Year-end usually brings position cuts across crypto. Big wallets and smart money often reduce exposure to secure profits, sit on cash, and wait for lower-liquidity conditions to finish. That’s normal for December. Even with that backdrop, a few assets are seeing the opposite. Crypto whales are adding again across multiple time frames.

One shows steady 30-day accumulation, another gets 7-day whale support, and a third just saw fresh 24-hour inflows.

Chainlink (LINK)

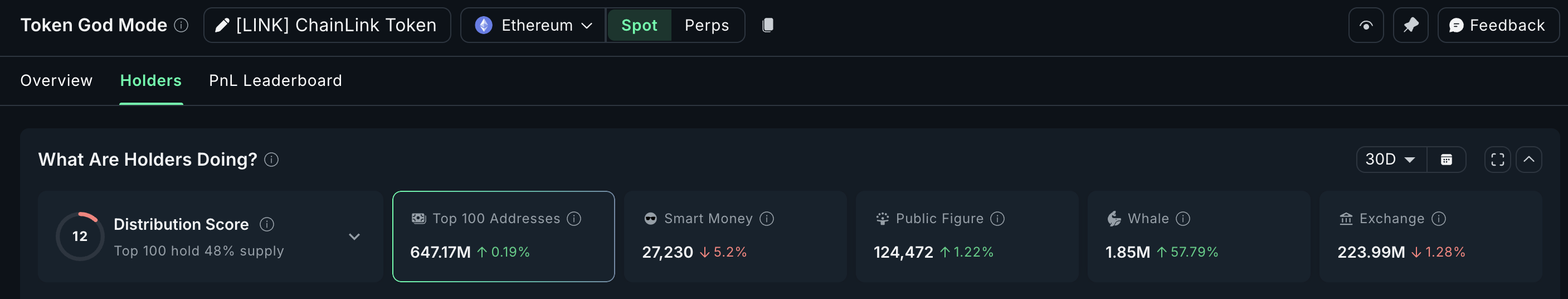

The first token on the list that crypto whales are buying is Chainlink. Whale wallets have raised their holdings by 57.79% over the last 30 days. This means whales added about 680,000 LINK in that period.

At the current LINK price, that is close to $8.5 million in accumulation.

LINK Whales: Nansen

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

This buildup occurs while Chainlink has corrected by about 7.5% over the same period. Smart money wallets have reduced exposure by 5.2%, suggesting whales are positioning early rather than expecting an immediate move.

