KEY TAKEAWAYS

Jito’s JTO token made its debut on the market in December 2023.

JTO has spent most of its time in or around the lower reaches of the top 100 cryptos.

Will a meeting between Jito and the SEC boost its price?

Our Jito price prediction says JTO could reach $5.50 this year.

Interested in buying or selling JITO? Read our review of the best exchanges to buy and sell JITO.

The Jito platform was launched in late 2023, and since then, its native JTO token has been hovering around the lower reaches of the top 100 cryptos by market cap.

While the token has been pretty volatile since its launch, investors will be hoping that a meeting between Jito representatives and members of the United States Securities and Exchange Commission (SEC)’s crypto task force about crypto staking in exchange-traded funds (ETFs) will boost JTO’s price.

On Feb. 24, 2025, JTO was worth about $2.65.

Let’s take a look at our Jito price predictions, made on Feb. 24, 2025. We will also examine the Jito price history and talk a little about what Jito is and what it does.

Jito Price Prediction

Let’s examine some of the Jito price predictions made on April 3, 2024. It is crucial to remember that price forecasts, particularly for a potentially volatile asset like cryptocurrency, often turn out to be inaccurate.

| Minimum JTO price prediction | Average JTO price prediction | Maximum JTO price prediction | |

|---|---|---|---|

| 2025 | $1.20 | $3.85 | $5.50 |

| 2026 | $2 | $6.50 | $9 |

| 2030 | $4.50 | $12 | $18 |

Jito Price Prediction 2025

JTO is currently consolidating within a symmetrical triangle, indicating a potential breakout in 2025. If bullish momentum prevails, it could rally toward $5.50, but failure to hold key support may see it drop to $1.20 before stabilizing around $3.85.

Jito Price Prediction 2026

By 2026, if JTO successfully breaks above long-term resistance, it could enter a sustained uptrend, pushing toward $9. However, market volatility and corrections could see the price fluctuate, with strong support likely forming around $2 and an average price near $6.50.

Jito Price Prediction 2030

With increased adoption and market maturity, JTO could experience significant growth by 2030, potentially reaching $18. Even in a bearish scenario, historical trends suggest a price floor near $4.50, with an average valuation stabilizing around $12.

Jito Price Analysis

JTO’s daily chart shows a prolonged consolidation within a symmetrical triangle, forming higher lows since July 2024. This pattern typically precedes a breakout, though the direction remains uncertain.

The price recently rejected $3.85 on Feb. 21, reinforcing it as a key resistance, while $2.58 remains strong support. Elliott Wave analysis suggests an ABCDE correction, with wave E likely completed near $2.22 on Jan. 13, signaling an impending move.

The RSI remains neutral, reflecting market indecision. A breakout above $3.85 could push JTO higher, while losing $2.58 may trigger a drop toward $2.01.

Short-term Jito Price Prediction

JTO is retesting Fibonacci support on the one-hour chart after bouncing from $2.58. The next move will determine if it resumes an uptrend or continues ranging.

A bullish scenario targets $3.15 and $3.85, with a breakout potentially reaching $4.99. Failure to hold $2.58 could lead to deeper retracements toward $2.01 or $1.20.

The RSI is near oversold, hinting at a possible bottom, but confirmation is needed. The Jito price prediction for the next 24 hours all hinges on whether JTO can hit a breakout point.

Jito Average True Range (ATR): JTO Volatility

The Average True Range (ATR) measures market volatility by averaging the largest of three values: the current high minus the current low, the absolute value of the current high minus the previous close, and the absolute value of the current low minus the previous close over a period, typically 14 days.

A rising ATR indicates increasing volatility, while a falling ATR indicates decreasing volatility. Since ATR values can be higher for higher-priced assets, normalize ATR by dividing it by the asset price to compare volatility across different price levels.

On Feb. 24, 2025, Jito’s ATR was 0.345, suggesting relatively high volatility.

