Shiba Inu (SHIB) continued to trade under pressure on Wednesday, extending a multi-day decline as bearish momentum persisted across the broader cryptocurrency market. The memecoin’s price remained below the $0.0000060 level, marking its fifth consecutive session of losses and reinforcing concerns that prices could revisit yearly lows.

Market data from on-chain analytics and derivatives platforms point to declining investor engagement, zero token burns and growing downside positioning. Together with technical indicators, these signals suggest that SHIB is struggling to find near-term support, even as other segments of the crypto market attempt to stabilize.

? #Shibainu Price pressure & burn slowdown — #SHIB recently saw zero token burns in a 24-hour window, and selling pressure has intensified, contributing to weakness in price action. pic.twitter.com/Yuaea45YAq

— Terra Army ? (@terra_army) December 24, 2025

On-Chain Metrics Reflect Falling Market Attention

Data from Santiment shows a sustained drop in Shiba Inu’s social dominance, a metric that tracks the share of SHIB-related discussion across crypto-focused media and platforms. Since mid-November, this measure has steadily declined, reaching approximately 0.032% on Wednesday, close to its lowest reading of the year. Analysts often interpret falling social dominance as a sign of reduced retail interest and weakening sentiment, particularly for community-driven assets such as memecoins.

Derivatives data reinforces this view. According to figures compiled by Coinglass, Shiba Inu futures open interest on the BitMEX exchange fell to around $50,140 on Wednesday, setting a new yearly low. Declining open interest typically indicates that traders are closing positions rather than opening new ones, reflecting reduced conviction or increased caution.

Positioning Data Shows Bearish Bias

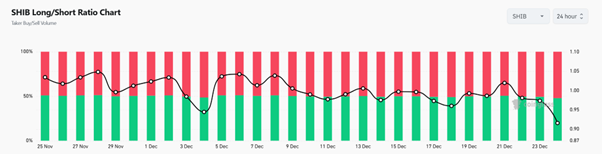

Additional derivatives metrics point to a market skewed toward downside expectations. Coinglass data shows SHIB’s long-to-short ratio at 0.83, the highest level in over a month but still below the neutral threshold of one. A ratio below one indicates that short positions outweigh long positions, suggesting that a larger share of traders are betting on further price declines.

Image Courtesy: Coinglass

From a technical perspective, Shiba Inu was rejected earlier this month from the upper boundary of a falling wedge pattern, a move that preceded a decline of more than 14% over roughly two weeks. As of Wednesday, the token continued to trade near $0.0000070, keeping pressure on key support levels.

Technical Indicators Point to Ongoing Weakness

Momentum indicators remain tilted to the downside. The daily Relative Strength Index (RSI) stands near 32, approaching oversold territory but still reflecting strong bearish momentum. Meanwhile, the Moving Average Convergence Divergence (MACD) indicator posted a bearish crossover last week, a signal often associated with continued downward pressure.

If current conditions persist, analysts note that SHIB could retest its yearly low of approximately $0.0000067, last recorded on October 10. A sustained recovery would likely require a shift in broader market sentiment, potentially allowing SHIB to challenge higher resistance levels such as the 50-day exponential moving average near $0.0000085.

For now, Shiba Inu’s price action underscores the sensitivity of memecoins to sentiment-driven indicators, highlighting the role of participation, attention, and derivatives positioning in shaping short-term market dynamics.

Maxi Doge Prepares for Its Own Breakout

Maxi Doge ($MAXI) turns the iconic Doge meme into a high-octane trading culture built for degens who thrive on leverage, momentum, and bull-market energy. More than a meme coin, Maxi Doge is creating a social trading ecosystem where retail traders connect, share alpha, compare strategies, and trade in real time.

Holding $MAXI unlocks access to the community and competitive events like Maxi Doge and Maxi Ripped, where users compete for rewards, status, and bragging rights. Staying true to its fearless ethos, up to 25% of presale funds will be used for 1000x leveraged YOLO trades, with any gains reinvested into marketing. With under 18 hours to the next price increase and over $4.35M raised, momentum is accelerating.

To buy early, visit the official Maxi Doge website and connect a wallet.