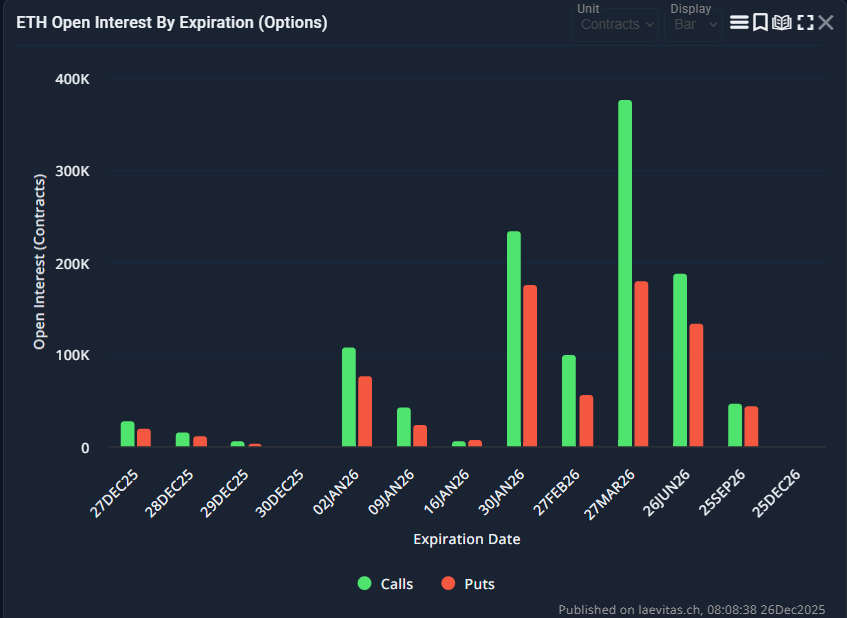

Ethereum price prediction has become the focal point of discussion this Friday, as the altcoin faces $6 billion in options expiry. Data shows that call options constitute more than 2.2x as many as puts, with the notional value concentrated between $3,500 and $5,000 and now mostly out of the money.

Currently, ETH is trading around the crucial $3,000 level, and this massive options expiration could play a key role in shaping short-term price action.

Institutional accumulation in Ethereum is also in the conversation with Trend Research’s 46,379 ETH purchase on Wednesday to raise its holdings to approximately 580,000 ETH. It has become the third-largest Ethereum accumulator, after Bitmine and Sharpink.

Recent developments have prompted investors to track ETH near the $3,000 level closely. Many are now diversifying into early-stage low-cap tokens like Bitcoin Hyper, a presale token with real-world application and strong investor confidence.

Long Liquidations Signal Ongoing Stress for Dip Buyers

Ethereum (ETH) is entering an inflection point as a massive batch of options contracts is set to expire, drawing trader attention to the $3,000 level.

Source: laevitas

Source: laevitas

A large share of open positions are still bullish, but many of these bets rely on ETH moving higher soon. If the price fails to bounce back, a significant number of call options could expire without value, quickly shifting market sentiment.

At the same time, futures open interest stands near $37.3 billion, while trading activity remains muted. This imbalance makes the market vulnerable, as even modest price swings can trigger sharp reactions. Recent liquidation data shows that long positions have taken the biggest hit and could impact Ethereum price prediction in the coming days.

Institutional Accumulation Accelerates Amid Correction

Despite the market being bearish, institutions are still accumulating Ethereum. In a recent purchase, Trend Research acquired around 46,379 ETH.

Treasury’s associate company, LD Capital, founder Jack Yi said, “I announce that Trend Research is preparing another $1 billion, and on this basis, we will continue to increase holdings and buy ETH.”

我宣布Trend Research再准备10亿美金,在此基础上继续增持买入ETH,我们言行一致,强烈建议不要做空,毫无疑问这将是历史性机会。 https://t.co/bJCjdABpB0

— JackYi (@Jackyi_ld) December 24, 2025

The largest corporate Ethereum holder, BitMine, announced on Tuesday that it had acquired 3.3% of the circulating supply. The company said that it now has 4 million Ethereum on its balance sheet. Bitmines’ goal is to expand its treasury well beyond current levels, targeting 5% of the total supply.

Ethereum Price Prediction: ETH At Crucial Resistance

The second-largest crypto has been consolidating within a range of $2,800 and $3,000 over the last two weeks. Currently, it is trading below the $3,000 resistance level, and a rejection or breakout from here could determine the altcoin’s mid-term direction.

Ethereum Price Chart. Image Courtesy: TradingView

Ethereum Price Chart. Image Courtesy: TradingView

The current technical sentiment for Ethereum remains bearish, with a slight increase in the past 24 hours. In the lower timeframe, the $2,900 level remains a strong demand zone, and $3,000 a local resistance level. A decisive breakout in either direction could dictate ETH’s short-term price trajectory.

ETH’s market cap is currently at $360 billion, with total supply remaining stable at around 120.69 million ETH in circulation. While the technical analysis shows calm price action in the short term, the overall sentiment will depend on broader market recovery.

Bitcoin Hyper Closes in on $30 Million Presale Milestone

With the Ethereum price prediction yet to see a recovery, retail investors’ attention is shifting towards low-cap altcoins with higher upside potential. Bitcoin Hyper is an emerging presale token and the first-ever layer-2 infrastructure project on Bitcoin. The project has been gaining considerable traction despite ongoing market uncertainty, raising nearly $30 million.

The central focus of the project is to build a Solana-like environment without directly modifying the native Bitcoin layer. Bitcoin Hyper integrates the Solana Virtual Machine into Bitcoin’s base layer, allowing high-speed smart contract execution. This enables users to enjoy DeFi, Web3, and gaming applications for the first time on Bitcoin.

Bitcoin Hyper is gaining traction due to nearly $30 million raised in just months and tokens available at a discounted presale price of $0.013485, offering a quick return.

By combining lightning-fast transactions, DeFi capabilities, and staking access, Bitcoin Hyper positions itself as more than just another speculative presale token. With the HYPER token’s value surging every 72 hours, it is emerging as a stable, high-reward investment opportunity with the potential for exponential long-term growth.