Bitcoin is treading water near the $88,000 mark as traders navigate conflicting technical signals, with a bullish MACD crossover emerging against a backdrop of persistent resistance and fragile range support.

The world’s largest cryptocurrency has entered a consolidation phase following its volatile 2025 rally. This pause reflects a familiar late-cycle dynamic: thinning liquidity, reduced leverage, and growing hesitation among market participants. In similar low-volume environments, traders often step back and wait for a decisive daily close outside established ranges, which is why the repeated defense of key support levels is drawing increased attention in the current setup.

Bitcoin Price Today Holds Range as Market Waits for Direction

The broader Bitcoin market cap remains resilient as BTC continues to fluctuate between $86,500 and $90,000, a range that has defined recent price action. Despite intraday volatility, the price has failed to secure acceptance beyond either boundary, reinforcing the sense of equilibrium between buyers and sellers.

Bitcoin remains range-bound between $86.5K and $90K, with a breakdown risking $80K while a $90K breakout could open a move toward $105K. Source: @CryptoMichNL via X

Crypto analyst Michaël van de Poppe described the market as effectively stalled within this zone. “It remains to be stuck in a range, which is between $86.5K and $90K,” he noted in a recent update. He warned that repeated tests of the lower boundary could weaken buyer defenses, adding that “if it tests $86.5K again, we’re likely to break through and test lower grounds around $83K and possibly $80K.”

Such behavior aligns with short-term bitcoin technical analysis today, where muted momentum indicators and compressed volatility often precede expansion. Historically, repeated taps into the same support zone during low-liquidity conditions tend to reduce bid strength, making the next reaction increasingly consequential for short-term positioning.

MACD Bullish Cross Revives Bitcoin Forecast Optimism

While the spot price remains range-bound, momentum indicators are beginning to spark discussion. Crypto trader Ted Pillows highlighted that Bitcoin’s 3-day MACD has registered a bullish cross, an event that, in prior cycles, has coincided with broader trend reversals rather than short-term bounces.

Bitcoin’s 3-day MACD has turned bullish, echoing April 2025’s reversal, raising questions if history will repeat. Source: @TedPillows via X

“$BTC 3D MACD bullish cross has happened. This marked the bottom and reversal in April 2025. Will it happen again?” Ted wrote on X.

In April 2025, a similar signal preceded a powerful rally that carried Bitcoin from below $80,000 to above $127,000, marking its all-time high. However, seasoned traders note that higher-timeframe MACD crosses tend to be more reliable when confirmed by expanding volume and higher-low price structure, conditions that are not yet fully established in the current range.

As a result, the signal is widely viewed as early and conditional, rather than a standalone confirmation of trend reversal.

Bitcoin Technical Analysis Today Shows Key Support and Resistance

From a structural standpoint, TradingView analyst Ratner observes that BTC continues to trade within a well-defined ascending channel, indicating that the broader bullish framework has not yet been invalidated. The recent rejection from the $89,000 resistance zone appears corrective rather than impulsive, suggesting profit-taking rather than aggressive distribution.

BTC is trading inside a clear ascending channel, consolidating between support and $89K resistance, with the recent pullback appearing corrective rather than a reversal. Source: Ratner on TradingView

“As long as BTCUSDT holds above the $87,300 support zone, the bullish structure remains intact,” Ratner explained. A sustained defense of this area could set the stage for another attempt at resistance, where acceptance above $90,000 would carry greater technical weight than any momentum indicator alone.

On the downside, a decisive breakdown below both the support zone and channel structure would shift the bias toward a deeper corrective phase. This risk is compounded by BTC liquidation heatmap data, which shows concentrated liquidity pockets below $86,000, levels that could accelerate downside moves if breached during a volatility expansion.

Final Thoughts

Bitcoin’s price action near $88,000 reflects a market balancing patience with uncertainty. While higher-timeframe momentum signals, such as the MACD bullish cross, suggest that downside pressure may be moderating, price structure and volume remain the dominant confirmation tools.

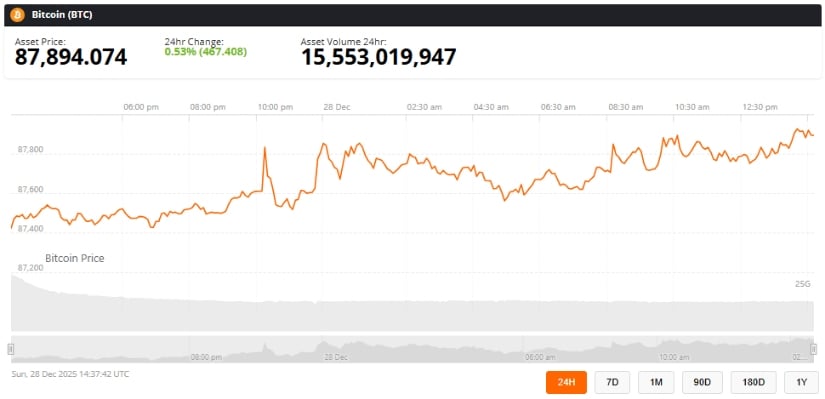

Bitcoin was trading at around 87,894, up 0.53% in the last 24 hours at press time. Source: Bitcoin price via Brave New Coin

For short-term traders, the $86,500–$87,300 zone remains the key risk area to monitor, as repeated tests could weaken support. Trend-focused participants, meanwhile, are likely to wait for a high-volume breakout and sustained close above $90,000 before reassessing directional bias. Until that confirmation arrives, Bitcoin’s consolidation remains less a signal of direction and more a test of conviction on both sides of the market.