Bitcoin (BTC) may be forming a cyclical bottom as a cluster of high-confidence technical signals, a downtrend break, volatility collapse, seller exhaustion, and options repositioning, start aligning for the first time since the October decline, according to new analysis from 10x Research.

The cryptocurrency has traded sideways for weeks, masking shifts beneath the surface that historically precede multi-week recoveries.

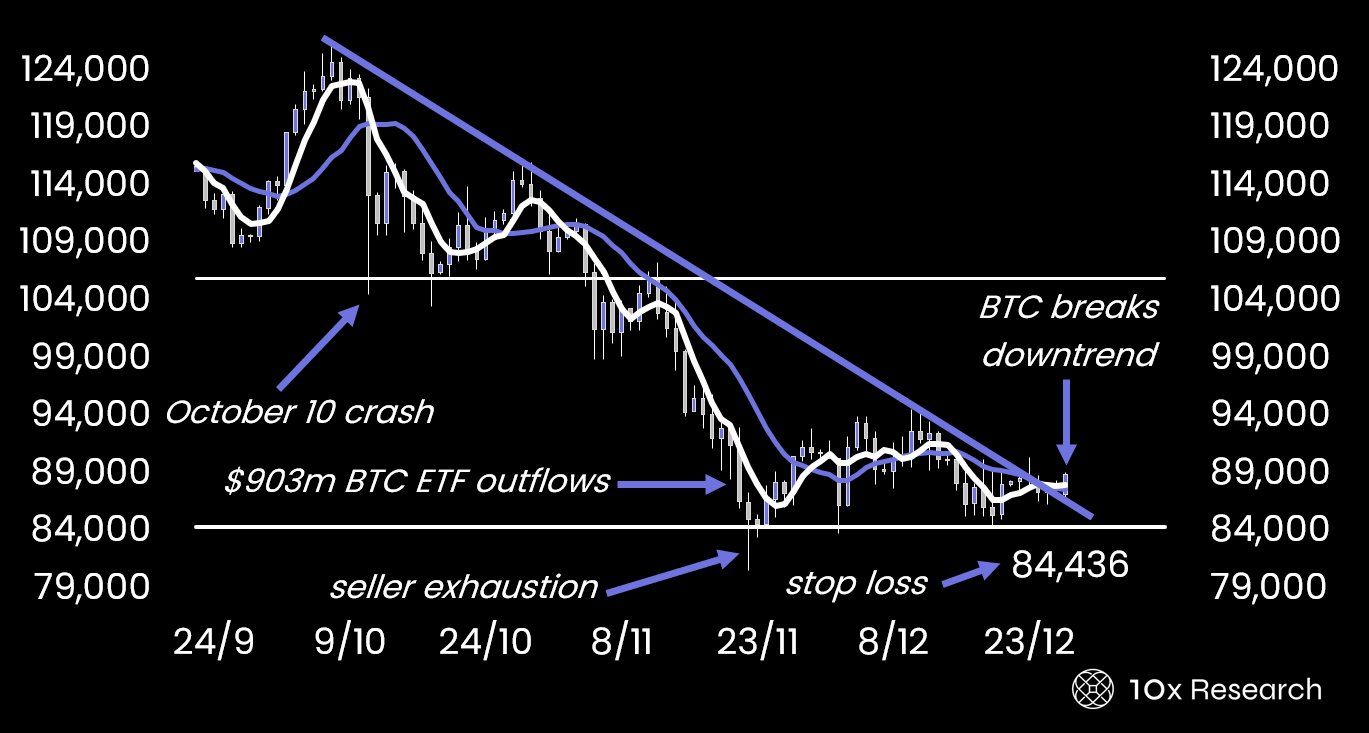

The latest chart shows Bitcoin breaking above a descending trendline that has capped price since early October, a structural change analysts consider essential for any sustained reversal.

A Technical Landscape Resetting After Months Of Pressure

The October 10 crash and nearly $903 million in Bitcoin ETF outflows after the October 29 FOMC meeting created an impaired market structure that lingered through November.

By November 22, 10x Research estimates that seller exhaustion had largely set in, yet price failed to recover, not due to weak fundamentals but because capital rotation flowed elsewhere into year-end outperformers.

Also Read: UK Risks 'Sleepwalking Into Dollarization' Without Unified Crypto Strategy, Says Lord Chris Holmes

The chart highlights this reset: a long downtrend, multiple failed rallies, a capitulation-like stop-loss sweep to around $84,436, and finally a clean breakout above trend resistance.

Historically, this pattern has preceded renewed upside when supported by improving volatility dynamics.

Rare Alignment Of Indicators Suggests Inflection Point

10x Research notes that a “rare convergence” of market factors, options positioning, deeply compressed volatility, and reduced selling pressure, is emerging.

These conditions typically don’t guarantee a rally but have strong predictive value for bottom formation.

Importantly, the firm argues that capital has stayed sidelined not because Bitcoin lacked value, but because “timing has been off.”

With risk budgets resetting into the new year, liquidity may re-enter the market just as technical conditions stabilize.

If the breakout holds, their analysis suggests that a multi-week uptrend becomes a realistic scenario, marking Bitcoin’s first meaningful structural improvement since early Q4.

Read Next: Dogecoin After The Election Surge: What Went Wrong With The $1 Thesis