The WalletConnect Token (WCT) powers the WalletConnect Network, an on-chain user experience ecosystem that supports over 150 million connections for more than 23 million users that spans 600 wallets, 40,000 app projects, and every major blockchain. It recently launched on the Optimism Mainnet and benefits from Ethereum’s security alongside Optimism’s speed and scalability.

Ever since the inception of Web3, establishing smooth and secure connections between wallets and applications across multiple blockchains has been a persistent hurdle. As a core piece of crypto infrastructure for retail users, the WalletConnect network has emerged as an industry standard to solve this issue. It offers users reliable, cross-chain interoperability that improves the on-chain user experience. Now with the recent launch of its native token WCT, WalletConnect is entering a new phase of decentralized governance. This piece dives into the intricacies of the WalletConnect Network in terms of Web3 innovation, as well as WalletConnect Token’s economic model and economic potential.

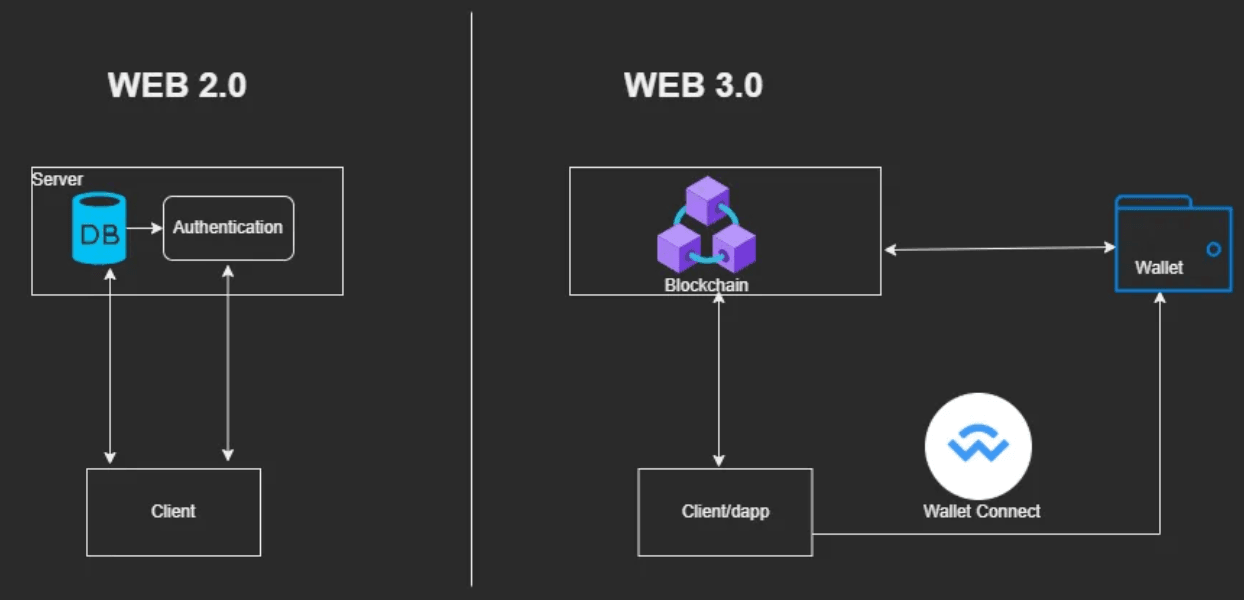

Source: CoinMonks

What is WalletConnect?

