Bitcoin is entering a fragile phase where price stability is increasingly dependent on capital behavior rather than hype or narrative.

Several independent on-chain indicators are now pointing to the same issue: liquidity is not leaving the crypto market, but it has stopped moving. This distinction matters. Markets usually break not when money exits, but when it freezes.

Key Takeaways

Bitcoin is holding up, but market momentum and capital deployment are clearly weakening

Stablecoin inflows to exchanges have dropped sharply, limiting upside potential

If liquidity doesn’t return, the market risks a slow bleed or eventual capitulation

Recent data from Alphractal and CryptoQuant highlights a market that is drifting into a low-conviction environment – one where participants are hesitant to commit fresh capital or deploy existing reserves.

Market Cap Momentum Is Fading, Not Collapsing

Bitcoin’s market cap growth rate has slipped into a zone historically associated with prolonged downside pressure. This does not automatically signal an imminent crash, but it does suggest that the forces driving expansion have weakened materially.

According to analysis shared by Joao Wedson, continued deterioration in this metric would raise the probability of a capitulation-style move. Historically, when market cap growth stalls while price remains elevated, the market becomes vulnerable to sharp re-pricing once confidence breaks.

Bitcoin’s Market Cap is currently in a zone that signals an aggressive bear market ahead.

If this metric declines further over the coming weeks, BTC’s price is likely to enter a capitulation phase.

It’s important for the Bulls to take action!

Chart: @Alphractal pic.twitter.com/5SA2qvlBUL

— Joao Wedson (@joao_wedson) December 28, 2025

In other words, Bitcoin is currently supported more by inertia than by demand.

Stablecoins Reveal a Market on Pause

If Bitcoin’s market cap shows slowing momentum, stablecoin flows confirm the hesitation beneath the surface.

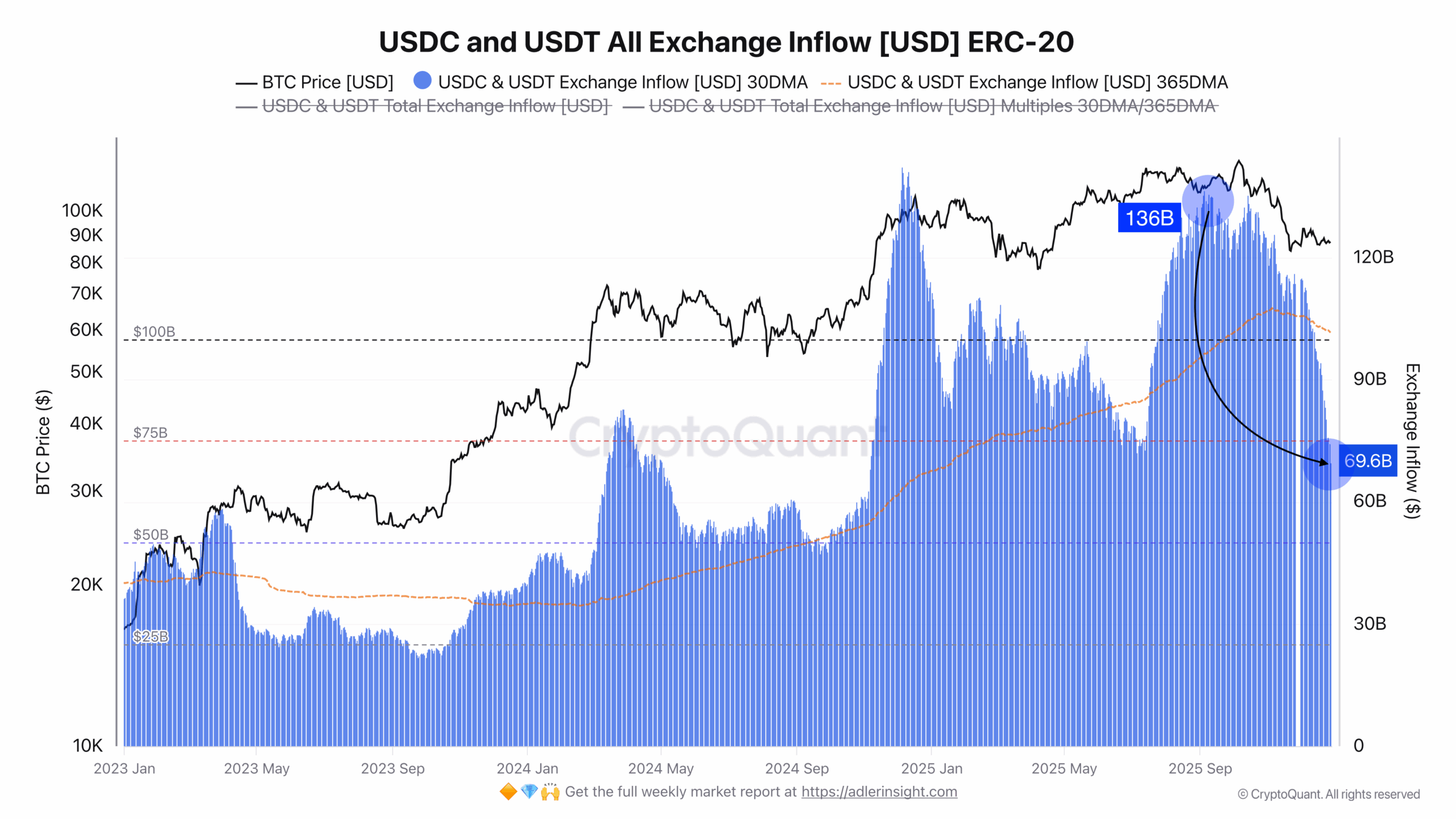

Exchange inflows of USDC and USDT – often a proxy for deployable buying power – have dropped sharply. Average monthly inflows have fallen from roughly $136 billion in early autumn to around $70 billion now, effectively cutting available exchange liquidity in half.

This trend, highlighted by Darkfost, suggests that while capital remains inside the crypto ecosystem, it is not being converted into active risk exposure.

This is not panic behavior. It is defensive positioning.

Liquidity Is Trapped Inside the System

One of the most important takeaways from the data is what is not happening.

There is no large-scale exit from crypto into fiat. Stablecoin market caps have not collapsed, and capital is not fleeing exchanges en masse. Instead, funds appear to be parked – waiting for clarity.

This creates a market that can drift lower without heavy selling pressure, but also struggles to rally meaningfully. In such conditions, price becomes highly sensitive to negative catalysts, while positive news produces only muted reactions.

Why This Phase Is Dangerous for Bulls

Markets do not need aggressive sellers to fall. They only need a lack of buyers.

If stablecoin inflows remain weak and market cap growth continues to trend lower, Bitcoin risks entering a slow grind that eventually forces capitulation through exhaustion rather than fear. This is often the phase where leveraged positioning gets quietly unwound and sentiment erodes without dramatic headlines.

For bulls, the challenge is clear: price needs renewed capital commitment, not just holding behavior.

Without that, support levels become increasingly fragile.

What to Watch Next

Going forward, stablecoin inflows will likely be the decisive signal. A sustained recovery in exchange inflows would indicate that sidelined capital is re-engaging, potentially stabilizing Bitcoin’s structure.

Until then, the market remains in a holding pattern – cautious, illiquid, and vulnerable.

In past cycles, this kind of environment has resolved in one of two ways: either a sharp flush that resets positioning, or a slow bleed that drags price lower over time.

At the moment, Bitcoin appears uncomfortably positioned between the two.