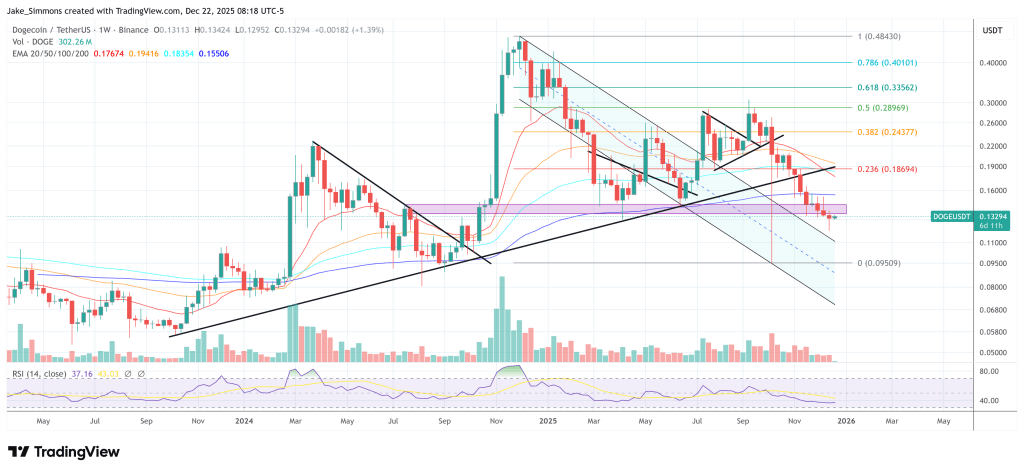

Dogecoin is doing that thing again, not pumping, not capitulating, just sitting there on the weekly like it’s waiting for a cue. And if you’re the type who still believes memes have market structure like in 2017 and 2021, one chart making the rounds on X says this is exactly what the pre-run “calm” has looked like before.

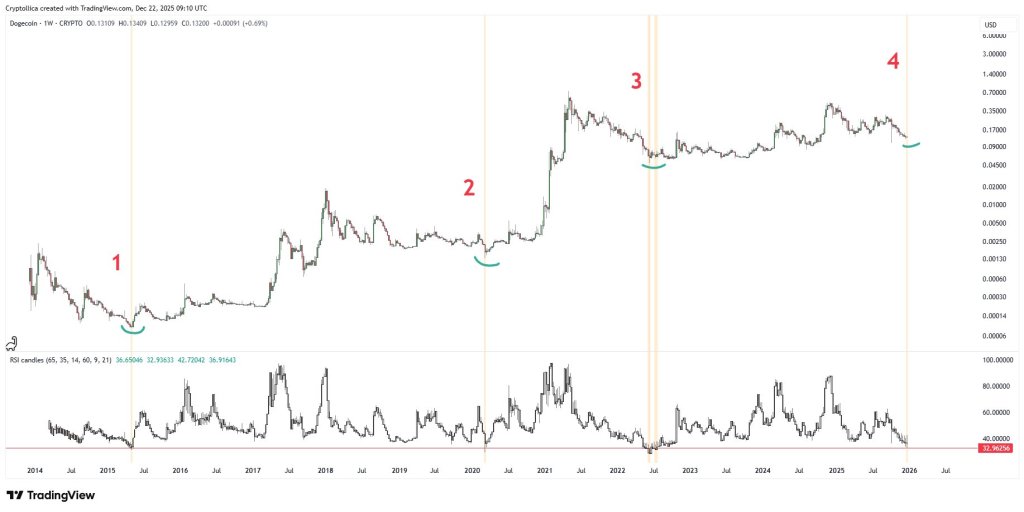

Crypto analyst Cryptollica (@Cryptollica) posted a weekly DOGE chart marking four major structural points across the coin’s history, arguing the current stretch maps onto prior accumulation phases.

“We are looking at a textbook fractal setup,” Cryptollica wrote. “The chart highlights four distinct structural points (1, 2, 3, 4). We are currently at Point 4, and the structure is rhyming perfectly with the pre-bull run accumulation phases of the past.”

Will History Repeat For Dogecoin?

The pitch is basically: zoom out, stop staring at intraday noise, and look at the cycle cadence. In his framing, Zones 1 and 2 were the “boredom phases,” the stretches where volatility dried up, price rounded out a base, and the market slowly rotated from weak hands to more patient holders. Zone 2, he says, was the launchpad that ultimately led into the 2021 face-melter.

“Zones 1 & 2: These were the ‘boredom phases’ where volatility died, and smart money accumulated,” he wrote. “Zone 2 specifically was the launchpad for the massive 2021 parabolic run. Zone 4 (Current Price Action): We are seeing the exact same rounding bottom formation.”

That “rounding bottom” bit matters, because it’s not the dramatic reversal traders love to screenshot. It’s the opposite. It’s price stabilizing, forming a heavy base, refusing to break down — and doing it slowly enough that most people stop paying attention. Which, again, is kind of the point.

Then there’s the RSI argument, and it’s the cleaner one. Cryptollica highlighted a weekly RSI floor around the low-30s area, suggesting DOGE has repeatedly found major cycle bottoms when momentum reset to that band. “Look at the RSI indicator at the bottom. The red line (~32 level) acts as a historical floor,” he wrote. “Every single time the weekly RSI touched or hovered near this baseline (Points 1, 2, and 3), it marked a macro bottom. Now: The RSI has reset back to this critical support level.”

That’s the “sellers are exhausted” claim — not because a candle says so today, but because the longer-term momentum gauge has already done the full trip down to where DOGE previously stopped bleeding out and started building again.

And he’s not being subtle about what comes next, at least in the cleanest version of the fractal. “This isn’t just random noise; it’s a cyclical reset,” Cryptollica wrote. “The chart suggests we are in the ‘Golden Pocket’ for accumulation. If the fractal plays out like it did in 2020 (Zone 2), the current price action is simply the calm before the storm.”

To be clear, fractals aren’t guarantees. DOGE isn’t trading in a vacuum, and the macro/liquidity backdrop can absolutely mess with tidy historical comparisons. But if history repeats for DOGE, the best days could be ahead.

At press time, Dogecoin traded at $0.13294.