Huma Finance is the first PayFi network, built on Solana, bringing real-world yield, instant liquidity, and 24/7 global payments to blockchain using stablecoins and on-chain infrastructure.

As traditional finance struggles with slow settlements, high fees, and limited accessibility, Huma Finance is leading a new wave of decentralized innovation. With over $4.4 billion in PayFi transaction volume and more than 50,000 depositors, it is already proving that blockchain-powered financial systems can operate on a global scale and deliver sustainable, real-world returns.

Now, with the launch of Huma 2.0 and the $HUMA token airdrop underway, this guide will walk you through everything you need to know about how Huma works, what makes it different, its tokenomics, how to claim your HUMA airdrop, and what’s ahead for the protocol.

What Is Huma Finance ($HUMA), and What Is Huma 2.0?

Source: Huma Finance

Huma Finance is a Solana-based DeFi protocol that powers the emerging category of PayFi, or payment-enabled finance built on blockchain. Its mission is to create a financial system that is programmable, permissionless, and inclusive, giving people and businesses access to credit, yield, and instant payments through stablecoins.

Huma supports real-world financial services such as invoice financing, payroll advances, and working capital loans using smart contracts. The protocol is built on Solana, leveraging its speed and low cost to enable real-time settlement and open participation.

It connects borrowers, capital providers, underwriters, and platforms in a modular network. Instead of relying on crypto-native collateral, Huma uses off-chain data to assess borrower risk and allocate capital based on real economic activity.

