KEY TAKEAWAYS

SPK price has doubled in the past week, driven by a breakout above a symmetrical triangle.

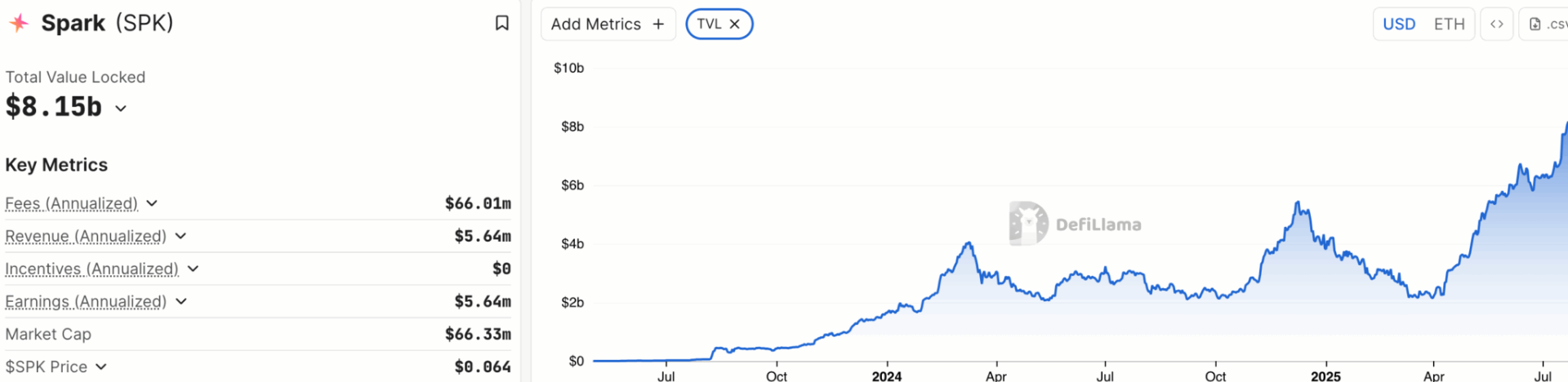

Spark’s TVL has surged to $8.15 billion, signaling increased user interest and capital inflow.

If accumulation increases, SPK could target $0.10, though traders should watch the 20 EMA.

SPK, the native token of the decentralized finance (DeFi) platform Spark, has skyrocketed by 100% in the last seven days.

Following the move, the Spark crypto price is now 17% from reclaiming the all-time high.

At press time, SPK was trading at $0.065 — a level it last touched following last month’s airdrop.

Here’s what’s driving the price recovery and what could come next for the altcoin.

Spark Chart Squeeze Ends Bullish

On the daily chart, CCN observed that Spark’s price broke out after bulls successfully pushed it above a symmetrical triangle.

Between June 29 and July 18, SPK formed a series of lower highs, which outlined the upper trendline (resistance) of the triangle.

Meanwhile, the lower trendline (support) was drawn from a sequence of higher lows and converged with the resistance.

This setup led to a tight price squeeze, and eventually, SPK broke through the triangle’s upper boundary. As a result, it surpassed the resistance at $0.044 while maintaining support at $0.029.

As of this writing, the Chaikin Money Flow (CMF) reading has climbed above the zero signal line. The rise in the CMF indicates notable buying pressure.

Like the CMF, the Bull Bear Power (BBP) reading shows that accumulation has outweighed distribution. If this trend continues, SPK’s price might break above $0.066.

Rising TVL Backs Rally

Amid this breakout, data from DeFiLlama shows that Spark’s Total Value Locked (TVL) has surged to $8.15 billion.

A rising TVL generally indicates that more users are committing capital to the platform, whether for staking, lending, or yield farming. This influx of value reflects growing trust in the Spark ecosystem and suggests that user activity is on the rise.

From a price perspective, an increase in TVL is typically a bullish signal, as it implies deeper liquidity, stronger protocol fundamentals, and potential revenue growth — all of which can drive demand for the native token.

In this case, if the TVL continues to increase, the Spark crypto price might also reach higher values.

SPK Price Analysis: Path Opens to $0.10

Looking at the technical perspective again, the daily chart shows that SPK has risen above the upper trendline of a descending triangle. The altcoin has also climbed past the 20-day Exponential Moving Average (EMA).

The rise above the EMA indicates strong support for the cryptocurrency. If sustained, this could drive Spark’s price to the highest point of the wick, as shown below, at $0.073.

Once this happens, SPK’s next target is around $0.10, which could represent a new all-time high. However, if selling pressure increases, bears might tug SPK below the 20 EMA (blue).

In that scenario, the SPK price might decline to $0.056. In a highly bearish scenario, it could slide toward $0.046.