Bitcoin price prediction analysis is once again gaining attention after BTC regained the crucial $90,000 in the early morning session on Monday. The largest crypto is up 2.77% in the past 24 hours, with trading volume surging 90% to $27 billion.

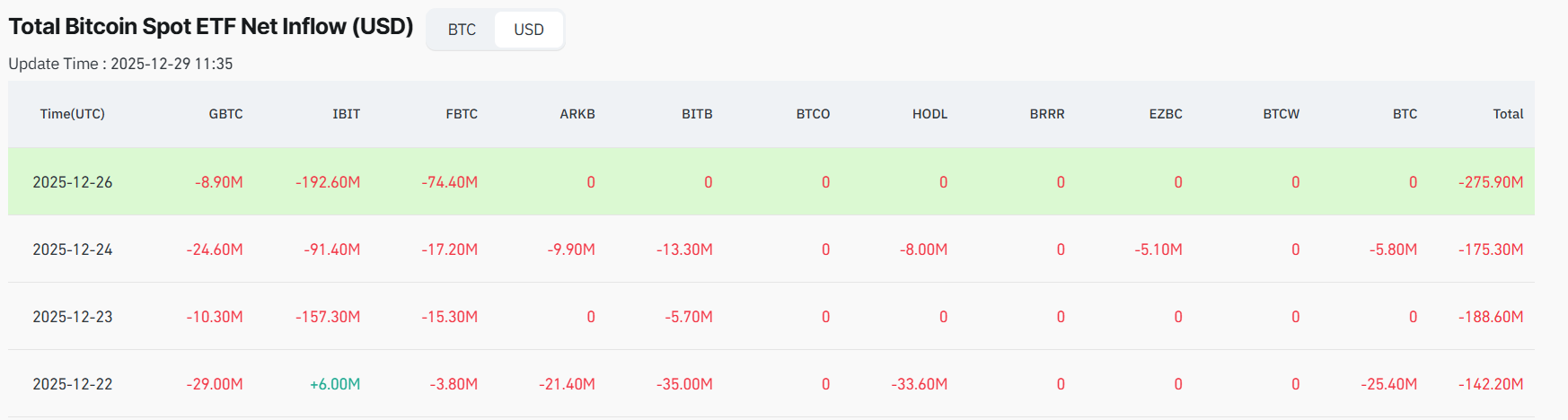

However, last week’s performance in Bitcoin ETFs does not support this revival. During Christmas week, BTC ETFs saw $782 million in outflows. The total net assets across these ETF products fell to roughly $113.5 billion by the weekend.

Despite this, a strong price rebound in Bitcoin, accompanied by increased volume, has renewed investor interest. Expert investors are expecting a New Year rally in the crypto market, and capital rotation has already begun. Leading the presale pack is Bitcoin Hyper, which is nearing the $30 million milestone, as savvy investors continue to increase exposure at lower prices.

Holiday Slowdown Drains Liquidity, New Year May Reset Sentiment

Spot Bitcoin exchange-traded funds (ETFs) recorded significant losses during Christmas as a liquidity crunch hit the market. The ETF products saw investors pull a combined $782 million, according to data from Coinglass.

BTC ETFs saw their largest weekly outflow on a Friday, with investors withdrawing $276 million. BlackRock’s IBIT took the most brutal hit, losing close to $193 million, while Fidelity’s FBTC recorded withdrawals of about $74 million. Grayscale’s GBTC also continued to face smaller but steady outflows.

Source: Coinglass

Despite that short-term dip, the broader picture remains strong. By mid-December, spot Bitcoin ETFs had attracted a combined $57.7 billion in net inflows since launching in January 2024. This shows that long-term investor interest has mainly stayed intact.

In a recent conversation, Vincent Liu, chief investment officer at Kronos Research, said, “As desks return in early January, institutional flows typically re-engage and normalize.”

As more financial institutions gradually adopt these products, Bitcoin ETFs have moved out of the spotlight. Market attention has instead shifted toward the possibility of new ETF launches, which could drive higher digital asset prices and open the door for a wider group of investors.

Bitcoin Price Prediction Aims For $100K Recovery

Bitcoin has regained the key $90,000 level on Monday after weeks of consolidation below the psychological mark. In the past two weeks, the crypto has struggled to regain this level, only to fail several times.

Bitcoin Price Chart. Image Courtesy: TradingView

The year-end rally expectations and broader market strength across global financial markets led to Bitcoin’s rise on Monday. The primary factor investors continued to rely on for bullish momentum was the expectation that the U.S. Federal Reserve would further reduce interest rates in 2026 following its recent cut.

Bitcoin’s price is currently hovering just below $90,000 after a slight rejection at the resistance level. The 50-day moving average is acting as a crucial resistance breakout, which could pave the way for $100,000. On the downside, $86,500 and $84,000 are the major support levels.

Bitcoin Hyper Emerges As a Strong Bet Backed By Bitcoin’s Security

As the Bitcoin price prediction analysis points to a short-term recovery, one layer-2 Bitcoin project, Bitcoin Hyper, is quickly becoming one of the most talked-about projects of 2025. The project has captured nearly 50,000 presale holders and is building real momentum, reaching close to $30 million in presale volume.

Bitcoin Hyper positions itself as a fast, next-generation Layer-2 network built to extend what Bitcoin can do. It uses a Solana-style virtual machine for execution while anchoring final settlement on Bitcoin, combining speed with security.

Holiday vibes, long-term vision.

Bitcoin Hyper keeps building. ?⚡️https://t.co/VNG0P4FWNQ pic.twitter.com/oPpGCvz8wg

— Bitcoin Hyper (@BTC_Hyper2) December 27, 2025

This setup helps remove one of Bitcoin’s biggest limits, slow and costly transactions, making it more practical for real-world financial use, including large-scale institutional strategies.

Instead of pushing every transaction directly onto Bitcoin’s main chain, Bitcoin Hyper handles activity off-chain at extremely high speeds and then batches the results back onto the main chain. This approach dramatically increases throughput, cuts transaction costs, and eases network congestion, all without weakening Bitcoin’s underlying security model.

$30 Million Milestone, Low Price, and Community Incentives

With over 650 million tokens sold in just a few months of launch, Bitcoin Hyper has emerged as the best crypto presale of 2025. In the current presale stage, HYPER tokens are available at just $0.013495 with presale standing at $29.85 million. Analysts believe that crossing the $30 million milestone could trigger a sharp price surge.

Another highlight of the project is 39% p.a. Staking rewards for presale adopters, which is the highest in the industry. With strong investor backing and revolutionary technology, Bitcoin Hyper could emerge as the next star in the crypto market.