Bitcoin is hovering near $89,000, entering a critical decision zone after weeks of consolidation. A record options expiry is amplifying attention, setting the stage for a potentially volatile breakout.

Historically, large expiries during range-bound conditions have often triggered volatility within 48–72 hours, although the direction frequently depends more on spot volume and liquidity than derivatives positioning alone. This historical perspective underscores the uncertainty traders face today.

Bitcoin Price Today Stalls Between $86.5K Support and $90K Resistance

Crypto analyst Michaël van de Poppe points to Bitcoin’s repeated inability to break $90,000 or lose $86,500, calling this a decisive short-term structure. “Bitcoin is stuck between levels. It couldn’t lose $86.5K and couldn’t break $90K,” van de Poppe said, noting that a breakout from this range is likely to determine near-term direction.

Bitcoin stuck between $86.5K support and $90K resistance, with today’s options expiry likely to signal the next short-term market trend. Source: @CryptoMichNL via X

Such prolonged consolidation historically precedes volatility expansions, particularly when combined with major derivatives events, but direction is not guaranteed.

Bitcoin Options Expiry Emerges as Key Market Catalyst

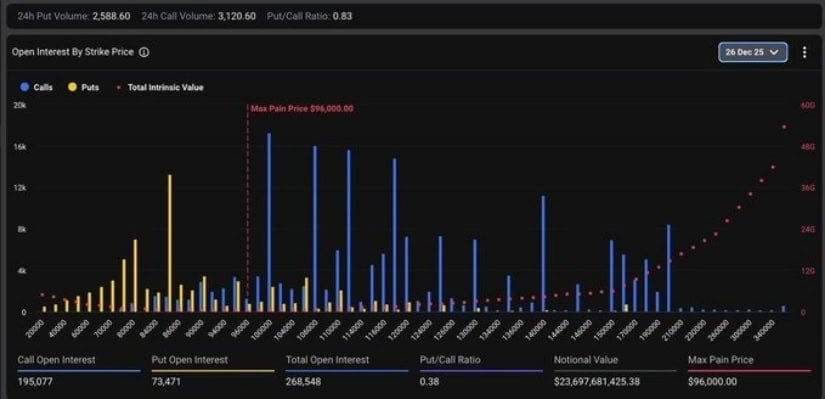

Market commentator Gerla (@CryptoGerla) reminded traders of the $23.7 billion BTC options expiry, emphasizing its potential to increase swings. Open interest shows calls concentrated at higher strike prices and puts at lower strikes, while the put/call ratio sits around 0.38, highlighting the balance between bullish and bearish bets.

Over $23B in Bitcoin options expire today, setting the stage for potential market swings. Source: @CryptoGerla via X

“With more than $23 billion in BTC options expiring, traders should be prepared for swings, but follow-through will depend on spot liquidity,” Gerla said.

Thin year-end liquidity and cooling ETF flows mean Bitcoin’s next move could be sharp, but muted post-expiry action is also possible.

Bitcoin Technical Analysis Today Shows Structure Still Intact

From a technical standpoint, Bitcoin remains constructive. Price is above the 50-period and 200-period EMAs, and recent pullbacks are controlled retracements rather than reversals. The demand zone ($87,600–$88,050) aligns with Fibonacci OTE levels, prior demand blocks, EMA support, and sell-side liquidity absorption.

BTC poised for bullish continuation between $87,600–$88,050, with key EMA and Fibonacci confluences guiding potential breakout targets. Source: SMC-Trading-Point on TradingView

A sustained break below $87,600 would invalidate the continuation thesis, while reclaiming $90,000 with follow-through would favor bullish continuation. As TradingView analyst SMC-Trading-Point notes, “Technical confluences highlight opportunity, but confirmation depends on actual market participation rather than theoretical setups.”

Near-term focus is on spot volume and post-expiry activity near $90,000, while $86,500 remains the key structural level for swing participants.

Final Thoughts

Bitcoin’s consolidation near $89,000 reflects a market in tension rather than indecision. While historical precedents suggest volatility expansion following large options expiries, directional outcomes are conditional, relying on spot liquidity, volume, and support/resistance tests.

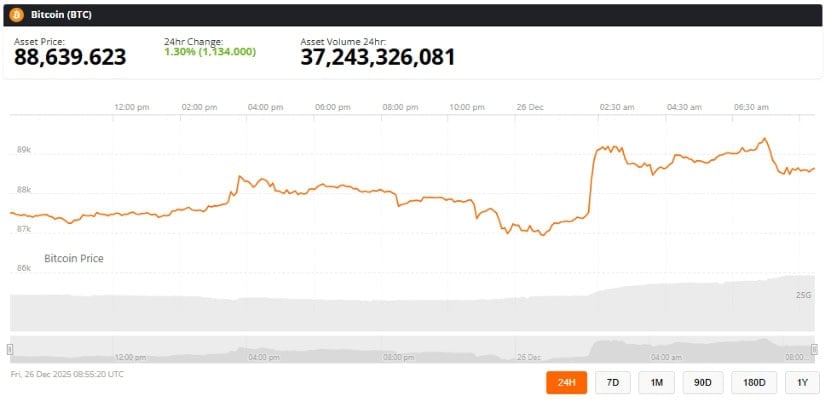

Bitcoin was trading at around 88,639, up 1.30% in the last 24 hours at press time. Source: Bitcoin price via Brave New Coin

Whether Bitcoin breaks higher or revisits lower demand will depend on these factors, with $90,000 and $86,500 emerging as the most meaningful markers for near-term trends. Traders should interpret technical signals within a probabilistic framework, acknowledging that even structurally bullish setups can fail under thin participation.

The market is at a defining moment, and close observation of both spot and derivatives activity will be key to anticipating the next move.