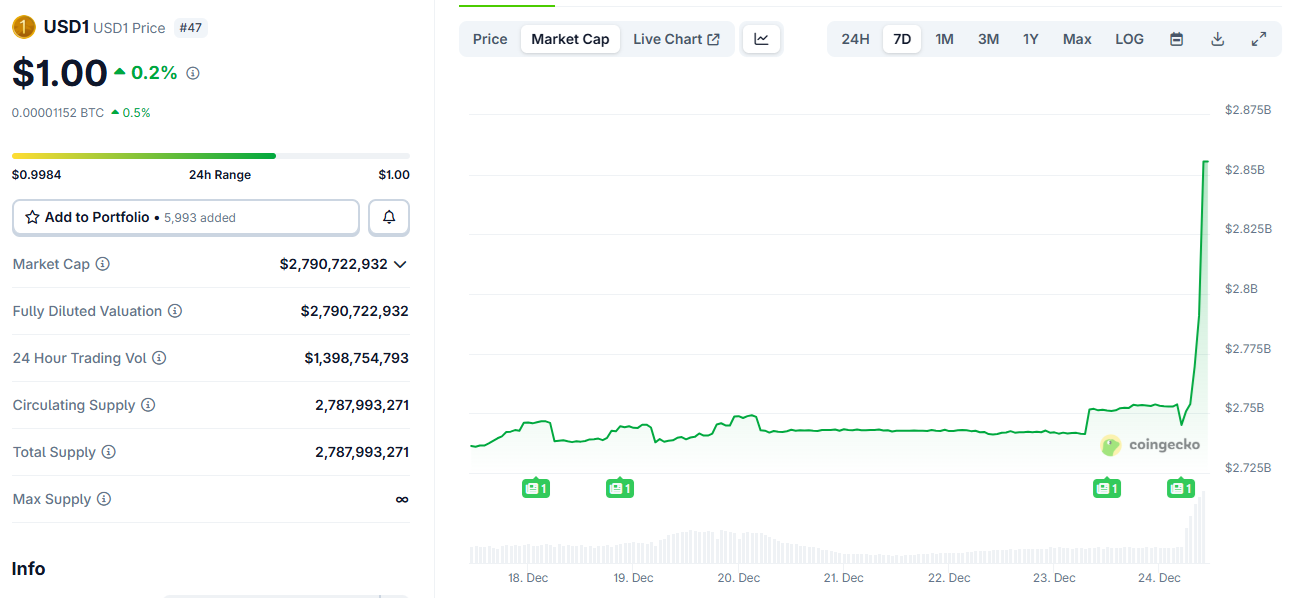

USD1 increased its supply by over 45M tokens, expanding to 2.79B tokens. The stablecoin has joined the Binance ecosystem with a 20% yield product.

USD1 expanded its supply in the past day, just after adding another yield product in the Binance ecosystem. The new supply entered the market just as USD1 was added to the Binance Booster program.

The program is limited to 50,000 USD1 deposits and offers a 20% annualized yield. The yield is part of Binance’s usual Earn program, with a special addition of USD1.

The stablecoin, minted by World Liberty Fi, will have a limited period for subscriptions, running from December 24 to January 23, 2026.

USD1 is represented on Binance through the USD1/USDT pair. Additionally, Binance has suggested users can acquire the token through the P2P Express market. Existing holders can deposit the USD1 into their Binance account.

Will USD1 expand its influence?

USD1 already has most of its supply active on the BNB Chain, with an even higher total float of over $2.85B. The token has been added to multiple DeFi protocols, though with a much lower APY.

The stablecoin is already active and can gain yield through PancakeSwap, Uniswap, and Venus Protocol. However, the addition to Binance’s official yield program will give the token more exposure.

Just after the new token mint, USD1 trading volumes also grew to a one-month peak. The newly injected supply coincided with sudden investor interest, with $1.39B in daily volumes.

On the USD1/USDT pair on Binance, more than $150M in buying volume emerged after the announcement. The centralized exchange also has the biggest share of USD1 spot trading. The increased trading interest is considered a signal of demand for secure yield.

Yield-bearing stablecoins are becoming one of the staples in the crypto market. Large-scale investors and institutions have abandoned most other risky narratives, instead choosing the most liquid ecosystems.

Can WLFI make a comeback?

The increased influence of USD1 sparked a discussion on the eventual growth of the World Liberty Fi project. The platform is expected to launch an app in early 2026, potentially reviving the WLFI token.

Before the latest yield product launch, USD1 was widely used in meme token pairs in the Binance ecosystem. For a brief period, those pairs were one of the liveliest meme token hubs. The extremely volatile behavior of memes led to a withdrawal of users. Now, USD1 may be used in a much more predictable way, with yield accrued daily into user accounts.

As of December 24, WLFI tokens traded above $0.13, up from a local low of $0.12 in the past week. WLFI has not been instrumental to the ecosystem, and did not rise even after World Liberty Fi added buybacks.

Sharpen your strategy with mentorship + daily ideas - 30 days free access to our trading program