XRP price has quietly slipped into an uncomfortable spot. The price is down about 9% over the past 30 days, momentum feels stale, and positive social chatter around the token has turned noticeably sour. At first glance, that looks like weakness. But XRP has a history of doing its best work when enthusiasm disappears.

This time, the problem dragging sentiment lower may also be the exact condition that sets up the next move. Possibly led by a key holder group.

The Problem: Positive Sentiment Collapses as Short-Term Holders Exit

The core issue is not price. It is sentiment.

XRP’s positive social sentiment has dropped to a three-month low, falling sharply from recent highs. This metric tracks how often XRP is discussed positively across social platforms. When it collapses, it signals crowd fatigue rather than panic buying.

History shows this matters.

In mid-October, a similar sentiment drop preceded a rally of roughly 15% over the following days. In early November, another local low in positive sentiment was followed by a 17% advance within a week. Late November showed the same pattern, with prices rising about 14% after sentiment hit a trough.

Collapsing Positive Sentiment: Santiment

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

This time, the sentiment drop is deeper than those prior lows.

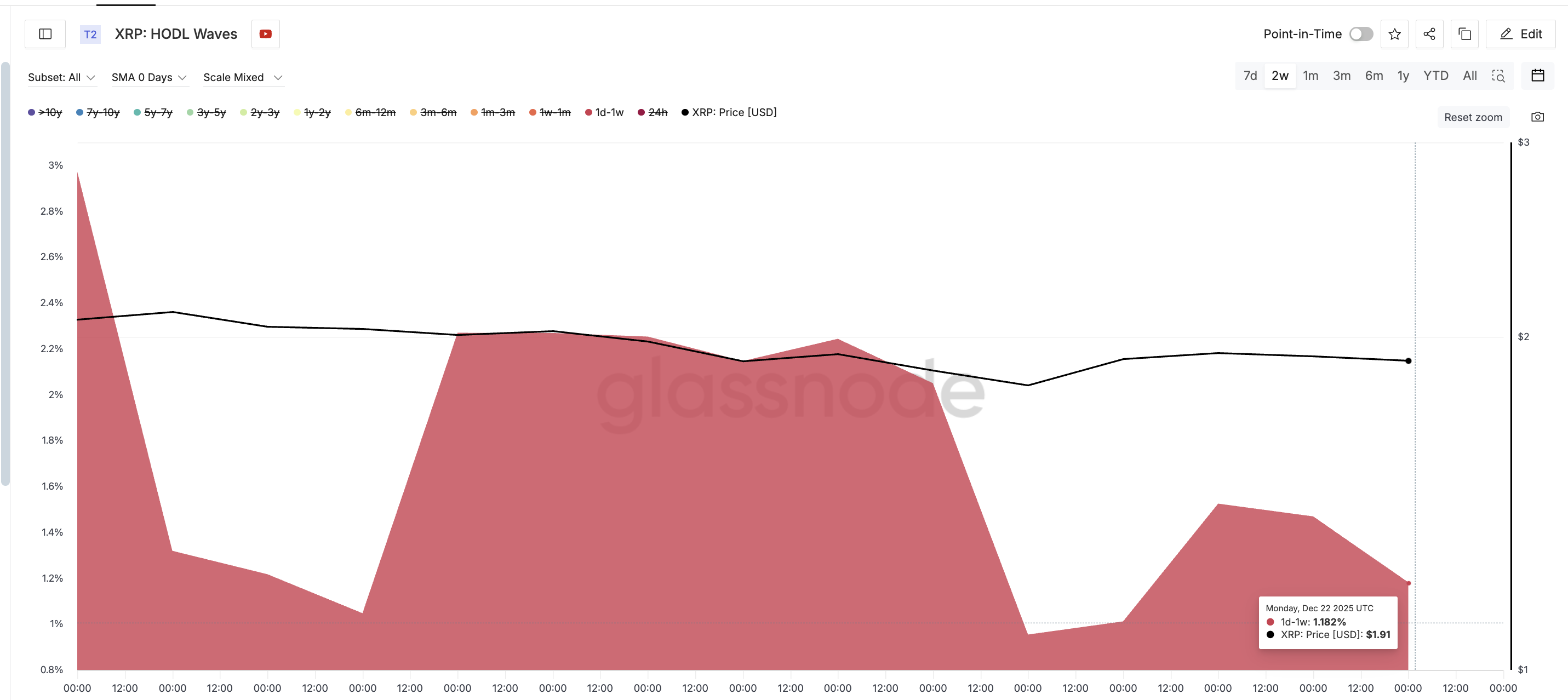

That sentiment dip could be powered by the short-term holders. HODL Waves, which track how long coins have been held, show that wallets holding XRP for one day to one week have reduced their supply share sharply. This cohort held about 2.97% of the supply earlier this month. That figure has now fallen to roughly 1.18%, a drop of more than 60%.

Short-Term Cohorts Fueling The Lack Of Positivity: Glassnode

In simple terms, fast, possibly retail, money has lost interest and moved on. That is the problem weighing on XRP sentiment. The next section highlights why it isn’t such a bad thing.