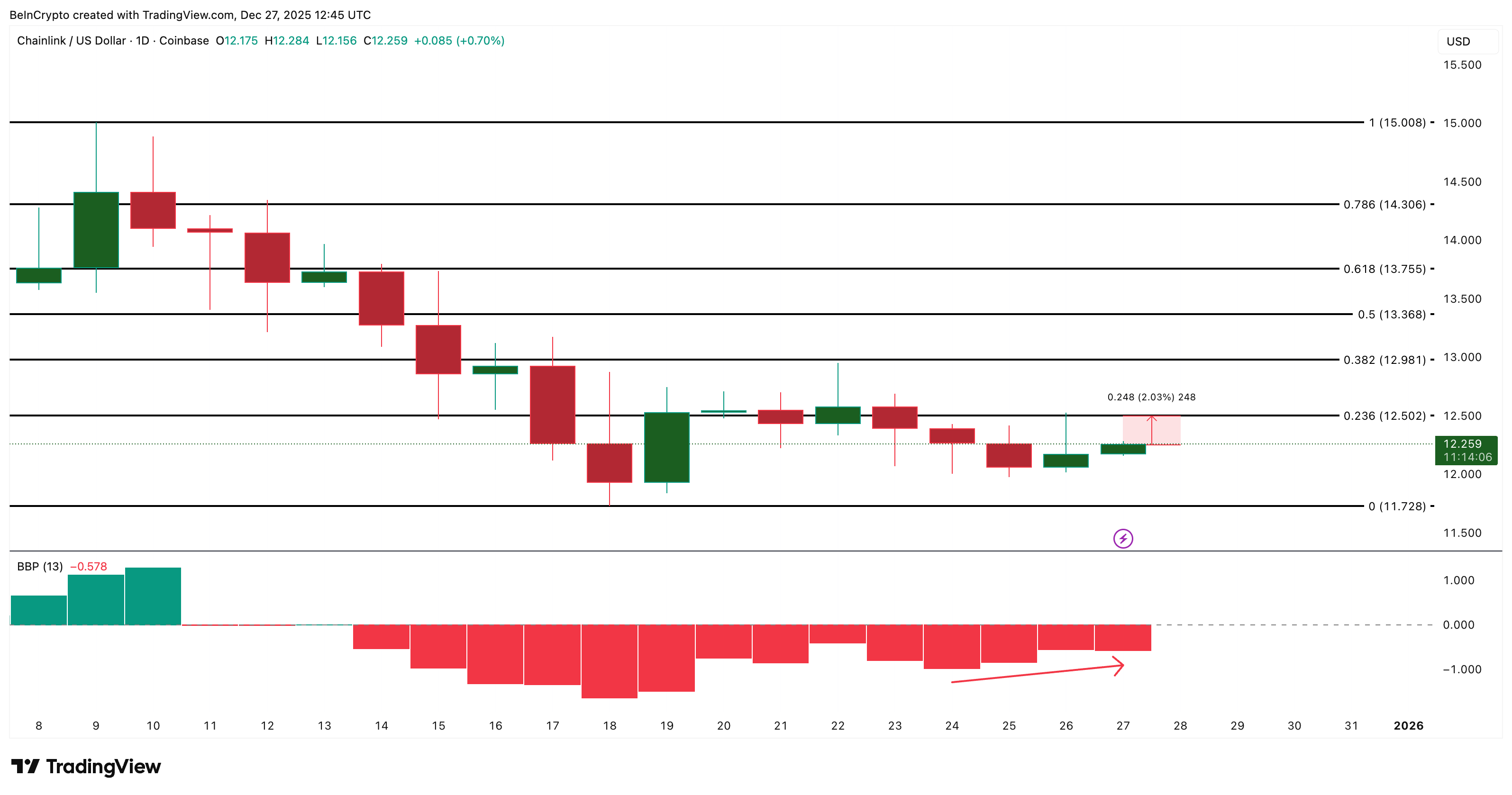

On the chart, the Bull Bear Power (BBP) indicator shows that red bars have been shrinking since December 24. BBP measures the distance between price and a moving average to highlight whether bulls or bears control momentum. When the red bars shrink, bearish pressure is fading.

At the same time, LINK is trying to reclaim a key short-term barrier near $12.50. A daily close above that level would put the token back inside the short-term breakout conversation. Above $12.50, the more critical levels sit near $12.98 and $13.75, and a move past $15.00 would return LINK to a clear bullish zone.

LINK Price Analysis: TradingView

Smart money exiting while whales continue to add hints at a slower setup. The structure suggests whales are accumulating into weakness for a potential move in early 2026, not an immediate breakout. Until $12.50 is reclaimed, LINK may stay range-bound. Also, a dip under $11.72 can invalidate the whales’ bullish theory for now.

Lido DAO (LDO)

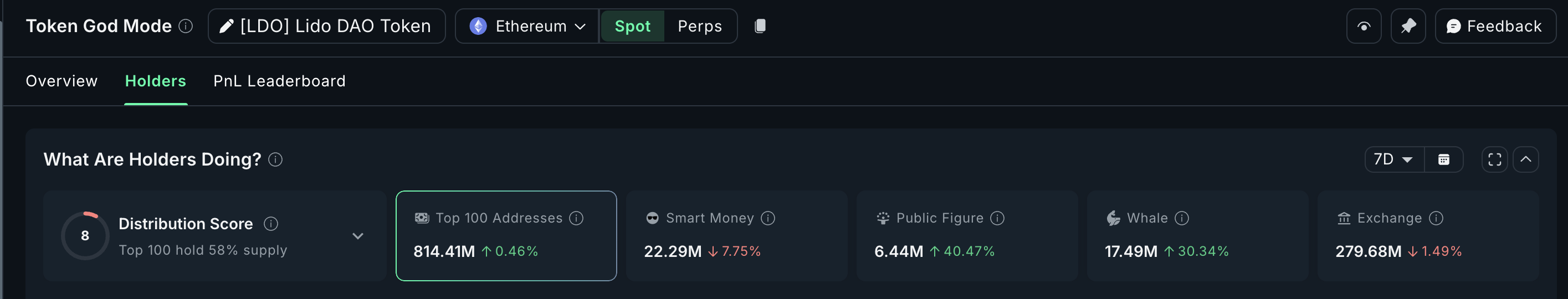

Crypto whales have also turned to Lido over the past 7 days. Their balances are up 30.34%, bringing the cohort’s stash to 17.49 million LDO. At the current price , whales added roughly 4.07 million LDO, worth about $2.28 million in a week.