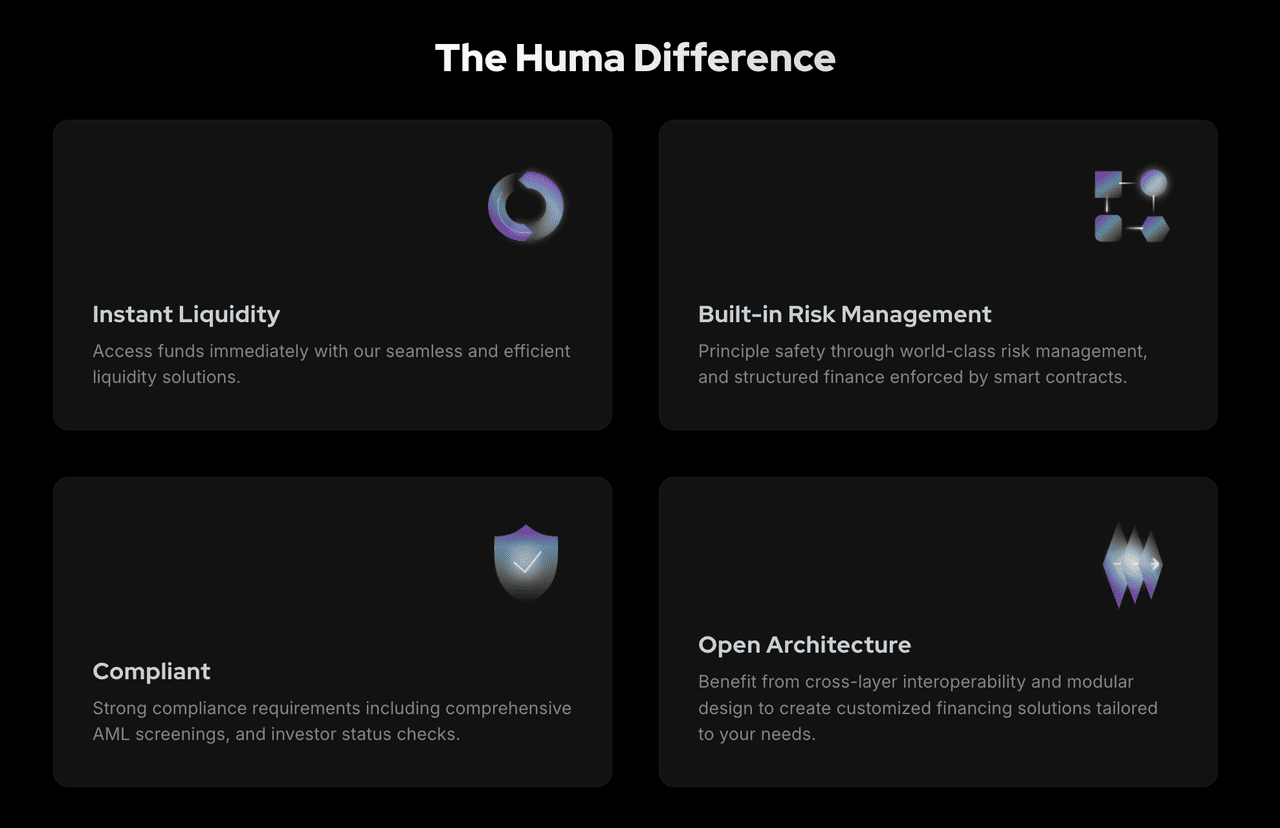

Key Features of Huma Finance

• Real-World Yield: Stablecoin returns are generated from real payment financing activities such as payroll advances, invoice factoring, and cross-border settlement.

• Programmable Credit: Loans are structured as on-chain repayment streams using smart contracts, with built-in automation and transparent repayment terms.

• Off-Chain Risk Models: Underwriters use real-world data to assess borrower risk and assign credit, replacing crypto-native collateral models.

• Modular PayFi Architecture: The protocol supports flexible roles for borrowers, Liquidity Providers (LPs), underwriters, and platforms, connected through smart contracts and composable layers.

• Solana-Native Deployment: Huma is deployed on Solana and integrated with top Solana DeFi protocols such as Jupiter, and Kamino. It does not currently operate on Ethereum, Base, or Polygon.

How Does Huma Finance Work?

Huma operates as a decentralized network that facilitates credit and payments through four core actors:

• Borrowers: Individuals or businesses who seek real-world funding

• Capital Providers: Liquidity providers who supply stablecoins in return for real-world yield

• Underwriters: Entities who assess borrower risk and secure loans using off-chain data

• Service Providers: Platforms that integrate Huma's protocol to offer PayFi-based financial services to users

Funds are disbursed on-chain via smart contracts, while repayments are managed automatically according to predefined conditions. Each transaction includes real-world context, enabled by Huma’s credit data system, repayment streams, and performance-based risk models.

What Makes Huma Finance Unique?

Huma Finance is more than a lending protocol. It is a blueprint for a programmable financial system that blends the transparency of DeFi with the utility of real-world payments. With the launch of Huma 2.0, the protocol has expanded into a fully permissionless PayFi network, giving users and builders greater control, flexibility, and access to global financial infrastructure.

Source: Huma Finance

By powering stablecoin-based credit and yield products that are tied to real economic activity, Huma connects capital to productive use cases with clear, programmable repayment rules.

Why It Matters

• Faster Access to Capital: Borrowers can get funded quickly without relying on traditional banks

• Sustainable Yield: Providers earn stablecoin-based returns from real-world financial activity

• Global and Always-On: Transactions run 24/7 across borders with instant settlement

• Transparent and Automated: Repayment terms are enforced by smart contracts with on-chain visibility

• Permissionless and Composable: Huma 2.0 allows anyone to plug into the network, from fintech apps to DAOs and underwriters

Huma is helping define the PayFi category. It offers a decentralized credit layer designed to serve real-world financial needs at global scale.

What’s the Tokenomics of Huma Finance ($HUMA)?

$HUMA is issued as a Solana SPL token, supporting fast on-chain interactions and integration with the broader Solana DeFi ecosystem. The $HUMA token is the native utility and governance asset of the Huma Protocol. It is designed to power a sustainable PayFi ecosystem by rewarding long-term participation, supporting decentralized governance, and funding future development.