Bitcoin price continues to trade around $86,770 on Wednesday, after failing to break above the $90,000 resistance.

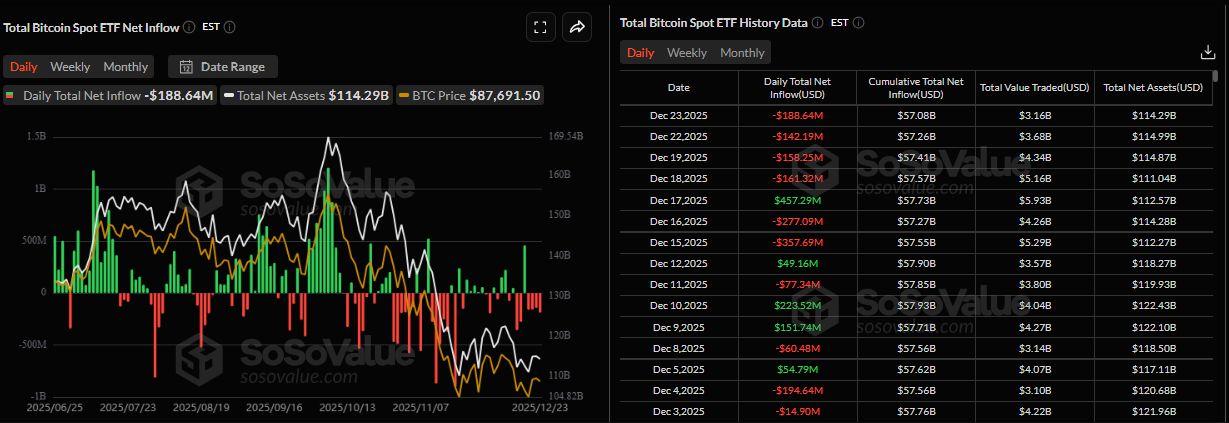

US-listed spot ETFs record an outflow of $188.64 million on Tuesday, marking the fourth consecutive day of withdrawals.

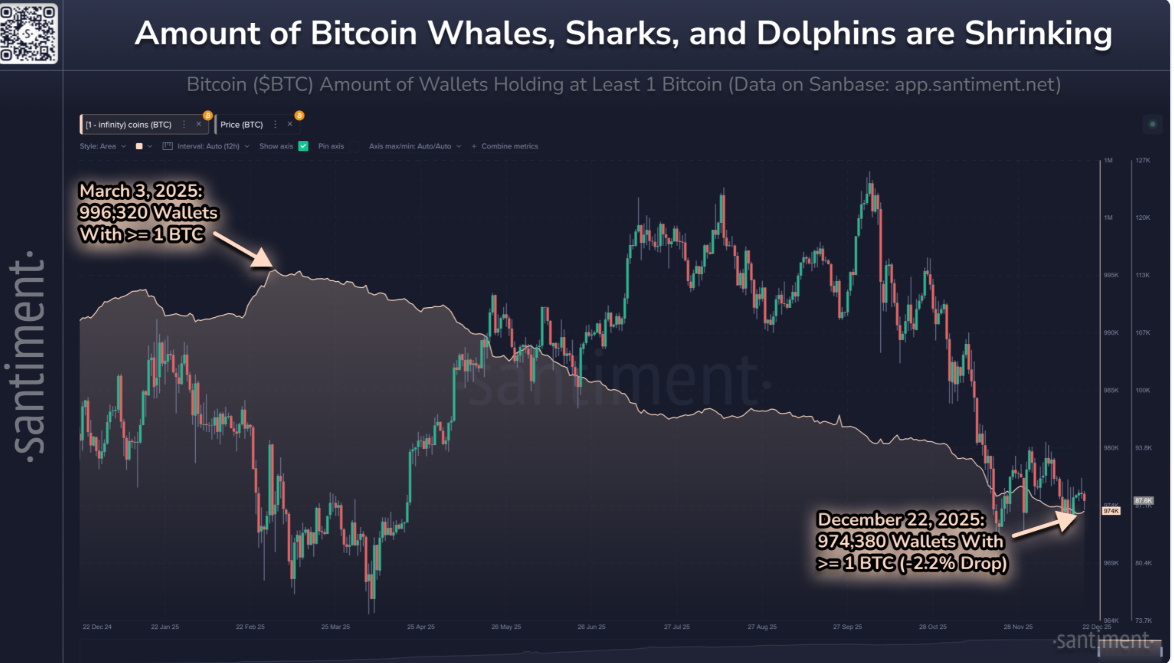

Santiment data show a decline in the number of Bitcoin whales, sharks and dolphins, indicating a large-holder participation reduction.

Bitcoin (BTC) price continues to trade in red below $87,000 on Wednesday, failing to reclaim a key psychological level earlier this week. Weakening institutional demand, as reflected in continued outflows from Bitcoin spot Exchange-Traded Funds (ETFs), alongside a decline in whale, shark, and dolphin participation, is weighing on market sentiment and keeping BTC’s short-term outlook cautious.

Weakening institutional demand weighs on the Bitcoin price

Institutional demand has continued to weaken this week. SoSoValue data show that Spot Bitcoin ETFs recorded an outflow of $188.64 million on Tuesday, marking the fourth consecutive day of withdrawals since December 18. If these outflows continue and intensify, the Bitcoin price could see further correction.

Shrinking whale, sharks and dolphins

The Santiment chart below shows that the number of wallets holding at least 1 Bitcoin decreased by 2.2% from 999,320 on March 3 to 974,380 on Monday, suggesting reduced large-holder participation and softer market confidence. If this trend continues and intensifies, BTC could see further correction.

Bitcoin Price Forecast: BTC faces rejection from the $90,000 mark

Bitcoin price was retested at the psychological level of $90,000 on Monday and declined slightly the following day. As of Wednesday, BTC hovers around $87,700.

If BTC continues its correction, it could extend the decline toward the key support at $85,569.

The Relative Strength Index (RSI) is 41, below its neutral level of 50, indicating that bearish momentum is gaining traction. The Moving Average Convergence Divergence indicator showed a bullish crossover last week; however, the falling green histogram bars indicate fading bullish momentum.

On the other hand, if BTC closes above the $90,000, it could extend the recovery toward the next resistance at $94,253.