Verge price prediction attracts many crypto investors who want to understand if this coin has real potential. Verge is one of the older cryptocurrencies. It focuses on privacy, fast payments, and everyday use. Because of this, many investors still watch it closely.

At the moment, Verge trades around $0.0048. The monthly low stands at $0.0046, reached on December 19. The recent monthly high reached $0.008 on November 23. These price levels show how volatile XVG can be, even in short periods. For beginners, this volatility may look confusing. However, it also creates opportunities and risks worth understanding.

This article explains everything in simple terms. You will learn what Verge is and how it works. We will look at its history, key features, and price behavior. You will also discover what experts say about future price trends. Step by step, we will break down XVG price predictions for the coming years.

| Current XVG Price | XVG Price Prediction 2026 | XVG Price Prediction 2030 |

| $0.0048 | $0.03 | $0.3 |

Verge (XVG) Overview

Verge is a decentralized cryptocurrency created for everyday payments. It launched in 2014 under the name DogeCoinDark. Later, the project rebranded to Verge to focus on privacy and usability. The XVG token powers the network.

Verge aims to offer fast, private, and low-cost transactions. Unlike many newer projects, Verge does not rely on smart contracts or complex ecosystems. Instead, it focuses on being digital cash. Users can send payments globally without revealing personal data.

The network uses an open-source blockchain. Anyone can review the code. This approach improves transparency and trust. Verge does not have a central company behind it. A global community of developers and supporters maintains the project.

Privacy plays a key role in how Verge works. The network integrates technologies like Tor and I2P. These tools hide IP addresses and user locations. As a result, transactions become harder to trace. This feature appeals to users who value anonymity.

Verge uses a Proof-of-Work mining model. Multiple algorithms secure the network. This design helps prevent mining centralization. It also allows more people to participate using different hardware setups.

Another important aspect is speed. Verge confirms transactions faster than Bitcoin. Fees remain very low, even during network congestion. This makes XVG suitable for small payments and daily use.

Verge also supports real-world adoption. Over the years, merchants have accepted XVG for goods and services. While adoption remains limited, the goal stays clear. Verge wants to act as private digital cash for everyone.

XVG Price Statistics

| Current Price | $0.0048 |

| Market Cap | $79,148,419 |

| Volume (24h) | $4,589,285 |

| Market Rank | #298 |

| Circulating Supply | 16,521,951,235 XVG |

| Total Supply | 16,555,000,000 XVG |

| 1 Month High / Low | $0.008 / $0.0046 |

| All-Time High | $0.2619 Dec 24, 2017 |

XVG Price Chart

CoinGecko, December 23, 2025

Verge Price History Highlights

2014: The Beginning – Ultra-Low Price Era

Verge Currency entered the market in October 2014 under the name DogeCoinDark. The first recorded price stood at $0.0000078. From the start, selling pressure dominated. By year-end, the price fell to $0.000003, marking a 55% decline. Despite the tiny price, volatility reached extreme levels. Average market capitalization stayed near $18,000, reflecting almost no market awareness.

2015: Slight Growth at the Bottom

In 2015, Verge showed early signs of life. The price increased sharply in percentage terms but remained very low in absolute value. XVG closed the year at $0.000013, up 330% from the prior close. January marked the all-time low at $0.0000025. Despite growth, Verge remained obscure, with an average market cap of $114,000.

2016: Rebranding and First Structural Shift

The rebrand to Verge Currency marked a turning point. The project shifted focus toward privacy and transaction anonymity. By the end of 2016, XVG traded around $0.000019, up 45% year over year. While still small, the average market capitalization rose to roughly $429,000, signaling early community interest.

2017: Historic Bull Market Explosion

2017 defined Verge’s legacy. The price opened near $0.00001 and surged to a peak of $0.3 in December. The year closed around $0.2226, representing a gain of over 1,100,000%. Factors included a broader crypto bull run, public promotion by John McAfee, and anticipation of the Wraith Protocol. Average market cap climbed to $121 million, while volatility exceeded 390%.

