Arbitrum (ARB) is showing early signs of stabilization after an extended downtrend, drawing renewed attention from market participants monitoring both technical indicators and on-chain activity. Recent chart patterns and ecosystem data suggest that downside momentum may be easing, even as broader crypto markets remain cautious.

The development is notable because Arbitrum is one of the largest Ethereum layer-2 networks by usage, and shifts in its market structure are often watched as a barometer for activity across the scaling ecosystem.

Ecosystem Metrics Continue to Expand

According to commentary from market analyst Michaël van de Poppe, Arbitrum’s underlying fundamentals have continued to strengthen despite prolonged price weakness. Total value locked (TVL) on the network has increased on a year-over-year basis, reflecting steady growth in deployed capital across decentralized finance applications.

I remain cautiously bullish on $ARB.

From a fundamental perspective, there's a lot of momentum, constant growth.

How?

TVL constantly grows year after year, where also the DEX volume starts to accelerate and the amount of active accounts and transactions continue to expand.… pic.twitter.com/WXQBo5wmb4

— Michaël van de Poppe (@CryptoMichNL) December 21, 2025

Decentralized exchange activity has also accelerated, alongside rising numbers of active accounts and transactions. These trends indicate sustained network usage rather than short-lived speculative surges, reinforcing the view that Arbitrum’s core infrastructure remains in demand among developers and users.

Higher-Timeframe Charts Show Bullish Divergence

From a technical standpoint, higher-timeframe charts are beginning to reflect a change in momentum. While ARB’s price has continued to print lower levels over recent months, momentum indicators have flattened and started to turn upward, forming what technicians describe as a bullish divergence.

Van de Poppe notes that this divergence has been developing since January 2025, suggesting a gradual shift rather than an abrupt reversal. Such patterns often emerge during accumulation phases, when selling pressure weakens and longer-term participants quietly build positions.

Short-Term Trading Activity Signals Reduced Selling Pressure

Shorter-term charts provide additional context. On the four-hour ARB/USDT timeframe, price rebounded sharply from mid-December lows before entering a tighter consolidation range near the $0.19 level. Trading volume expanded during the rebound and then moderated as price stabilized.

This behavior typically reflects a transition away from panic-driven selling toward more balanced trading conditions. While no directional breakout has been confirmed, the structure suggests that downside acceleration has slowed.

Broader Altcoin Context

Arbitrum’s setup is unfolding amid a challenging environment for altcoins, many of which have seen prolonged drawdowns and diminished retail interest. Van de Poppe frames this period as one where fundamentally strong projects can become overlooked, even as network usage continues to grow.

Historically, similar phases have preceded longer-term trend shifts across the altcoin market, though outcomes vary by project and market conditions.

Implications for the Layer-2 Sector

Taken together, Arbitrum’s improving technical structure and expanding ecosystem metrics highlight a disconnect between price performance and on-chain activity. While caution remains warranted given macro and market uncertainty, ARB’s recent behavior underscores how layer-2 networks with active user bases can continue building through market downturns, potentially shaping the next phase of Ethereum scaling adoption.

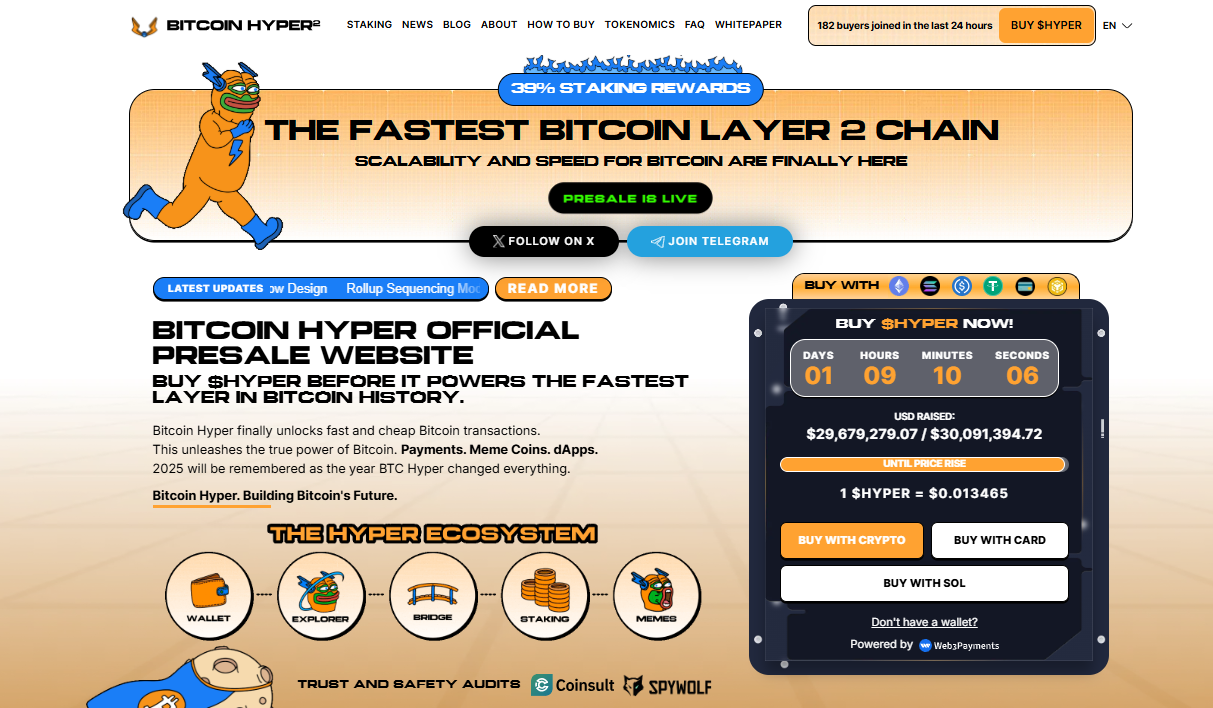

Bitcoin Hyper: A Safe Haven Bet Amid Extreme Bearish Pressure

In the broader context of DeFi infrastructure where oracle networks such as Chainlink are often cited in price outlooks for their role in cross-chain data, new Bitcoin-focused execution layers are also emerging. One example is Bitcoin Hyper (HYPER), a Solana-based Layer-2 that aims to extend DeFi functionality to Bitcoin by enabling higher-throughput smart contract execution that ultimately settles back to the Bitcoin network. The project positions itself within the BTCFi narrative as an auxiliary execution environment rather than a base-layer change. According to publicly shared figures, the presale has raised approximately $29.68 million to date.

Key features:

Massive opportunity to unlock $2 trillion in Bitcoin capital

39% staking rewards with explosive price growth potential

Security audited by Coinsult and Spywolf