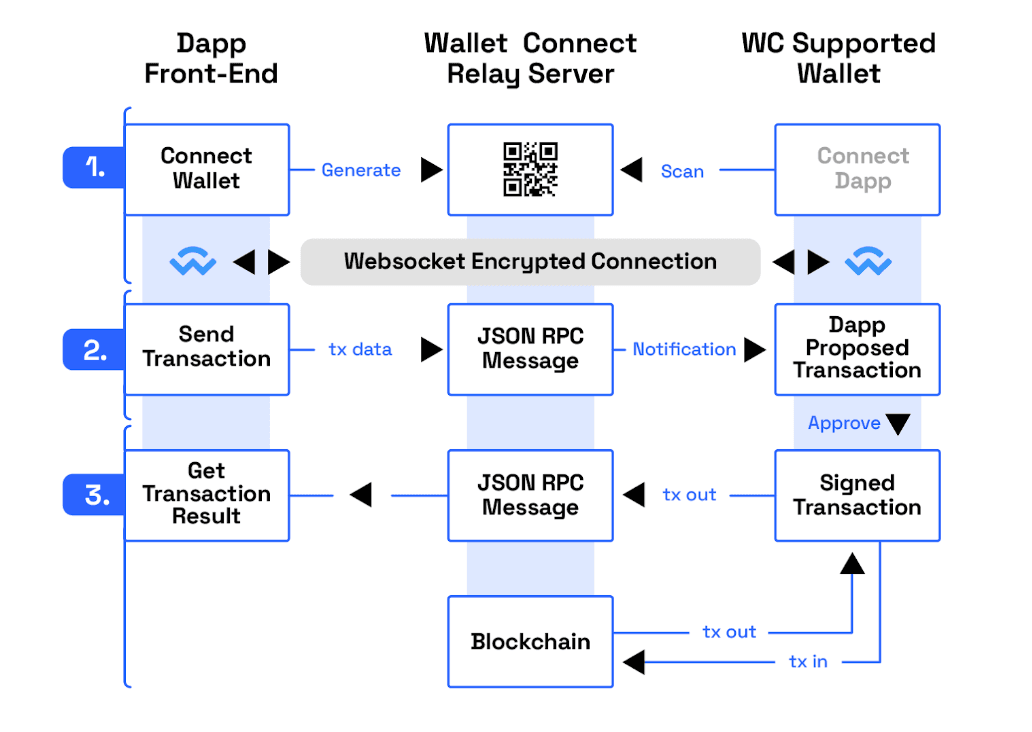

WalletConnect is an on-chain user experience infrastructure platform that allows users to link their crypto wallets to decentralized applications through their web browser or a mobile app. Since its launch in 2018, WalletConnect has aimed to address the connectivity problem in Web3 and is now a core component of today’s decentralized ecosystem. It connects wallets to dApps using deep linking and encrypted QR codes, meaning users simply scan the WalletConnect QR code to initiate the connection. At the heart of WalletConnect’s technology is a decentralized database utilizing rendezvous hashing that’s supported by a network of service nodes and gateway nodes. The platform facilitates interactions by transmitting application requests to user wallets for approval, while maintaining privacy and security through end-to-end encryption.

WalletConnect is completely chain-agnostic, so it functions seamlessly across multiple blockchain ecosystems including Ethereum and its Layer 2 networks, as well as Solana, Cosmos, Polkadot, Bitcoin, and more. As the network continues to grow, it plans to transition into a fully permissionless system as evidenced by the launch of its new native governance token WCT.

How Does WalletConnect Work?

Decentralized Database - At its core, WalletConnect uses a permissionless, decentralized database built on rendezvous hashing similar to other large-scale systems like Cassandra, DynamoDB, and MongoDB. This structure supports global scalability and removes single points of failure to ensure network resilience and decentralization.

Service Node Architecture - WalletConnect’s architecture is designed to handle clients who may be offline for extended periods. It leverages a “mailbox” system to store messages, allowing users to retrieve them once they reconnect.

Source: OneArt Digital

Cross-Chain Compatibility - WalletConnect is chain-agnostic and functions smoothly across leading blockchain ecosystems. This eliminates the need for users to rely on separate tools for different chains.

End-to-End Encryption - WalletConnect’s relay system uses end-to-end encryption to secure all data transmissions. This prevents relays from accessing wallet addresses, transaction details, KYC data, or any other sensitive information shared between apps and wallets. Therefore, the platform can be applied to privacy-focused use cases like online payments, where users can trust that intermediaries can't see what they’re purchasing.

What is the WalletConnect Token (WCT)?