The Solution: Long-Term Holders Are Selling Less, Not More

Here is where the story changes.

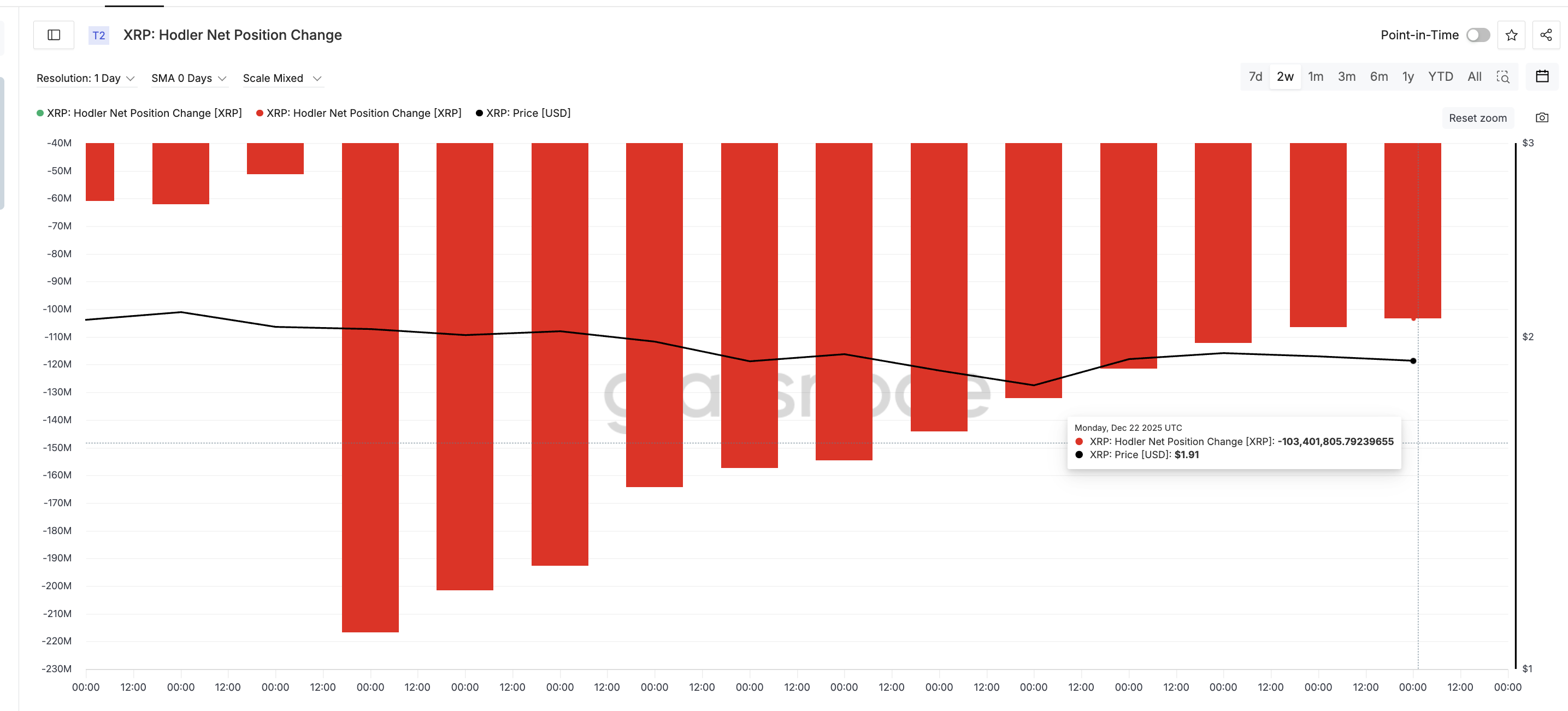

While short-term holders are exiting, long-term holders are doing the opposite. Data tracking long-term holder net position change shows that selling pressure from these wallets has dropped meaningfully.

Earlier this month, long-term holders were selling roughly 216 million XRP per day. That figure has steadily fallen to about 103 million XRP, a reduction of more than 50% in selling activity.

Long-Term XRP Holders Doing The Opposite: Glassnode

This matters because long-term holders tend to act early, not late. When they slow distribution during periods of weak sentiment, it often signals quiet accumulation or strategic patience.

The problem for XRP is crowd apathy. The solution is that experienced holders are no longer feeding supply into that apathy.

XRP Price Levels That Decide Whether the Solution Works

If this sentiment-driven setup plays out again, the XRP price levels will confirm it quickly.

An initial move toward the next resistance at $2.03 implies an upside of roughly 8% from current levels. Clearing that zone would open room for a larger push toward the next resistance bands, $2.09 and $2.17, where prior rallies stalled.

On the downside, XRP must hold its key support at $1.77. A breakdown there would invalidate the sentiment-driven thesis and signal that long-term holders are no longer absorbing supply.

XRP Price Analysis: TradingView

For now, the structure remains intact.

XRP’s biggest problem is that positive sentiment has vanished. But history shows that when optimism disappears, weak hands leave first and strong hands step in. If that pattern repeats, the same problem weighing on the XRP price today could become the solution that unlocks its next move.