2018: Collapse and Loss of Trust

The bullish momentum collapsed in 2018. XVG fell from $0.2217 to $0.0068, a 97% drop. Delays and disappointment surrounding Wraith Protocol hurt sentiment. Multiple 51% attacks further damaged trust. Even the Pornhub payment announcement failed to reverse the trend. Volatility dropped sharply as market interest faded.

2019: Extended Bear Market

In 2019, the downtrend continued. Verge declined from $0.00703 to $0.00344, a 50% decrease. Trading activity weakened, and volatility dropped below 100%. Average market capitalization hovered around $94 million, far below its peak.

2020: Early Signs of Recovery

The broader crypto recovery lifted XVG in 2020. The price rose from $0.00356 to $0.00754, delivering a 110% gain. Increased interest in alternative coins helped Verge regain some traction, though market cap remained modest at around $78 million.

2021: Second Bull Cycle

Verge benefited from the 2021 bull market. The price climbed from $0.00730 to $0.0171, a 135% increase. The yearly high reached $0.0792, still far below the 2017 peak. Market capitalization averaged $436 million, the strongest level since 2018.

2022: Severe Bear Market Pressure

Macro tightening and crypto collapses hit Verge hard. The price dropped from $0.0177 to $0.00266, down 85%. Interest declined sharply, and average market cap fell to $98 million.

2023: Slow Recovery With a Sudden Spike

In 2023, XVG ended higher at $0.00399, up 50%. A sudden mid-year rally pushed the price briefly to $0.009657 without clear catalysts. Many viewed the move as speculative. The price later stabilized, with volatility remaining elevated.

2024: Strong Rebound

Verge surged in 2024, rising from $0.00413 to $0.0132, a 220% gain. Renewed market optimism and Bitcoin ETF approval fueled momentum. The yearly high reached $0.0206, still far below the all-time high.

2025 to Date: High Volatility Returns

In 2025 so far, XVG fell from $0.0143 to $0.0048, a 65% decline. The year showed sharp monthly swings, reflecting weak conviction. Average market capitalization stands near $106.9 million, confirming Verge’s niche position.

Verge Price Prediction: 2026, 2027, 2030-2050

| Year | Minimum Price | Maximum Price | Average Price | Price Change |

| 2026 | $0.007 | $0.058 | $0.03 | +525% |

| 2027 | $0.011 | $0.08 | $0.04 | +730% |

| 2030 | $0.03 | $0.64 | $0.3 | +6,150% |

| 2040 | $2.48 | $7.42 | $5 | +104,000% |

| 2050 | $3.34 | $13.8 | $8 | +166,500% |

Verge Price Prediction 2026

DigitalCoinPrice analysts forecast that in 2026, Verge could trade between $0.00916 (+95%) and $0.0116 (+145%). This outlook assumes gradual adoption growth and improving market sentiment.

According to PricePrediction, XVG may see more modest movement. Their models suggest a minimum of $0.00736 (+55%) and a potential high of $0.00864 (+80%), indicating a consolidation phase.

Telegaon is significantly more bullish. Their 2026 projection places Verge between $0.028 (+490%) and $0.058 (+1,100%), driven by expectations of renewed interest in privacy-focused cryptocurrencies.

Verge Price Prediction 2027

DigitalCoinPrice expects Verge to extend its upward trend in 2027, with prices ranging from $0.0127 (+170%) to $0.0168 (+255%), supported by steady ecosystem development.

PricePrediction aligns with a cautious growth scenario. Their estimates point to a floor of $0.011 (+130%) and a ceiling of $0.0126 (+165%).

Telegaon maintains an aggressive stance. Their 2027 forecast sees XVG trading between $0.059 (+1,150%) and $0.082 (+1,630%), reflecting strong confidence in long-term adoption.

Verge Price Prediction 2030

By 2030, DigitalCoinPrice believes Verge could reach $0.0295 (+520%) at the low end and $0.0373 (+685%) at the high end, assuming broader crypto market expansion.

PricePrediction sees similar momentum. Their projections suggest a minimum of $0.0321 (+580%) and a maximum of $0.0381 (+700%).

