As a centralized finance (CeFi) crypto wealth platform, Nexo offers a suite of services and tools for crypto investors to earn passive income. Like BlockFi and Celsius before, it’s one of the major players in the CeFi space, but unlike its predecessors, it survived the last crypto bear market thanks to better risk management.

In this comprehensive Nexo review, I’ll cover everything that Nexo is and aims to be, analyzing its features, wealth management options, passive income offerings, supported assets, interest rates, and safety features. I’ll also talk about the Nexo Card and the Nexo platform’s native token, as well as how you can join Nexo and start earning. Let’s begin.

Our Verdict on Nexo

Nexo is a robust crypto wealth platform that integrates several valuable services. These include borrowing, interest-earning, spot and futures trading, a crypto-based credit and debit card, and more.

All of these services are integrated into a single, user-friendly platform and often work in combination with one another. You get to earn interest on unspent balances on your Nexo Card or earn interest while your assets are in active trades.

This comes at the cost of extensive regulation and various fees, but it also offers stability, which is one of the most elusive commodities in the crypto sphere.

Pros

Up to 16% APY on crypto and fiat

Borrow with an APR of 2.9% to 18.9%

2% cashback on Nexo Card purchases

Both spot and futures trading

Over 1,500 trading pairs and 100 cryptos

Cons

High fees, especially on fiat transfers

Nexo holds custody of your assets

What Is Nexo?

Nexo is a centralized crypto wealth platform that offers Nexo lending and borrowing. It also features a CEX for crypto spot and futures trading and offers the Nexo Card, which allows you to pay with crypto without selling your assets for fiat, while also earning cashback. It operates a loyalty program and offers discounts and benefits for using its native token, NEXO.

Nexo is a CeFi platform, meaning it’s completely centralized. This is directly opposed to the DeFi model, used by platforms like Uniswap and Aave, as well as other platforms that offer some of the best crypto staking coins.

DeFi platforms leave ownership of assets to you, and you’re in charge of their security, while Nexo and other CeFi platforms operate as custodians of your assets.

Nexo began operations in 2018 and has since grown into one of the leading global players in the crypto investment space. Today, it is present in over 200 jurisdictions and manages assets exceeding $11 billion. It’s a high-liquidity platform that has processed over $371 billion to date. As of September 2024, the last time the Nexo CeFi platform released its numbers, it had more than 7 million users.

The platform has achieved some significant milestones in its history:

In 2019, it issued the world’s first crypto-backed loan that was used for a mortgage.

In 2020, just two years after its launch, it gained 1 million users.

In 2022, it launched the world’s first crypto card, the Nexo Card, in partnership with Mastercard.

In 2024, it won the FinTech Breakthrough Award.

The company currently partners with a wide range of security firms and fintech companies like Ledger, Fireblocks, Chainalysis, Blockchain.com, Amazon Web Services, Fidelity, Cloudflare, and Mastercard.