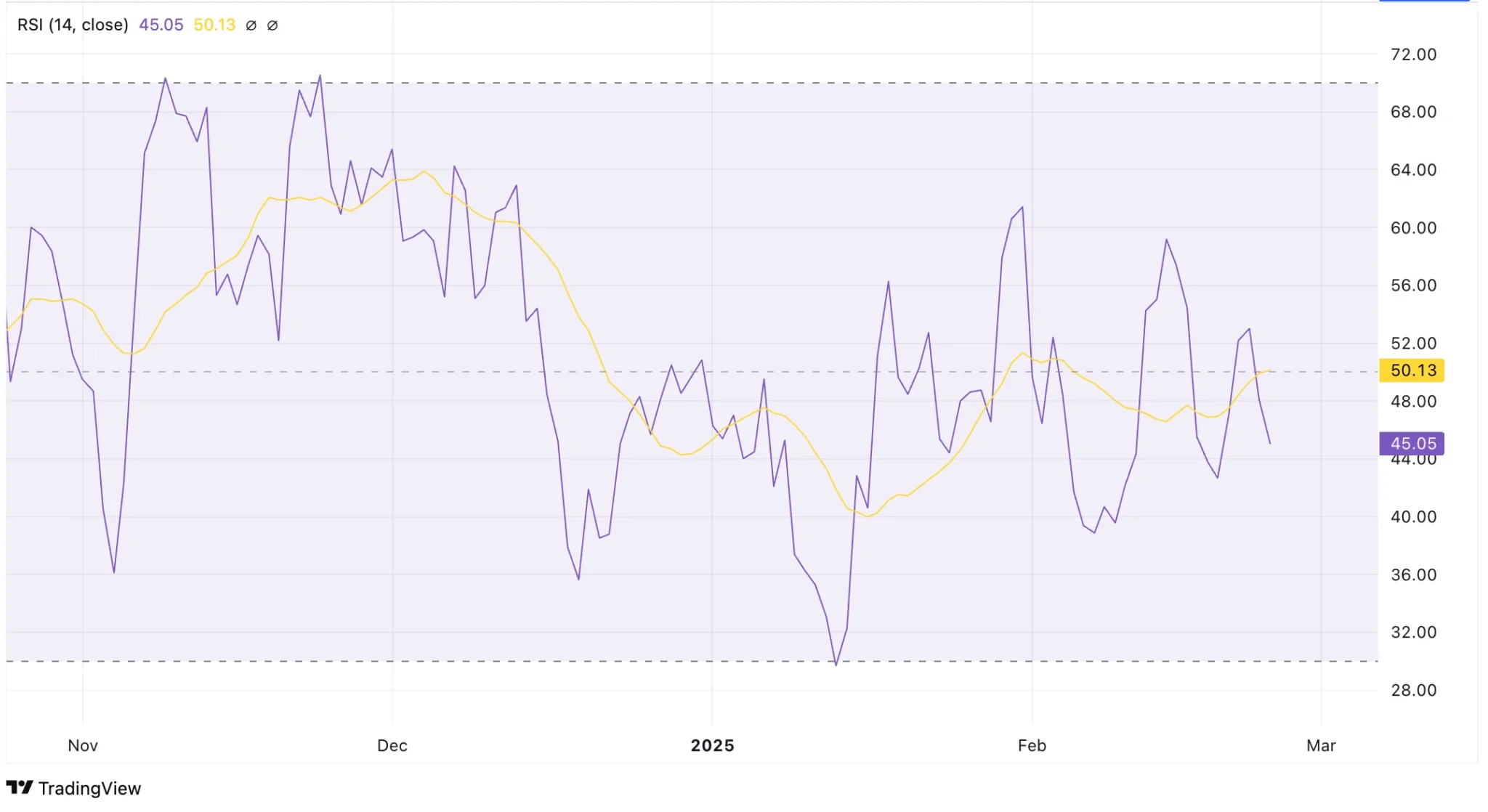

Jito Relative Strength Index (RSI): Is JTO Overbought or Oversold?

The Relative Strength Index (RSI) is a momentum indicator traders use to determine whether an asset is overbought or oversold.

Movements above 70 and below 30 show over and undervaluation, respectively. Movements above and below the 50 line also indicate if the trend is bullish or bearish.

On Feb. 24, 2025, the Jito RSI was at 45, indicating somewhat bearish conditions.

Jito Market Cap to TVL Ratio: Is JTO Overvalued or Undervalued?