Telegaon’s long-term model is far more optimistic. Their 2030 outlook places XVG between $0.44 (+9,050%) and $0.64 (+13,200%), based on strong speculative and adoption-driven growth.

XVG Price Prediction 2040

PricePrediction’s ultra-long-term scenario for 2040 estimates Verge between $2.48 (+52,000%) and $3 (+62,400%), assuming widespread real-world usage.

Telegaon projects an even higher range. Their 2040 forecast spans from $5.48 (+116,000%) to $7.42 (+157,0800%), reflecting a highly bullish adoption curve.

Verge Price Prediction 2050

Looking further ahead, PricePrediction suggests XVG could trade between $3.34 (+70,000%) and $3.84 (+81,000%) by 2050, if Verge secures a lasting role in the crypto ecosystem.

Telegaon’s most optimistic model places Verge between $11.09 (+231,000%) and $13.78 (+287,000%), assuming long-term mainstream acceptance and sustained demand.

XVG Price Prediction: What Do Experts Say?

Crypto4light offers a scenario-based view that helps beginners understand risk and reward. His analysis separates conservative, bullish, and aggressive outcomes. In a cautious scenario, he points to $0.05 as a realistic target if Verge confirms a long-term trend reversal. This level represents a large upside from recent prices. A stronger bullish case places XVG near $0.08, assuming privacy coins regain market attention and Verge holds key support zones.

The most aggressive outlook targets $0.5, close to the 2017 all-time high. However, Crypto4light clearly states this outcome requires specific conditions. The most important one is a drop in Bitcoin dominance below 50%. This shift often signals capital rotation into altcoins. He also warns that failed accumulation could push XVG back toward the $0.002–$0.0046 range.

Moon333 focuses on chart structure and breakout patterns. He highlights a multi-year formation with higher highs and higher lows. His key resistance zone sits between $0.017 and $0.021. A confirmed breakout could open the path toward $0.05, while the long-term technical ceiling stands near $0.1. He stresses patience and volume confirmation before entry.

XVG USDT Price Technical Analysis

This analysis uses monthly data from Investing.com, which many traders treat as a benchmark for technical sentiment. On the monthly timeframe, indicators focus on long-term trends rather than short-term noise. For beginners, this view helps identify the dominant market direction.

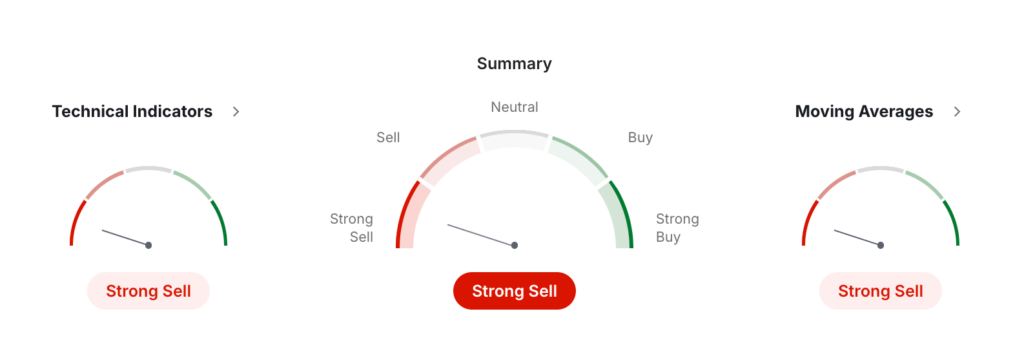

The overall monthly summary for XVG/USDT is “Strong Sell.” Both major groups of indicators confirm this signal. Moving averages show zero buy signals and twelve sell signals, which suggests that the long-term trend remains clearly bearish. Price trades below all key averages, including the 50, 100, and 200-month levels. This setup usually signals sustained downward pressure.