Nexo Review: Markets and Assets

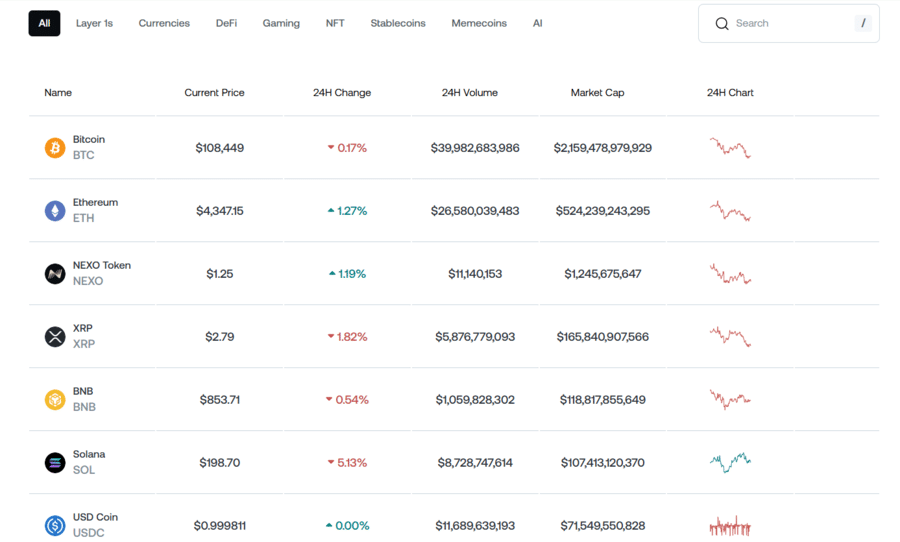

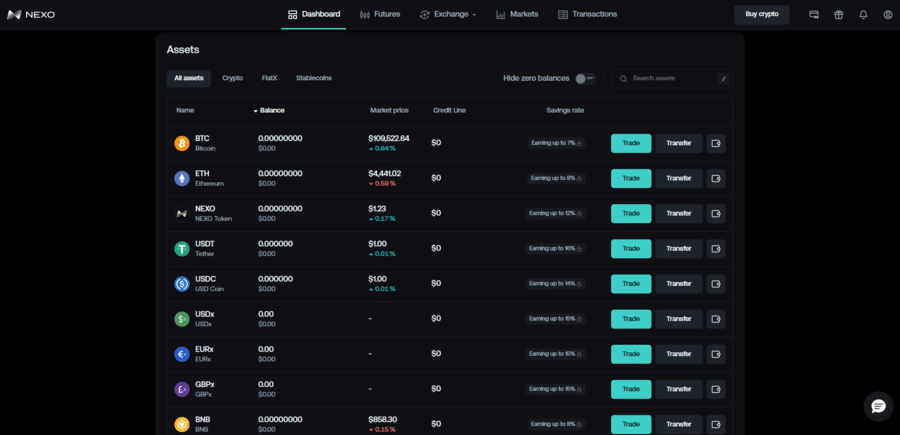

Nexo covers a broad range of cryptocurrencies, including Bitcoin, over 100 altcoins, and several stablecoins.

The exact ones you get depend on the service you’re using. As every Nexo exchange review will tell you, the exchange supports over 100 cryptocurrencies and more than 1,500 trading pairs.

Nexo also supports fiat currencies, but since it is not a bank, they are effectively digital representations of fiat, called fiatX. The X symbol indicates that you are actually holding an internal, platform-specific asset on Nexo, rather than the actual asset. However, the exchange rate is always 1:1, so if you earn 100 USDx from your savings plan, you’ll have earned $100.

Speaking of this, Nexo supports three major fiat currencies: USD, EUR, and GBP. These are the currencies you’ll be able to deposit and withdraw on Nexo, and also the ones you’ll get to use in Nexo’s savings plans or as collateral for a credit line. You’ll also be able to spend them using the Nexo Card.

Nexo staking supports 40 currencies, including the three usual suspects mentioned above. Some of the major cryptocurrencies available here include BTC, ETH, BNB, SOL, USDT, USDC, ADA, DOT, TON, DOGE, and LINK.

The Nexo borrowing service is a bit different, as you’re allowed to borrow funds and keep them in your Nexo account, but also your bank account. With the latter option, you can choose from a broad range of fiat currencies and receive the loan in the currency of your choice. If you get the loan on Nexo, it will be in one of the supported cryptocurrencies.

Collateral for these loans is accepted in over 90 cryptocurrencies, including BTC, ETH, XRP, AVAX, DOT, ATOM, NEAR, POL, BNB, SOL, ADA, USDT, DAI, USDC, LINK, ARB, and AXS, among others.

Nexo’s Top Features & Tools

As you’ve probably noticed from this Nexo crypto review so far, the platform offers a broad range of services, including crypto trading and swapping, as well as saving and borrowing crypto and fiat. Let’s review what to expect from these.

