicted that Bitcoin (BTC) could reach $250,000 by the end of 2027, a 179% increase from current levels.

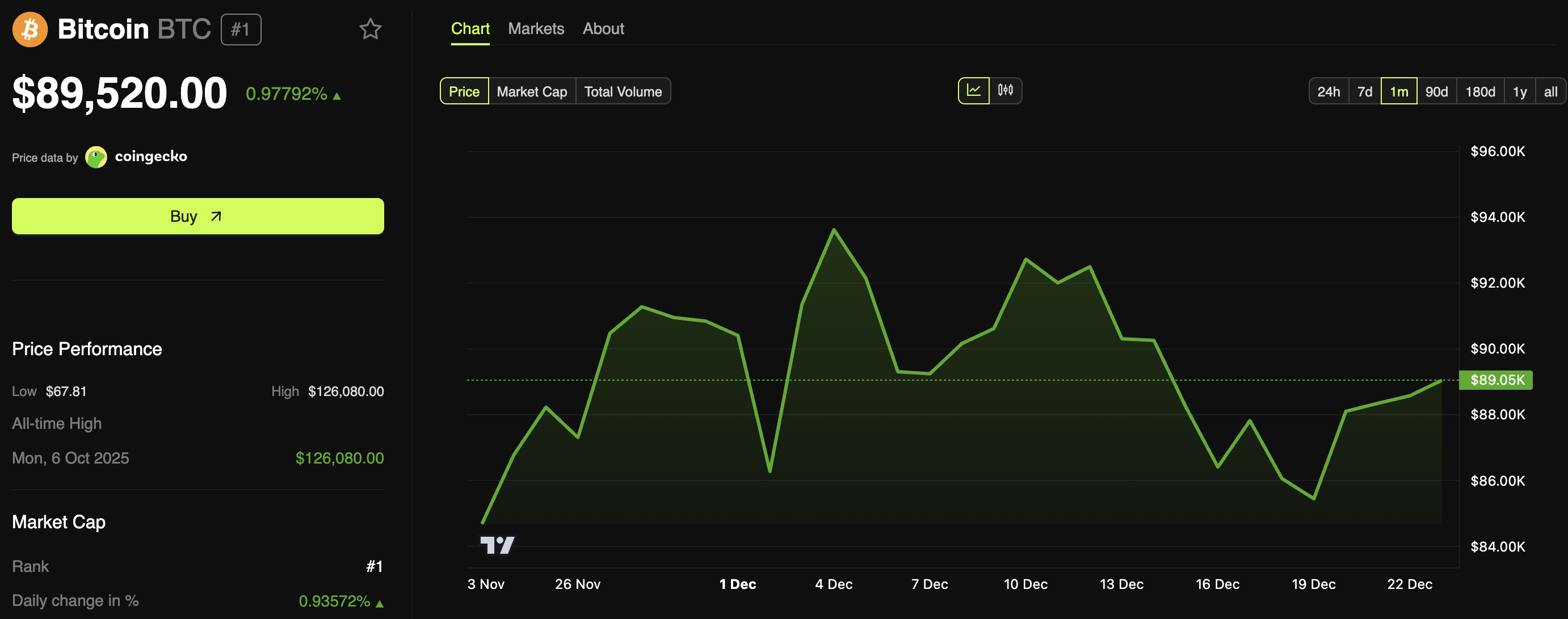

This long-term projection comes as Bitcoin trades near $89,000, well below its October peak. The cryptocurrency has been enduring a challenging fourth quarter characterized by substantial price volatility.

Galaxy Digital Shares 2027 Bitcoin Prediction

In a recent post on X (formerly Twitter), Alex Thorn explained that Bitcoin’s maturation and institutional adoption will continue to accelerate. According to Thorn, expanding institutional access, combined with easing monetary policy and rising demand for dollar hedge assets, could strengthen Bitcoin’s position.

Thorn suggested that within the next two years, Bitcoin could possibly start being used in the same way gold is used today, as a widely adopted “monetary debasement hedge.”

“BTC will hit $250k by year-end 2027,” the post read.

He also pointed to notable shifts in Bitcoin’s volatility profile. Thorn stated that long-term volatility has been trending lower, a development he partially attributes to the expansion of Bitcoin yield strategies programs and option overwriting.

“What is notable is that the BTC vol smile now prices puts in vol terms as more expensive than calls, which was not the case 6 months ago. This is to say, we are moving from a skew normally seen in developing, growth-y markets to markets seen in more traditional macro assets,” he wrote.

While maintaining a long-term bullish outlook, Thorn held off from offering a clear price forecast for 2026. He did not rule out the possibility of Bitcoin reaching new highs next year, but described 2026 as “too chaotic to predict.”

He cited a combination of macroeconomic ambiguity, political developments, and more as the reasons. Thorn explained that,

“At the time of writing, broader crypto is already deep in a bear market, and bitcoin has failed to firmly re-establish its bullish momentum. Until BTC firmly re-establishes itself above $100-$105k, we feel risk remains to the downside in the near term. Other factors in the broader financial markets also create uncertainty, such as the rate of AI capex deployment, monetary policy conditions, and the U.S. midterm elections in November.”

Furthermore, to illustrate this uncertainty, Thorn referenced the options market pricing, which currently reflects evenly split expectations across extreme outcomes.

There are similar probabilities that Bitcoin will trade at either $70,000 or $130,000 by the end of June 2026, and at $50,000 or as high as $250,000 by the end of the year, reflecting the lack of near-term consensus on its direction.

“2026 could be a boring year for Bitcoin, and whether it finishes at $70k or $150k, our bullish outlook (over longer time periods) is only growing stronger,” the executive noted.

Bitcoin May Fall Short of Galaxy Digital’s 2025 Price Target

The forecast comes as Bitcoin is on track to record its worst fourth-quarter performance since 2018. The asset has declined 21.5% so far this quarter, while year-to-date losses stand at 4.2%.

At the time of writing, Bitcoin was trading at $89,520, representing a 0.97% increase over the past 24 hours.

Bitcoin (BTC) Price Performance. Source: BeInCrypto Markets

The performance of the largest cryptocurrency has prompted several analysts to revise their outlooks downward. Thorn previously cut his 2025 year-end Bitcoin price target from $185,000 to $120,000.

He attributed the downgrade to multiple factors, including whale distribution, washed-out leverage, capital rotation into AI stocks and gold, rapid stablecoin growth, waning retail participation, and more. However, Thorn has now cautioned that Bitcoin could even fall short of the revised target.

“In November, we lowered our EOY price target to $125k. At the time of writing, BTC is trading in the $80-90k range and looks unlikely to meet our updated EOY price target for 2025,” Thorn said.

Thus, while the near-term outlook remains uncertain, it is clear that the expert maintains a bullish long-term view on Bitcoin. As 2026 approaches, the market will be closely watching how BTC’s price performs.