As Bitcoin continues to underperform in the fourth quarter of 2025, its investors have had multiple reasons to offload and shave off their holdings. Among these investors is a certain cohort, its short-term holders (STHs), who have been facing heat over an extended period.

STH MVRV In Deep Red For 60 Consecutive Days

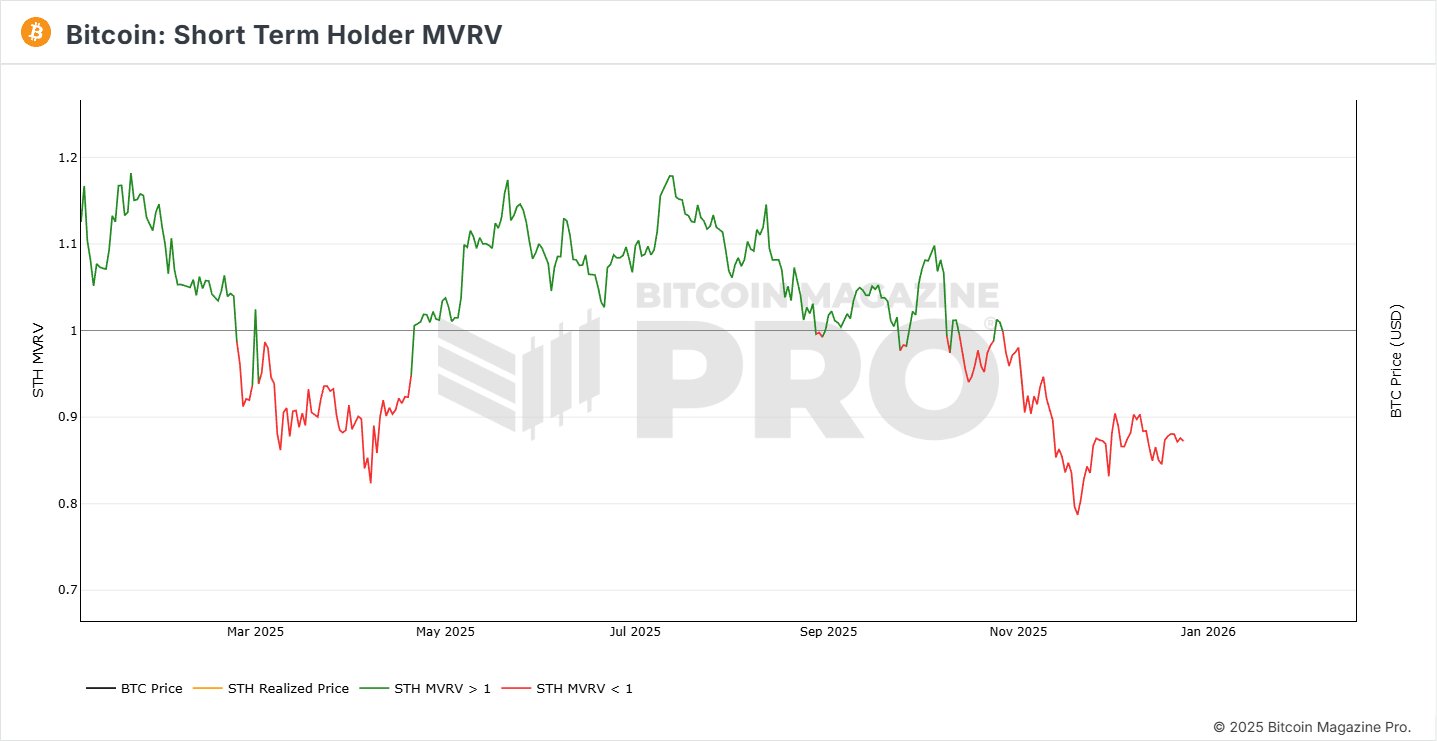

In a recent post on the X platform, market quant Burak Kesmeci revealed an interesting perspective regarding the current market condition for Bitcoin’s most reactive investors — the short-term holders. Kesmeci’s post revolves around the STH MVRV (Market Value to Realized Value) metric.

For context, this metric compares the market value of BTC to its realized value, thus serving as a means to track whether Bitcoin’s short-term investors are, on average, in profit or at a loss.

A reading less than the neutral “1” level typically indicates that the STHs are in the red. Depending on the depth of this value, it could also foreshadow capitulation events. On the other hand, values above 1 reveal that short-term investors are in profit. The higher the value, the more probable it is for profit-taking events to follow.

In his post on X, the online pundit shared that the STH MVRV has been in deep red territory for a full period of 60 days. Kesmeci explained that the flagship cryptocurrency’s short-term investors are now facing the highest level of “patience test” that they have ever witnessed throughout 2025.

Notably, prolonged periods of negative MVRV readings have often correlated with heightened market stress. Seeing as the market’s most-reactive investor cohort is the one concerned, the Bitcoin price could witness the effect of capitulation-driven sell-offs.

However, the opposite is also possible. In the scenario where bearish pressure eases off completely, prolonged negative readings could be a sign of imminent market stabilization.

Bitcoin Stays Beneath 111-Day SMA — What This Means For Price

To lend more weight to his on-chain revelation, Kesmeci also followed up with a key technical observation of Bitcoin’s price action. According to the analyst, Bitcoin has been trading below the 111-day simple moving average (SMA 111) within the same period.

This alignment between on-chain and technical analysis thus functions to reinforce a clear narrative; Bitcoin is either currently at a consolidatory or corrective phase. This is contrary to the belief that the premier cryptocurrency might be at the start of a significant upward trend.

From a broader perspective, Bitcoin’s future trajectory is not completely clear. Macro events, alongside renewed spot demand, could prove pivotal for the cryptocurrency in the future.

This market phenomenon could determine whether BTC plunges deeper to the downside or begins its recovery journey. As of this writing, Bitcoin is valued at around $87,380, with no significant movement in the past day