Investing, December 23, 2025

Technical indicators also lean bearish. Out of nine signals, six show sell conditions, two suggest buying, and one remains neutral. The RSI at 47.48 stays neutral, which means XVG is not extremely overbought or oversold on a monthly basis. However, oscillators tell a different story. The Stochastic and MACD both signal selling pressure, while Williams %R and StochRSI sit in oversold territory. This combination often appears during weak trends that may pause but not yet reverse.

Volatility remains high. The ATR reading of 0.0047 confirms wide monthly price swings. This explains why XVG often experiences sharp rallies followed by deep pullbacks. ADX signals weak trend strength, which means bears dominate but without strong momentum.

Pivot levels provide useful reference zones. The main monthly pivot sits near $0.007. Below this level, sellers control the market. Resistance zones appear around $0.009–$0.011, while deeper support starts near $0.005 and lower.

In simple terms, the monthly structure remains bearish. A trend reversal would require reclaiming key moving averages with strong volume. Until then, technical data favors caution.

What Does the XVG Price Depend On?

The price of Verge depends on several connected factors. For beginners, it helps to see price as a result of demand, trust, and market conditions. XVG does not move in isolation. It reacts to both internal development and external forces.

First, overall crypto market sentiment plays a major role. When Bitcoin rises strongly, capital often stays in Bitcoin. When Bitcoin dominance falls, altcoins like XVG tend to attract attention. Broad bull markets usually support higher XVG prices. Bear markets do the opposite.

Second, adoption and real-world usage matter. Verge Currency aims to act as digital cash. If more merchants accept XVG or if users actively transact on-chain, demand increases. Without visible usage growth, price rallies often fade quickly.

Third, privacy narrative strength influences interest. Verge competes with other privacy-focused coins. When regulators increase pressure or users seek anonymity, privacy coins often gain attention. If privacy falls out of focus, demand weakens.

Other important drivers include:

network activity and transaction volume;

development progress and software updates;

exchange listings and liquidity;

community engagement and visibility.

Another key factor is technical structure. Traders watch long-term support and resistance levels. If XVG holds support zones for months, accumulation may occur. Breakdowns below support often trigger sharp sell-offs due to low liquidity.

Macroeconomic conditions also matter. Rising interest rates reduce speculative capital. An easier monetary policy usually helps altcoins. Verge reacts strongly to these shifts because it lacks institutional backing.

Finally, trust and historical perception still influence price. Past security issues and failed expectations hurt confidence. This means XVG often needs stronger signals than newer projects to attract buyers.

Verge (XVG) Features

Verge focuses on privacy, accessibility, and fast payments. Its design differs from many modern blockchains. Instead of adding complex smart contract layers, Verge improves privacy at the network connection level. This approach reduces data leakage before transactions even reach the blockchain.

A key feature is native Tor integration. Verge wallets route traffic through Tor nodes. This process hides the user’s IP address and physical location. As a result, outside observers cannot easily link transactions to real identities. Verge also supports I2P tunneling, which uses packet-based routing. I2P adds another anonymity layer and improves resistance against traffic analysis.

Another unique element is the Wraith Protocol. This feature allows users to choose between public and private transactions. A public transaction appears on the blockchain like Bitcoin. A private transaction hides sender and receiver data using stealth addressing. This optional privacy model gives users flexibility instead of forcing full anonymity.

Verge uses a multi-algorithm Proof-of-Work consensus. The network supports five mining algorithms: Scrypt, X17, Lyra2rev2, myr-groestl, and blake2s. This structure allows miners with different hardware to participate. CPUs, GPUs, and ASICs can all secure the network. The goal is decentralization and protection against mining monopolies.

Historically, this design faced challenges. In 2018, attackers exploited timestamp manipulation on one algorithm. These events led to chain reorganizations and security concerns. Since then, developers patched the difficulty adjustment logic. While fixed, this history still shapes market perception.

Performance also matters. Verge produces blocks every 30 seconds, much faster than Bitcoin. The network can process around 100 transactions per second. Verge supports Simple Payment Verification (SPV), which allows lightweight wallets to confirm transactions in about 5 to 10 seconds.

XVG Coin Price Prediction: Questions And Answers

Is XVG a Good Investment?

