Polymarket, a decentralized prediction market platform, acknowledged that several user accounts experienced losses due to a security issue involving a third-party provider. The platform stated it has resolved the issue and that no lingering risks remain.

According to user reports on social media, the issue appears to have affected users who signed up for Polymarket through Magic Labs, which lets users sign in via email addresses and creates non-custodial Ethereum wallets.

Magic Labs sign-up is widely used by first-time crypto users who do not already have digital asset wallets.

Polymarket users confirm that their wallets have been hacked

The compromise news came last month. One of the senior traders stated that hackers have been using the Polymarket comment section to run a scam. As reported by Cryptopolitan, he claimed that users have lost over $500,000.

During the weekend, 23pds, SlowMist’s Chief Information Security Officer, retweeted a warning from a community user about a malicious code in a Polymarket copy-trading bot on GitHub, posing security risks.

Reports of account hacks surfaced again earlier this week on X and Reddit, as affected users took to social media to detail their losses.

“Today I woke up and see 3 attempts to login to polymarket — My device isn’t compromised, google found nothing suspicious, all other services are fine. “So I went to Polymarket and realized that all my deals were closed and balance is $0.01,” the victim wrote.

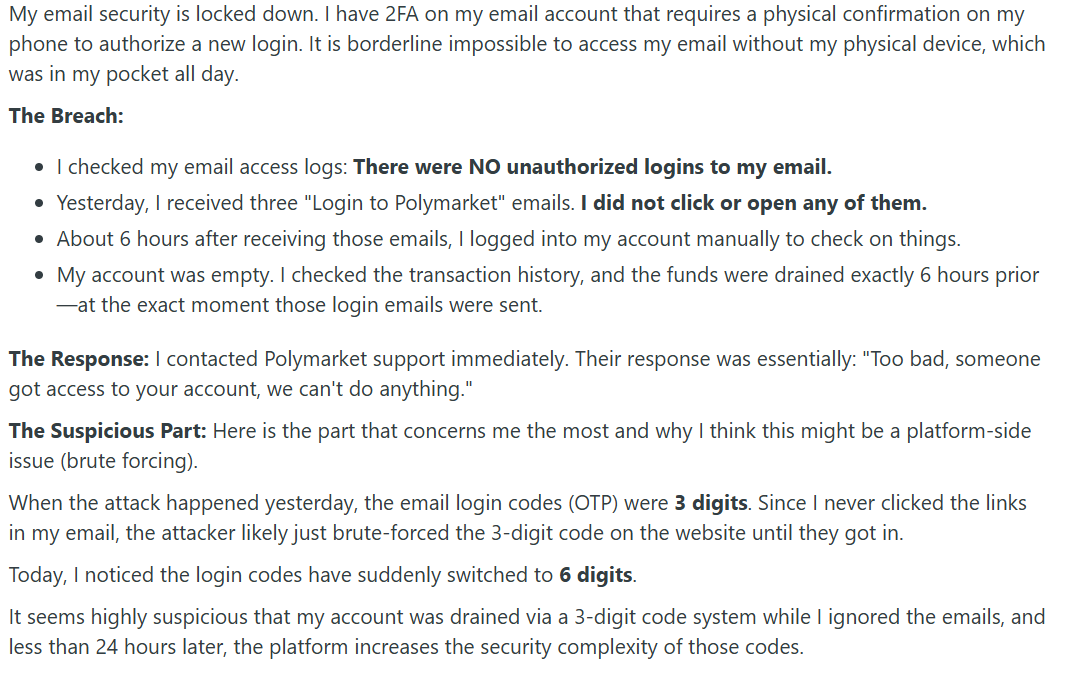

Another user in the comment section claimed to have experienced a similar security breach, receiving three attempted login notifications before funds were drained from their Polymarket account. The victim claims that he did not click any links and had two-factor authentication enabled on their email.

In response, Polymarket acknowledged the security issue on its official Discord channel.

“We recently identified and resolved a security issue affecting a small number of users […]The issue was caused by a vulnerability introduced by a third-party authentication provider […] We will be in contact with impacted users,” Polymarket wrote.

Polymarket’s AI support blames Polygon

According to one user, when he reached out to the Polymarket team, they answered that Polygon was responsible. “First line AI support told me it’s issue with Polygon what is obviously a bullshit. Then human gave me instructions how to check where my funds went to,” the trader wrote.

This follows news from Mustafa, a member of the Polymarket team, that the company plans to migrate from Polygon and launch an Ethereum Layer 2 network called POLY, which is the project’s current top priority.

Polymarket is gradually growing into a new behemoth with its entrance into the US market. The platform has recorded 419,309 active users this month , a total number of transactions is at 19.63 million, and the total trading volume sits at $1.538 billion.

Additionally, in 2025, the Polygon mainnet experienced 15 different network anomalies, maintenance events, or outages, some of which caused delays in Polymarket’s order matching. The most recent outage occurred on December 18. Also, the relatively weak ecosystem has objectively become a limitation.

This, however, will affect the Polygon network. Defillama data shows that all positions on the Polymarket platform are worth about $326 million right now. This is a quarter of the $1.19 billion that is locked up on the Polygon network.

Additionally, Coin Metrics stated that Polymarket transactions used about 25% of Polygon’s overall network gas. Statistics on Dune also show that transactions related to Polymarket used about $216,000 in gas in November. Token Terminal statistics show that Polygon used about $939,000 in gas in the same month, which is approximately 23%.

Don’t just read crypto news. Understand it. Subscribe to our newsletter. It's free.