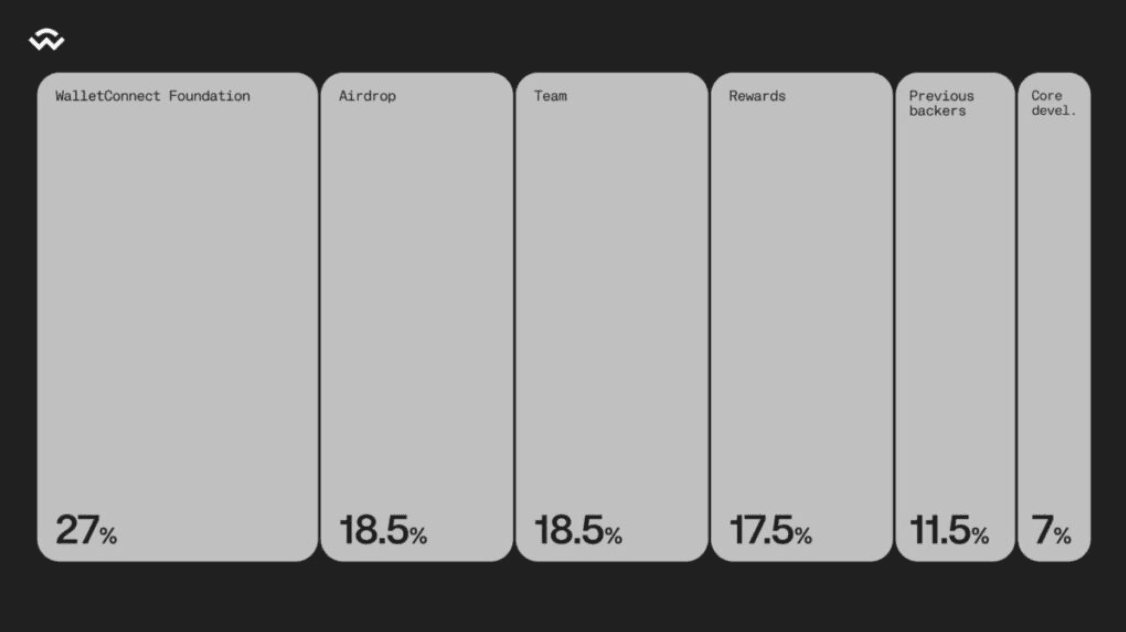

The Connect Token (WCT) is the native utility token of the WalletConnect Network. It has been launched on Optimism and will serve as both a governance and rewards token. The total supply of WCT is capped at 1 billion tokens. Of that, 27% is allocated to the WalletConnect Foundation, while 18.5% will be distributed via airdrops to eligible users and contributors. The remaining supply is designated for the project team, incentive programs, early supporters, and core development initiatives.

To support the growth and functionality of the WalletConnect, the WCT token was initially launched as non-transferable. This approach ensures the tokens are used within the ecosystem as intended - to foster long-term development and network stability. By delaying transferability, WalletConnect could thoroughly test token features and reduce potential risks associated with early trading or misuse. Just this past week, WCT became transferable after achieving multiple criteria including onboarding 16 node operators and accumulating 100 million WCT in the staking pool.

Source: WalletConnect

How Does WCT Coin Work?

Governance: The WalletConnect Foundation currently oversees network development by issuing grants, supporting app development, and forging partnerships. As the network moves toward decentralization, specialized councils will form to take on different responsibilities. WCT tokenholders will be able to vote on proposals and influence decisions, with increasing community involvement over time. The transition to full community control is planned in phases.

Rewards: To encourage early engagement, 17.5% of the total token supply is allocated for network rewards over the first few years. Rewards will go to various contributors based on performance and alignment with WalletConnect’s goal of improving the on-chain user experience. Node operators will also earn rewards based on uptime and performance, incentivizing continued infrastructure improvements.

Staking: WCT holders can stake their tokens to help secure and support the network, earning rewards in return. Staking rewards come from the overall rewards pool, with distribution rates governed by the community. Rewards are proportional to each staker’s contribution, though caps are in place to avoid excessive concentration. Longer lock-up periods and higher stakes result in greater rewards.

Fees: Initially, no fees will be implemented. However, once the ecosystem matures, the community can propose and vote on fee structures through governance. A proposed model suggests using a Monthly Active User (MAU) fee structure for the relay service, allowing for scalable, usage-based fees.