XVG can be considered a high-risk, speculative investment. Verge focuses on privacy and payments, not rapid innovation. This limits hype-driven growth but also reduces constant dilution. For beginners, XVG may work better as a small portfolio addition rather than a main asset. Its history shows strong rallies, but also very deep corrections.

What Are the Risks of Investing in XVG?

The main risks include low adoption growth, limited development visibility, and strong competition in the privacy coin sector. Verge also carries reputational damage from past security incidents. Low liquidity increases volatility. Because of this, XVG prices can fall quickly during bearish market phases or periods of low interest.

What Is Happening With Verge XVG Right Now?

Verge is currently in a long-term consolidation phase. Price action shows weak momentum and limited buyer conviction. Development continues quietly, but without major catalysts. As a result, XVG follows broader market trends rather than project-specific news. This makes price movements slower and more sentiment-driven.

Can Verge Rise Again in the Future?

Yes, Verge can rise again under the right conditions. A broader altcoin cycle, falling Bitcoin dominance, and renewed interest in privacy coins could support higher prices. However, sustained growth requires stronger adoption signals. Without them, rallies may remain short-lived and corrective in nature.

How High Can Verge Coin Go in a Bull Market?

In a strong bull market, analysts often point to $0.05–$0.1 as realistic upside zones. These levels align with historical resistance and long-term technical targets. Reaching higher prices would require exceptional market conditions and heavy capital inflows. Such moves should be treated as speculative scenarios, not base expectations.

Will XVG Price Reach Its All-Time High Again?

Reaching the 2017 all-time high near $0.3 would be extremely difficult. It would require a massive altcoin cycle and renewed trust in the project. While not impossible, current fundamentals do not strongly support this outcome. Most analysts see this scenario as low probability.

Will XVG Reach $1?

A $1 price target would require extraordinary growth and adoption. This would imply a market capitalization far above Verge’s historical levels. No major analyst currently treats this scenario as realistic. It remains a highly speculative narrative often driven by optimism rather than data.

Will XVG Reach $10?

A $10 valuation is considered unrealistic by nearly all market models. It would require Verge to become a dominant global payment network. There is no current evidence supporting such adoption. This target should be viewed as theoretical rather than investable.

What Is The XVG Price Prediction for 2026?

Most forecasts for 2026 place XVG between $0.007 and $0.058, depending on market conditions. Conservative models expect consolidation. Bullish models assume renewed interest in privacy coins. The wide range highlights uncertainty and the speculative nature of long-term forecasts.

How Much Will Verge Be Worth in 2030?

By 2030, projections range widely from $0.03 to above $0.4 in aggressive scenarios. Moderate forecasts assume steady market growth, while optimistic models rely on strong adoption. These estimates should be treated as scenarios, not guarantees, and depend heavily on overall crypto market expansion.

Is Verge XVG a Secure Coin?

Verge is considered technically secure today, but it carries historical risk factors. The network uses Proof-of-Work and multiple mining algorithms, which improve decentralization. Past attacks in 2018 exposed weaknesses, but developers patched them. Since then, no major exploits have occurred. Still, trust recovery remains slower compared to newer projects with cleaner histories.

Where to Buy Verge Coin?

StealthEX is here to help you buy XVG crypto if you’re looking for a way to invest in this cryptocurrency. You can buy Verge privately and without the need to sign up for the service. StealthEX crypto collection has more than 2,000 different coins, and you can do wallet-to-wallet transfers instantly and problem-free.

How to Buy Verge Coin: Quick-Step Guide

Just go to StealthEX and follow these easy steps:

Choose the pair and the amount you want to exchange — for instance, ETH to XVG.

Press the “Start exchange” button.

Provide the recipient address to transfer your crypto to.

Process the transaction.

Receive your Verge coins.

Follow us on Medium, X, Telegram, YouTube, and Publish0x to stay updated about the latest news on StealthEX.io and the rest of the crypto world.

Don’t forget to do your own research before buying any crypto. The views and opinions expressed in this article are solely those of the author.