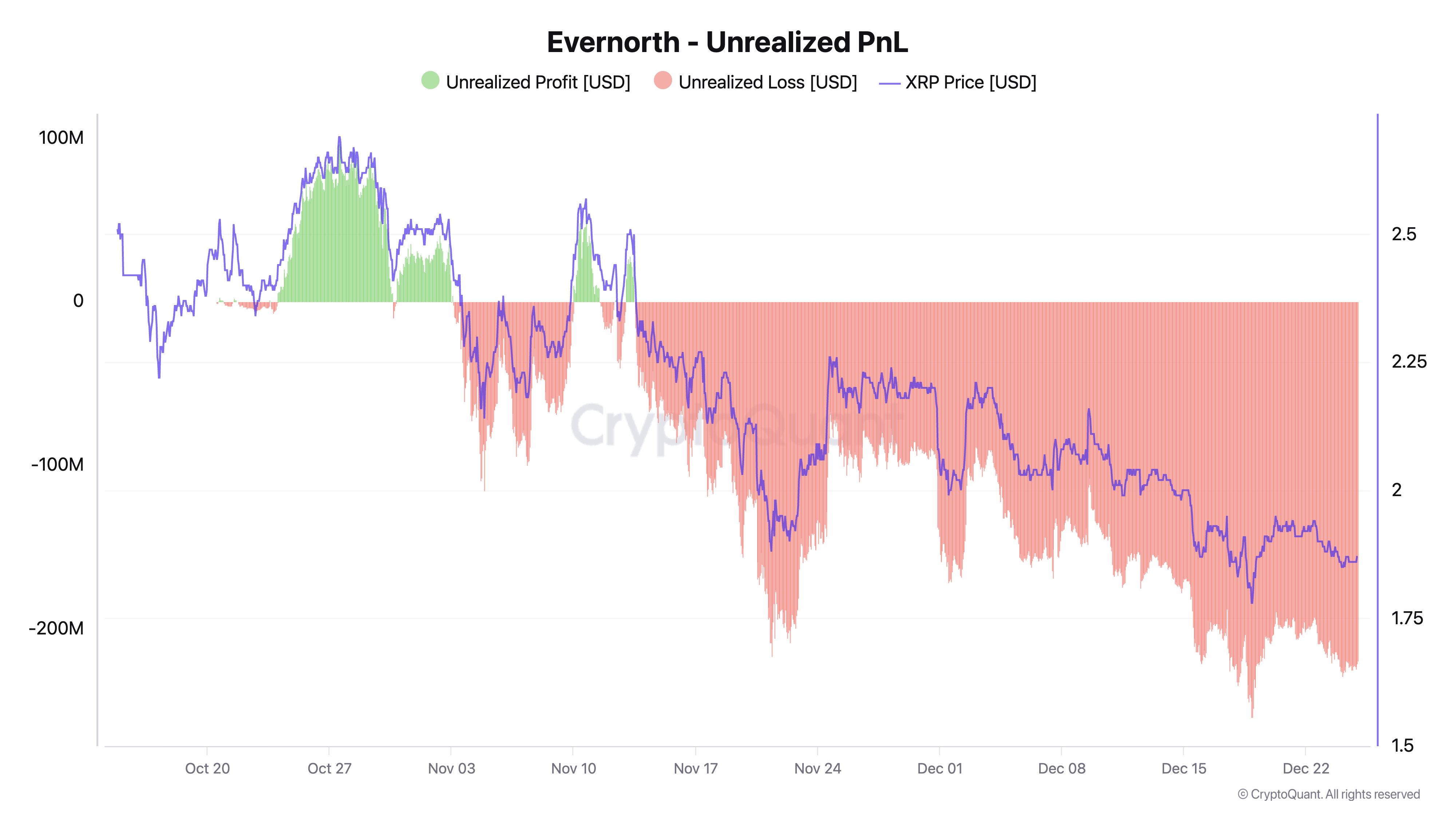

Evernorth, the largest institutional holder of XRP, is sitting on more than $200 million in unrealized losses.

This position highlights the volatility and risks associated with institutional cryptocurrency holdings during a market downturn.

XRP Treasury Firm Evernorth Sees Value of Holdings Drop by Over $200 Million

Evernorth has emerged as a prominent player in the institutional adoption of XRP. In late October, the Nevada-based firm announced plans to raise $1 billion to establish what it described as the “largest public XRP treasury company.”

On November 4, 2025, Evernorth acquired 84.36 million XRP at an average price of $2.54 per token. The transaction pushed the company’s total XRP holdings to more than 473.27 million tokens.

“This continued accumulation reflects Evernorth’s conviction in XRP as the most important asset of the internet, and its mission to build a long-term, institutional-grade XRP treasury with compounding yield,” the firm stated.

However, these purchases have come at a cost. According to data from CryptoQuant, Evernorth’s XRP position is now showing unrealized losses exceeding $200 million.

Evernorth XRP Holdings Performance. Source: CryptoQuant

Evernorth XRP Holdings Performance. Source: CryptoQuant

This mirrors broader weakness across the XRP market. Nearly half of the token’s circulating supply is currently held at a loss. The drawdown stems from XRP’s recent price weakness.

The altcoin has fallen by roughly 25% since Evernorth’s initial treasury announcement. It is now trading below price levels seen at the start of the year, highlighting the challenges facing XRP as momentum continues to fade.

At the time of writing, XRP’s trading price stood at $1.87. The price rose 1.5% over the past day as part of the broader market rally.

XRP Price Performance. Source: BeInCrypto Markets

XRP Price Performance. Source: BeInCrypto Markets

Still, BeInCrypto reported that the current market cycle threatens to end XRP’s two-year streak of positive annual returns, with the token likely to close the year down approximately 11%.

Meanwhile, XRP is not the only major crypto asset facing pressure in the fourth quarter of 2025. Other leading cryptocurrencies have also declined, weighing on institutional investors with large on-chain positions.

According to analyst Maartunn, BitMine is currently sitting on an unrealized loss of approximately $3.5 billion on its Ethereum holdings. Despite the drawdown, the firm has continued to accumulate ETH.

Bitcoin-focused treasuries are facing similar challenges. Metaplanet’s Bitcoin holdings are down roughly 18.8%, while several other institutional holders are showing comparable declines as broader market weakness persists.