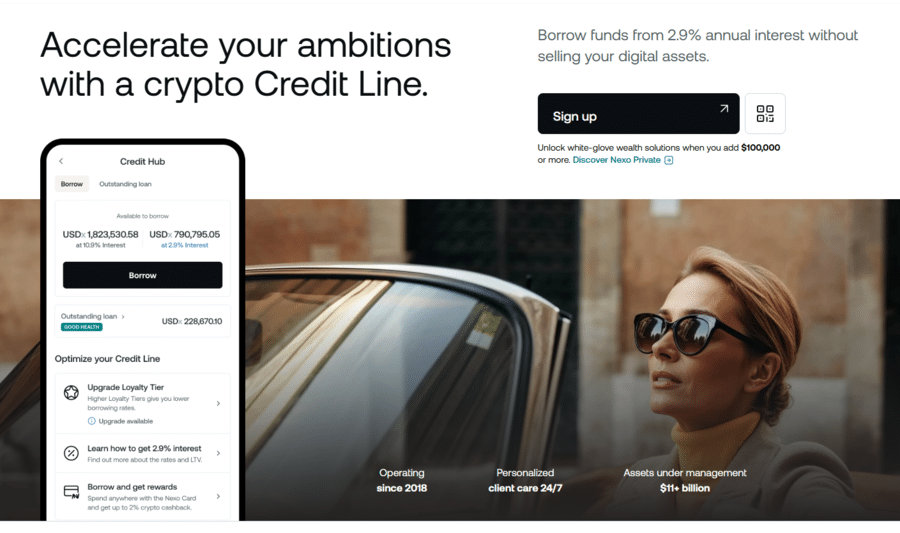

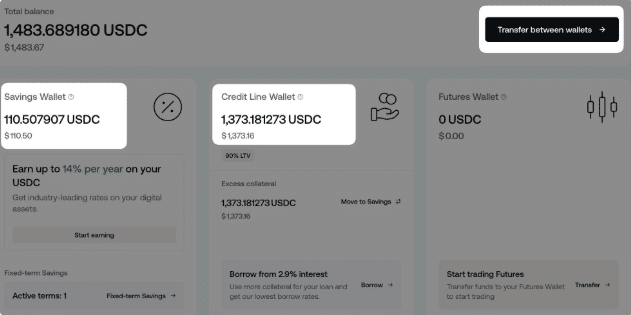

Crypto Borrowing & Credit Lines

One of the main features of the Nexo platform is its crypto credit lines. They allow you to borrow crypto or fiat with Nexo interest rates ranging from 2.9% to 18.9% annually. The exact percentage depends on your loyalty tier and portfolio balance.

The highest interest rate of 18.9% applies to users with a portfolio balance of less than $5,000 and to users who do not hold any NEXO tokens. However, users with NEXO tokens are divided into three loyalty tiers as follows:

Silver tier + at least 1% of portfolio in NEXO tokens: 17.9%

Gold tier + at least 5% of portfolio in NEXO tokens: 13.9%

Platinum tier + at least 10% of portfolio in NEXO tokens: 10.9%

You get further discounts on Gold and Platinum tiers if your loan-to-value (LTV) ratio is below 20%:

Gold tier: 5.9%

Platinum tier: 2.9%

These Nexo borrowing rates are typically higher than those of the brand’s competitors, but that’s primarily because their service differs. For instance, Ledn, another CeFi lender, offers more competitive rates, but these rates often come with fees and lack a loyalty tier structure.

As for other competitors, such as CEXs and DeFi protocols, their interest rates vary depending on supply and demand, whereas Nexo’s are more stable and predictable.

The maximum loan amount you can receive is $2 million daily. You receive the funds within 24 hours, either in crypto or one of the three supported fiat currencies on the Nexo platform. If you want to get them in a bank account, you can choose between a broad range of fiat currencies. Repayments are typically very flexible.

LTVs vary based on which crypto you’re using as collateral on your Nexo crypto credit line. For instance, LTV on BTC and ETH is 50%, but it’s only 15% on NEXO tokens.

Earning Interest on Crypto

Another top feature of Nexo is its earn program that puts it on par with some of the best crypto staking platforms.

The Nexo Earn Crypto program offers both flexible and fixed-term savings plans, with APYs ranging from 14% on flexible options to 16% on fixed-term options, while some cryptocurrencies’ APYs reach as high as 20%. Some of the most competitive interest rates come from USDC (12% or 14%), USDT (13% or 16%), DOT (14% or 15%), and AXS (16% or 20%).

You can also earn up to 15% interest on your USDx, EURx, and GBPx holdings.

As many as 37 cryptos and 3 fiat currencies are available, which is more than you’ll find on most competitor platforms.

The interesting aspect of the flexible plans is that your holdings accrue interest by default, as long as you maintain an account balance of more than $5,000. Non-EEA countries need to opt in to start earning.

You get paid daily on both types of plans. Fixed-term savings plans are available for 1, 3, or 12 months.