The Total Value Locked (TVL) to market cap ratio (TVL ratio) measures the valuation of a decentralized finance (DeFi) project by comparing its market capitalization to the total value of assets locked in its smart contracts. This ratio shows the project’s utilization and links the platform’s health to locked asset value.

A ratio above 1.0 indicates overvaluation because the market cap exceeds the value of assets used in the platform. A ratio below 1.0 indicates undervaluation because the market cap is lower than the value of locked assets.

On Feb. 24 2025, the Jito TVL ratio was 0.32, suggesting undervaluation.

Jito Price Performance Comparisons

Jito is essentially a Decentralized Finance (DeFi) protocol, so let’s compare it with other cryptos in the same category with similar market caps.

| Current price | One year ago | Price change | |

|---|---|---|---|

| JTO | $2.65 | $2.12 | +25% |

| TEL | $0.0109 | $0.001582 | +589% |

| RAY | $2.90 | $1.07 | +40% |

| PYTH | $0.227 | $0.5696 | -60.1% |

Best Days and Months to Buy Jito

We looked at the Jito price history and found the best times to buy JTO.

| Day of the Week | Friday |

| Week | 45 |

| Month | November |

| Quarter | First |

Jito Price History

Let’s now take a look at some of the highlights and lowlights of the Jito price history. While past performance should never be taken as an indicator of future results, knowing what the coin has done can help give us some very useful context when it comes to either making or interpreting a JTO price prediction.

| Time period | JTO price |

|---|---|

| Last week (Feb. 17, 2025) | $3.10 |

| Last month (Jan. 24, 2025) | $2.99 |

| Three months ago (Nov. 24, 2024) | $3.86 |

| Last year (Feb. 24, 2024) | $2.12 |

| Launch price (Dec. 7, 2023) | $0.5362 |

| All-time high (Dec. 7, 2023) | $5.61 |

| All-time low (Dec. 7, 2023) | $0.5362 |

Looking for a safe place to buy and sell JITO? See the leading platforms for buying and selling JITO

Jito Market Cap

The market capitalization, or market cap, is the sum of the total number of JTO in circulation multiplied by its price.

On Feb. 24 2025, Jito’s market cap was $795 million, making it the 84th-largest crypto by that metric.

Who Owns the Most Jito?

On Feb. 24, 2025, one wallet owned more than 20% of the JTO supply.

Jito Supply and Distribution

| Supply and distribution | Figures |

|---|---|

| Total supply | 999,999,768 |

| Circulating supply (as of Feb. 24, 2025) | 297,627,424 (29.76% of total supply) |

| Holder distribution | Top 10 holders owned 54.28% of supply as of Feb. 24, 2025 |

What is Jito?

Jito is a platform on the Solana blockchain that allows users to stake their SOL coins in exchange for JitoSOL. JitoSOL is a token that represents both staking and Maximum Extractable Value (MEV) rewards.

Jito is powered by its conveniently named Jito token, which is powered by the ticker handle JTO.

Because JTO is based on Solana, it is a token, not a coin. You might see references to Jito coin price predictions, but these are wrong.

How JTO Works

Users can exchange their SOL for JitoSOL tokens, which represent a claim on their staked SOL and a portion of the MEV rewards earned. This allows users to maintain liquidity and access their funds while still earning staking rewards.

Meanwhile, JTO holders can vote on changes to the Jito platform. People can also buy, sell, and trade JTO on exchanges.

Is Jito a Good Investment?

It is hard to say. Jito has been rather volatile lately, so we don’t know if and when its price will settle down. Also, the fact that there is no Jito whitepaper might lead some investors to put their money elsewhere.

On the other hand, Jito’s having the ear of the SEC’s crypto task force may help it.

As always with crypto, you should do your own research before deciding whether or not to invest in Jito.

Will Jito go up or down?

No one can really tell right now. While the Jito crypto price predictions are largely positive, price predictions have a well-earned reputation for being wrong. Keep in mind that prices can and do go down and up.

Should I invest in Jito?

Before you decide whether or not to invest in Jito, you will have to do your own research, not only on JTO, but on other related coins and tokens such as Ethereum (ETH) and Solana (SOL). Either way, you must also ensure you never invest more money than you can afford to lose.