This comes while the token has gained 4.2% during the same period, which suggests whales are buying into strength.

LIDO Whales: Nansen

Not all big buyers are anonymous. One of the most notable additions came from Arthur Hayes, who accumulated 1.85 million LDO worth around $1.03 million. It also explains why the “Public Figure” cohort has climbed alongside whale activity.

Smart money, however, shows a different stance. Their balances are down 7.75%. Exchange balances are also down 1.49%, hinting that retail may be removing tokens from exchanges rather than selling. This disconnect means the whale thesis might take time to play out and could stretch into early 2026 instead of an immediate move.

On the chart, Lido trades inside a clear range between $0.59 and $0.49. The On-Balance Volume (OBV) indicator, which measures whether volume flows in or out, broke its downtrend on December 23.

That happened at the same time whale inflows picked up, so the signal is worth watching.

A daily close above $0.59 is needed to confirm strength. That level broke on December 14 and hasn’t been reclaimed since. If buyers clear it with conviction, the next zones to watch are $0.76 (0.618 Fibonacci) and then $0.92, where momentum could flip from corrective to bullish.

LDO Price Analysis: TradingView

Until then, range-bound trading remains the base case. A loss of $0.49 would invalidate the current LDO price setup, especially if smart money keeps reducing exposure during year-end volatility.

Aster (ASTER)

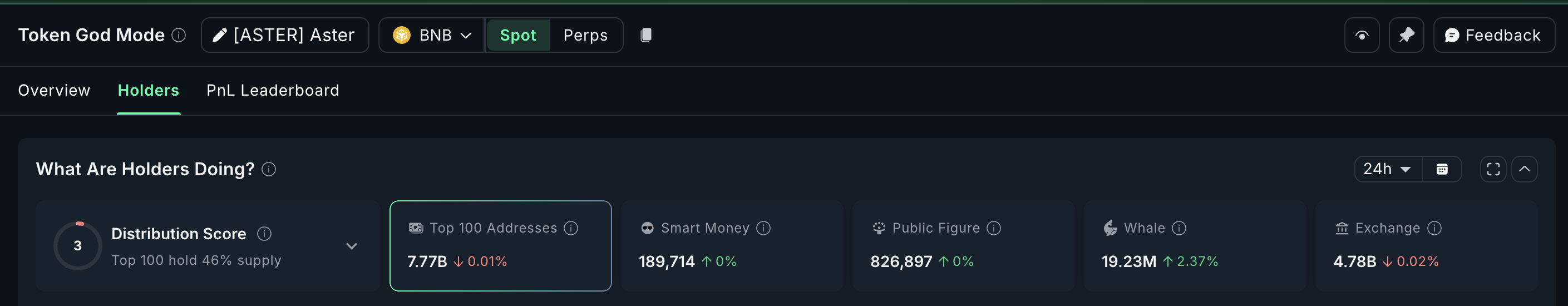

The third token on the list is Aster. This one has seen whale interest on the 24-hour window rather than a longer accumulation trend. Over the past day, whales added 2.37% to their existing stash.

Following this rise, whale holdings now stand at approximately 19.23 million ASTER. At a price of about $0.71, that means whales added roughly 455,000 ASTER, worth a little over $320,000.

ASTER Crypto Whales: Nansen

The addition is not massive. It stands out because ASTER has dropped more than 30% in a month, and this pickup might hint that sentiment is slowly shifting from heavy selling to cautious positioning.

Price action supports this reading. ASTER fell sharply from about $1.40 on November 19 and found support near $0.65, which has held as a floor through December. Selling pressure also looks weaker now. On the Wyckoff Volume indicator, red and yellow bars (seller control) have been fading since December 15. The recent shift toward lighter red/yellow bars suggests sellers are losing dominance.

If whales are right, the recovery attempt begins with a push to $0.83, which requires approximately a 16% move from current prices. Breaking above $0.83 opens room toward $1.03, and then $1.24 if market conditions improve.

ASTER Price Analysis: TradingView

If the price loses $0.65, the thesis breaks down. A clean loss of that level can put ASTER at risk of new local lows as year-end volatility picks up.