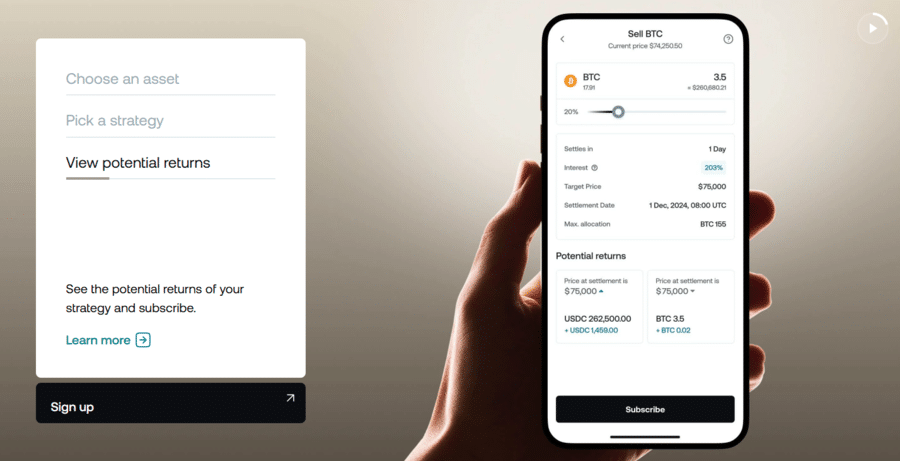

Nexo also offers Dual Investment services, where you earn high yields while buying low and selling high. In essence, you pick a crypto to buy or sell at a predetermined price in the future, while you earn enhanced daily yields until the strategy is executed.

Nexo Card

One of Nexo’s most popular services and its main product is the Nexo Card. It’s a crypto payment card that can operate as both a credit and a debit card, launched in partnership with Mastercard.

One of the leading Bitcoin debit card solutions on the market lets you spend your digital assets in your Nexo account, and even the three fiat currencies you can hold. It’s effectively connected to your crypto wallet and allows you to pay for things in the offline and online world, just as you would with a regular bank card. In essence, Nexo has successfully integrated the digital world of cryptocurrencies into the global financial system.

You’re never actually paying with crypto, but the card automatically and instantly exchanges your digital assets into the fiat currency in which you’re paying.

The card works as both a credit and a debit card in the sense that you can change between these two “modes” at any time.

You can claim a virtual Nexo Card if you have at least $50 in your Nexo account. A physical card is available only to those who have achieved the Gold loyalty tier and have a minimum balance of $5,000 in their account. Shipping is free, though, and you can connect either to your Apple Pay or Google Pay wallet.

While all this sounds like a major advantage, it’s not the only one. You also earn a crypto cashback of up to 2% on purchases in Credit Mode and earn up to 14% annual interest on all unspent balances. You can withdraw up to €2,000 for free every month at an ATM.

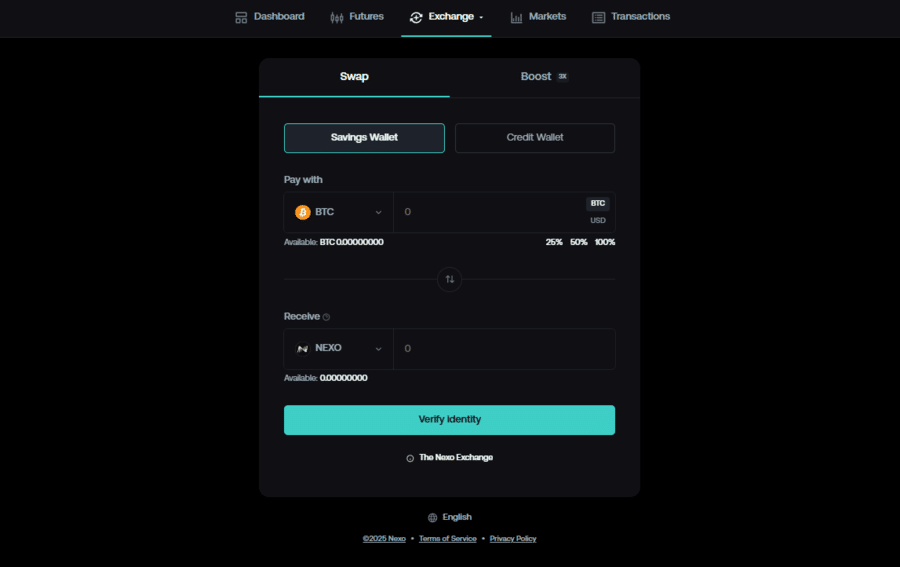

Nexo Exchange

The Nexo exchange works like any centralized exchange. It’s home to over 100 cryptocurrencies you can trade freely, using over 1,500 crypto trading pairs.

The exchange uses smart contracts to aggregate liquidity from numerous partners, so most swaps can work seamlessly, even those of up to $3 million in value.

Through the Dual Investment service I’ve covered, you can also earn interest from the assets you’re trading with.

The exchange is used for both spot and futures trading, with the latter offering up to 100x leverage on over 100 perpetual contracts. You can also test your strategies in Demo Trading mode.

