KEY TAKEAWAYS

NEWT broke out of a symmetrical triangle, with strong follow-through confirmed by the AO.

Its volume hit $900 million, and active addresses rose to 12,000, indicating growing demand.

NEWT could target $0.62 and $0.82, with $0.42 acting as a key support in case of a pullback.

NEWT, the native utility token of the Newton Protocol project, is one of the few cryptos that have posted notable gains today.

In the last 24 hours, the NEWT token price has increased by 40% and reached its highest level since June 24.

While trading at $0.50, several indicators reveal that NEWT might not give up its gains anytime soon. Instead, the altcoin might be in line to trade higher.

Here are the reasons and the potential price targets in the short and mid-term.

NEWT Rebounds After Slump

On the 4-hour chart, NEWT has printed two back-to-back bullish engulfing candles, pushing the price to $0.50.

That is a major shift from the post-airdrop slump, which saw the token bleed out in a steady correction.

This price action contradicts its performance some weeks after its airdrop and launch, resulting in a notable correction.

A closer look at the chart shows that the altcoin had to break out of a symmetrical triangle to reach this height.

Amid the NEWT token price increase, CCN observed that the Awesome Oscillator (AO) has formed higher green histogram bars.

Beyond that, the Bollinger Bands (BB), which measure volatility, have expanded. This expansion indicates heightened volatility around the altcoin, which could lead to quick price movement.

Hence, if bulls continue to dominate and the BB fails to contract, then NEWT’s price could accelerate the uptrend.

Participation Spikes, Volume Follows

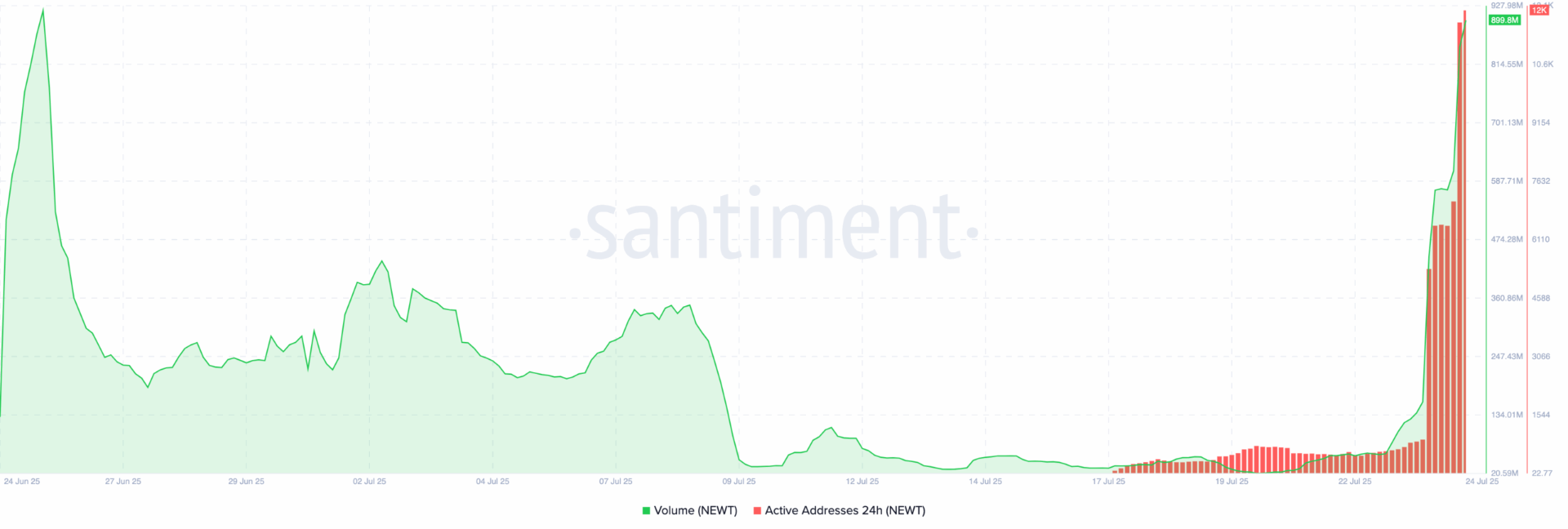

Outside the technical outlook, data from Santiment shows that NEWT’s trading volume has spiked to nearly $900 million, indicating that capital is rotating into the altcoin.

At the same time, 24-hour active addresses have hit an all-time high of 12,000. This is a key sign of growing network engagement and rising user activity.

A substantial price expansion starts when volume and active wallets spike together, especially for lower-cap assets.

If sustained, this surge in participation could fuel more upside for the NEWT token.

NEWT Price Targets the Wicks

Similar to the 4-hour analysis, the 2-hour NEWT/USD chart presents a bullish outlook.

The Moving Average Convergence Divergence (MACD) indicator remains in positive territory.

Additionally, the MACD, supported by the Exponential Moving Average (EMA), has formed a bullish crossover.

This crossover indicates that NEWT’s price is likely to rise above the highest wick point of $0.55.

If this occurs, the next target for the cryptocurrency could be a surge to $0.62, potentially paving the way for a move to $0.82.

However, if selling pressure arises, the NEWT token may struggle to reach these targets. In such a scenario, its value could decline toward $0.42.