The cryptocurrency market has seen a sharp divergence between Bitcoin and alternative digital assets following Bitcoin’s decline from its recent peak near $126,000. While Bitcoin has retained relative strength, most major altcoins have experienced significantly deeper losses, reshaping profitability across the sector.

Tokenization is dead.

The “altseason” you’re waiting for is never coming.

Because there’s no reason for it anymore.This table is one of the clearest examples of why people outside crypto are justified in not trusting it.

Most 2025 token launches are down 80–95% from starting… pic.twitter.com/P01iz1pi6U— Bring Me!! (@BringMeCoins) December 20, 2025

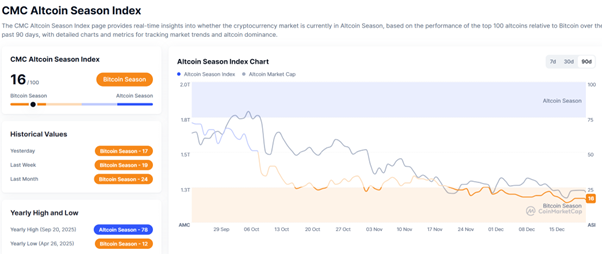

This shift is reflected in the Altcoin Season Index, a widely referenced metric published by CoinMarketCap, which has dropped to one of its lowest levels of the year. The reading suggests that altcoins are broadly underperforming Bitcoin as 2025 approaches its close.

Altcoin Season Index Signals Broad Underperformance

According to CoinMarketCap data, the Altcoin Season Index has fallen below 20, registering a score of 16 at the time of measurement. The index compares the 90-day performance of the top 100 cryptocurrencies, excluding stablecoins, against Bitcoin to assess whether capital is flowing into altcoins.

Image Courtesy: CoinMarketCap

A score of 16 indicates that only 16 of the top 100 altcoins have outperformed Bitcoin over the past 90 days. Readings at this level are typically associated with periods when Bitcoin dominance increases and risk appetite for smaller digital assets declines.

Ethereum’s Relative Weakness Reinforces Trend

Ethereum, often viewed as a bellwether for the broader altcoin market, has also lagged behind Bitcoin during this period. Over the last 90 days, Ethereum has declined by approximately 28.3%, compared with Bitcoin’s roughly 21.1% drawdown.

Historically, sustained altcoin rallies have often been led by Ethereum outperforming Bitcoin. Its current underperformance reinforces the broader message from the Altcoin Season Index that market conditions remain unfavorable for most alternative assets.

How the Index Defines Altcoin Seasons

The Altcoin Season Index uses a scale from 1 to 100 to classify market conditions. A reading of 75 or higher indicates an “altcoin season,” meaning the majority of tracked altcoins have outperformed Bitcoin over a three-month period. At those levels, capital rotation away from Bitcoin and into higher-risk assets is typically underway.

Lower readings signal either transitional phases or outright altcoin bear markets. The deeper the index falls below 75, the more pronounced the relative weakness of altcoins tends to be.

Context From Previous Market Cycles

Altcoin seasons have historically been marked by rapid and sometimes extreme price movements, particularly during the 2021 cycle when many assets posted outsized gains in short timeframes. Expectations for a similar environment to re-emerge in 2025 have so far not materialized.

Instead, major altcoins remain down between roughly 30% and 80% from their all-time highs, underscoring the scale of the current drawdown.

ALTCOINS ARE AT HISTORIC WEAKNESS LEVELS ?

Zoom out and look at this chart. Only ~3% of altcoins on Binance are trading above their 200-day moving average. That’s not normal, that’s washout territory.

Since early October, the damage has been real. Total alt market cap… pic.twitter.com/b3dlP6O7xg

— CryptosRus (@CryptosR_Us) December 22, 2025

Broader Market Implications

The current index reading highlights a cautious market structure where capital preservation has taken priority over speculative expansion. For investors and builders, the data underscores the continued dominance of Bitcoin and the challenges facing altcoins in regaining relative strength under present conditions.

Bitcoin Hyper: The Best Altcoin to Buy Now

Against this backdrop of declining altcoin participation, some market activity has shifted toward Bitcoin-centric infrastructure rather than speculative altcoins. One project cited in this context is Bitcoin Hyper (HYPER), which positions itself within the BTCFi narrative as a Solana-based Layer-2 designed to enable smart contract and DeFi functionality that ultimately settles back to Bitcoin.

The project frames its approach as complementary to Bitcoin’s base layer rather than a replacement. Public disclosures indicate the Bitcoin Hyper presale has raised approximately $29.71 million so far, highlighting continued interest in Bitcoin-focused scaling and execution solutions even amid broader altcoin weakness.