KEY TAKEAWAYS

DEGEN’s recent rally marks a 440% increase over the last three months, reclaiming price levels last seen in February.

According to IntoTheBlock, 14,920 addresses holding DEGEN at $0.0079 form a key support zone, outweighing resistance.

Despite an MFI reading of 93.46, the market structure and Supertrend indicator suggest buying pressure remains strong.

DEGEN, one of the top memecoins on the Base chain, has outperformed every other crypto in the top 500 today. Within the last 24 hours, the Degen crypto price has increased by 70%.

This price increase means that memecoin has risen by 440% in the last 90 days. At press time, DEGEN trades at $0.0073 — a level it last reached on Feb. 1.

On-chain data reveals a surge in trading volume, mirroring the explosive late-2024 rally. With momentum heating up, could DEGEN be on track for a new yearly high?

DEGEN Breaks Triangle, Smashes Resistance

DEGEN’s price broke out of a descending triangle on the daily chart, echoing a similar setup from October 2024. Back then, the token surged nearly 600% within two months.

Now, bullish signals are flashing again—Moving Average Convergence Divergence (MACD) has flipped positive. Also, in blue, the 12-day Exponential Moving Average (EMA) has crossed above the 26-day EMA (orange).

This same bullish crossover preceded the explosive rally to $0.030 last November. Therefore, if history repeats itself, the DEGEN crypto price could be gearing up for another major breakout.

Besides the MACD, the Awesome Oscillator (AO) reading has flashed five consecutive histogram bars. This pattern aligns with the bullish thesis, suggesting that the memecoin’s value could climb higher.

Support in Control

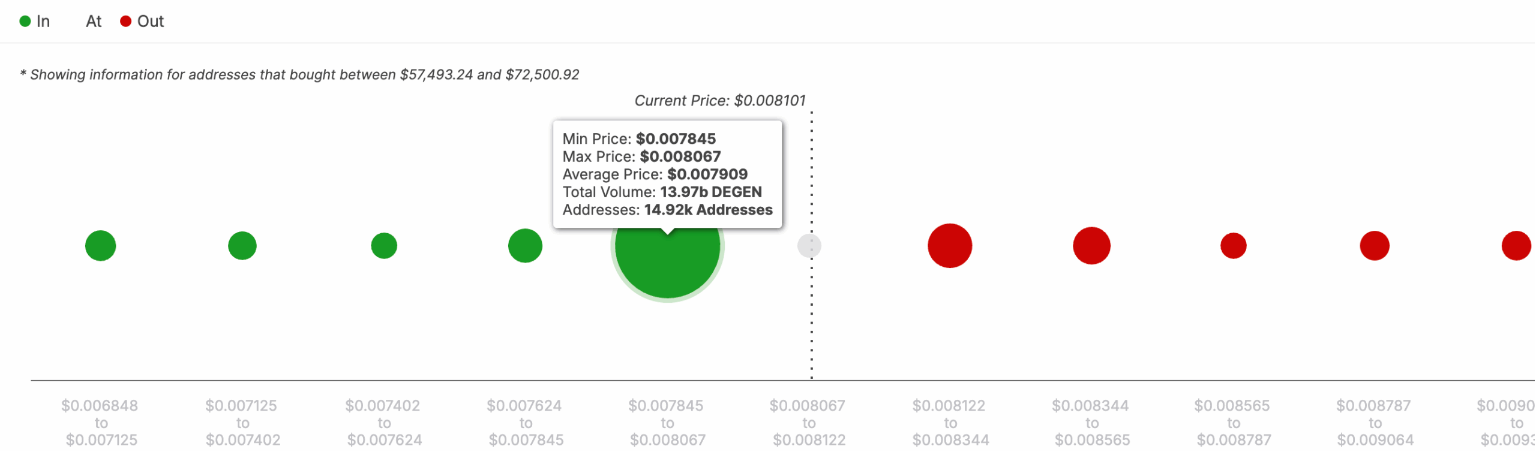

From an on-chain perspective, CCN analyzed the In/Out of the Money Around Price (IOMAP) metric, which spots key support and resistance zones by tracking wallet profitability.

Strong support forms where many holders sit on profits, while areas with heavy unrealized losses often act as resistance. According to IntoTheBlock data, the major support for DEGEN lies at an average price of $0.0079.

At this level, 14,920 addresses hold over 13 billion DEGEN tokens in unrealized profits, far outweighing the losses accumulated between $0.0081 and $0.0093.

This imbalance strengthens support and suggests that the DEGEN crypto price could soon break through resistance and hit a new yearly high.

Supporting this outlook, some analysts believe DEGEN’s rally could continue. For instance, Crypto Zeinab agrees that the memecoin mirrors its 2024 breakout and suggests its market value could climb even higher.

DEGEN Price Analysis: Not Overbought Yet

The daily chart shows a massive rise in the Money Flow Index (MFI) rating regarding its short-term price targets. The MFI measures buying and selling pressure with high values indicating notable capital inflow, while a low reading indicates otherwise.

At press time, the DEGEN/USD chart shows that the MFI has surged to 93.46, indicating high buying pressure. The Supertrend indicator also validates this thesis.

Typically, when the red line of the Supertrend is above the price, it indicates resistance. But this time, the green line is below DEGEN’s price, reinforcing the bias that the memecoin has strong support around it.

Should this trend remain the same, the next target for the DEGEN crypto price could be a spike above the resistance at $0.0093. If validated, the memecoin could climb toward the 0.618 golden ratio at $0.015.

On the contrary, if DEGEN becomes overbought, this forecast might not come to pass quickly. Instead, the cryptocurrency’s value might decline toward $0.0065.