XRP is showing signs of renewed market interest as extreme fear sentiment and oversold technical conditions suggest a potential rebound, attracting attention from both traders and analysts.

After a recent decline to around $1.88, XRP has entered a crucial support zone where price action, social sentiment, and technical indicators align. Analysts are observing this phase closely, noting parallels with previous rebound patterns, while emphasizing the importance of confirmation before initiating positions.

XRP Holds Critical Support Near $1.89

Technical analysis identifies $1.8889 as a key horizontal support level, based on repeated tests since late 2023. ChartNerd, a cryptocurrency analyst known for frequent XRP technical updates on X, notes, “XRP requires bullish confirmation, such as a higher low, before long positions are considered. A break below $1.8889 could see price target $1.60, though prior tests of this level have preceded notable recoveries.”

XRP hovers near key support; traders await confirmation before a potential rebound. Source: @ChartNerdTA via X

XRP’s Relative Strength Index (RSI) currently sits around 35, which is generally interpreted as oversold. Historical data show that similar RSI levels have often preceded short-term rebounds. Compared with prior oversold periods in 2024, the current RSI is slightly lower than the previous bounce point, suggesting potential buying interest if support holds.

Extreme Fear Signals Potential Bottom

Social sentiment analysis indicates that XRP is currently in a high fear zone. X Finance Bull, a market commentator with a focus on XRP and other altcoins, explains that such conditions often coincide with price bottoms: “Major XRP surges in the past year have often started from extreme fear zones.”

XRP hits an extreme fear historical bottom, suggesting a potential bounce and institutional buying. Source: @Xfinancebull via X

Data from Santiment, a blockchain analytics platform, shows that the ratio of positive to negative commentary has dipped below a defined fear threshold. This metric is based on daily sentiment tracking across social media channels and historically correlates with short-term accumulation phases. In past 2025 rallies, similar sentiment lows were followed by gains of 30–50%. demonstrating that contrarian investors often enter the market when sentiment is heavily negative.

Technical Indicators Suggest a Possible Bounce

According to Mrctradinglab, a TradingView analyst recognized for XRP technical analysis with over 50,000 followers, XRP has printed a market structure shift (MSS) and is consolidating above a local demand zone: “Price is pulling back into a demand zone after range highs were rejected. Holding above this area increases the probability of a bounce, while acceptance below it would invalidate the bullish setup.”

XRP shows a market structure shift, consolidating above key support with a potential bounce if demand holds. Source: Mrctradinglab on TradingView

This setup represents a high-risk-to-reward scenario for short-term traders, contingent on buying activity. In other words, while technical conditions suggest a potential rebound, failure to hold demand levels could trigger further downside.

Final Thoughts

XRP is at a critical juncture, balancing between oversold technical conditions and extreme fear sentiment. While metrics suggest a possible short-term rebound, caution remains warranted. Analysts and traders are advised to monitor price action, sentiment, and key support levels closely.

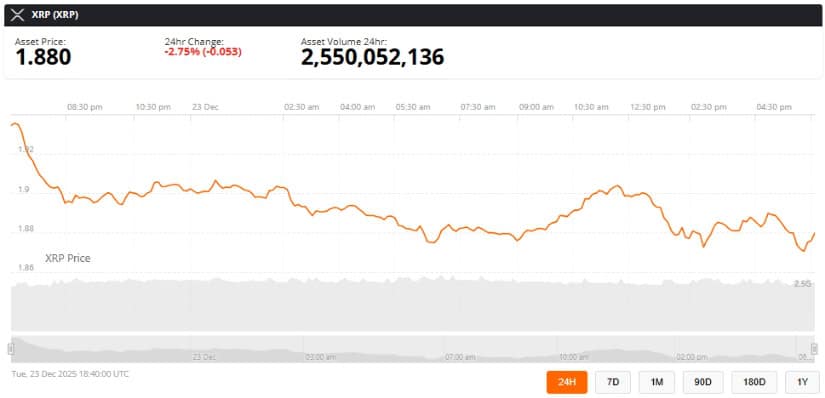

XRP was trading at around 1.88, down 2.75% in the last 24 hours at press time. Source: XRP price via Brave New Coin

By combining technical analysis, social sentiment tracking, and historical context, XRP demonstrates potential for strategic trading opportunities in both the short-term and long-term perspectives; however, uncertainty remains, reinforcing the importance of evidence-based decision-making.