Nexo offers a helpful feature called Collateral Swap, which allows you to swap cryptocurrencies used as collateral in one of your Nexo Credit Lines. This is particularly beneficial in instances where your collateral coin is underperforming on the market and you want to acquire a better one.

If you’re also interested in a Nexo wallet review, please note that the brand is discontinuing its self-custody crypto wallet, so you won’t be able to use it after 2026. You’ll still be able to keep your funds in your Nexo account, which is connected to the Nexo exchange. Moreover, you can always withdraw to your own crypto wallet.

Nexo App

Instead of using the Nexo platform through a browser, you can always download the Nexo app on your Android or iOS phone. As you’ll see in every Nexo app review, it’s very easy to use and similar to the desktop platform.

All the same services and features are available in the app, so if that’s what you prefer, you can effectively stop using Nexo on your computer.

Additional Tools

Nexo abounds in features, but in an effort to save time, here’s a short overview of the most important ones I haven’t covered:

Nexo Booster: This feature effectively boosts your portfolio by utilizing existing funds to enable you to borrow between 1.5 and 3 times more.

Demo trading: Instead of starting with actual trading immediately, you can always try the demo trading option, which effectively simulates trading without the actual funds.

Referral program: You can share up to $5,000 with a friend who signs up with your link, adds at least $5,000 worth of crypto, and grows or maintains their portfolio for 30 days.

Affiliate program: The Nexo affiliate program offers commissions for users you bring to the site. Affiliates get 10% of interest, 1% of borrowed funds, and 0.2% of swap volume in the initial 12 months. You also get a fixed $20 bonus after three Nexo Card purchases.

What Is the Nexo Token (NEXO)?

NEXO is the native token of the Nexo platform. It supports saving, borrowing, and other Nexo services. You can hold it as collateral, secure loans against it, and earn interest by holding it. It’s also tradable on the Nexo exchange, as well as most other exchanges and crypto DeFi platforms.

It offers users additional benefits, including better interest rates and significant fee discounts.

NEXO maintains a fixed supply of 1 billion tokens, and the price is on the lower side, usually between $1 and $2.

The company allocates a portion of its profits to token distributions and buybacks, allowing holders to share in the brand’s success.

Is Nexo Legit?

Nexo holds licenses and registrations worldwide and complies with regulations in over 150 jurisdictions. It holds licenses from the US California Department of Financial Protection and Innovation, the Australian Securities and Investment Commission, and the Financial Services Authority of Seychelles, among others.

The company boasts a global presence and complies with the latest cybersecurity measures to keep users’ funds secure.

It holds custody over user funds, which are protected by Nexo’s partnerships with institutional-grade custodians (Fireblocks and Ledger Vault) and reputable insurers (Lloyd’s of London and Arch Insurance).

Unlike its main competitors, Celsius and BlockFi, Nexo has weathered all storms so far and has managed to grow in both bear and bull markets. Celsius filed for Chapter 11 bankruptcy in July 2022, subsequently shutting down operations. BlockFi filed for bankruptcy in November 2022 in the wake of FTX’s collapse. As for Nexo, it has survived mainly due to its steadier and more conservative approach, as well as its strict adherence to regulations.

Nexo Fees

Nexo imposes a long list of fees, like every CeFi platform. The exchange operates under a standard maker/taker model, where fees decrease based on your 30-day trading volume. The numbers align with what most CEXs offer. You also get a significant 50% discount by holding NEXO tokens. There’s also a spread embedded in the price.

The biggest obstacles are the Nexo withdrawal fees, particularly for fiat transfers, while crypto transactions typically incur blockchain fees only. Platinum members get one free fiat withdrawal every month.

Here’s a full breakdown of all fees you should know about:

| Spot trading | 0.20% to 0.07% (takers) 0.20% to 0.04% (makers) |

| Futures trading | 0.06% to 0.03% (takers) |

| EUR withdrawal | €5 with SEPA €25 with SWIFT |

| GBP withdrawal | £5 with FPS £25 with SWIFT |

| USD withdrawal | $10 with ACH $25 with SWIFT |

| Card withdrawal | 1.99% for EEA countries 3.49% for non-EEA countriesMinimum $0.99 |

| Nexo Card exchange | 0.2% on EEA/UK/CH currencies 2% on all other currencies +0.5% on weekends |

| Nexo Card ATM withdrawal | Free with a monthly limit of up to €2,000 for the Platinum tier 2% after the limit with a minimum of €1.99 |

| Nexo Booster | 1% for LTV up to 50% 2% for LTV of 50-60% 3% for LTV above 60% |

Is the Nexo App User-Friendly?

Yes, the app is highly user-friendly, and arguably better and easier to use than the Nexo desktop site. This is also evident from user-made Nexo reviews and the app’s ratings on Google Play Store (4.2★) and Apple’s App Store (4.0⭐).

The app’s design does a great job of simplifying complex services, such as borrowing and dual investing, so even beginners shouldn’t have trouble getting the hang of things.

The important thing is that the app is easy to use overall and that it works quickly most of the time, without noticeable bugs or issues.

How to Start Borrowing and Earning With Nexo

If you’re ready to begin, here’s how you can start using the Nexo platform:

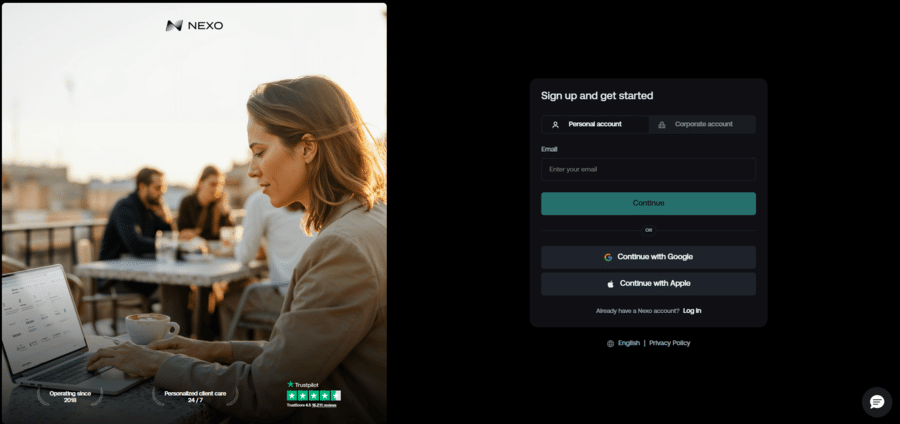

Create an Account

The first step is to register and complete your first Nexo login. You can use your email address or register via a third-party account, such as Google. The latter lets you complete this step in barely a minute. However, you’ll still need to provide your personal information afterwards.

Complete KYC

The KYC process is mandatory and provided by Sumsub. You only need to provide a live photo of a valid identity document and take a selfie. Once done, the review will likely take only a few minutes, and you’ll get a notification when you’re accepted.

Deposit Fiat or Crypto

You can deposit either cryptocurrency or fiat on Nexo, and all transactions can be completed through the main dashboard. Simply select the preferred currency and follow the instructions. You can also purchase crypto directly on the site with a bank card.

Start Saving or Borrowing

To start saving or borrowing, you can once again use the same dashboard. You only need to select a currency and pick the solution you’re interested in. Bear in mind that flexible savings are automatic, so you only need to have a sufficiently high portfolio to start earning. If you’re from a non-EEA country, you’ll also need to opt in.

If you need a more detailed explanation of the registration process, you should read Nexo’s account setup instructions, which delve into more details.

Customer Support

Nexo’s primary mode of support is its AI agent called Nora. It responds very quickly and can provide a lot of information about the platform. Unlike most basic chatbots, it can lead a conversation, so it’s easier to find answers with its help than you might think.

It can also transfer you to a human support agent if it can’t solve an issue on its own. They are on 24/7.

Nexo also features a comprehensive Help Center with in-depth articles that explain nearly every feature or service available on the site.

The Help Center also offers a support form that allows you to request assistance via email. Alternatively, you can contact Nexo directly by emailing support@nexo.com.

Nexo Review: Bottom Line

Is Nexo a safe and high-quality crypto wealth platform? It definitely is, all thanks to its borrowing and earning services. You always know what you’re getting because Nexo is a heavily regulated crypto service that operates somewhere in between crypto and traditional finance.

It offers competitive interest rates for both borrowing and earning, while the NEXO token and loyalty program provide significant discounts on fees and additional perks. Additionally, using the Nexo Card comes with cashback.

However, it remains a complex service, primarily due to its stringent regulations. You’ll have to contend with various fees, and you must also consider how comfortable you are with centralized custody of your funds.

Despite that, there’s the added benefit of interconnected services. Together, they bring more advantages than disadvantages. So, if you’re interested, all that’s left for you to do is sign up and start developing your portfolio.