ChatGPT predicts Bitcoin could reach between $175,000 and $230,000 by the end of 2026, drawing from historical cycles, macro volatility, and renewed institutional interest. Bitcoin’s current range near $89,000 signals mid-cycle consolidation, while trading volume has surged over 130% in the last 24 hours.

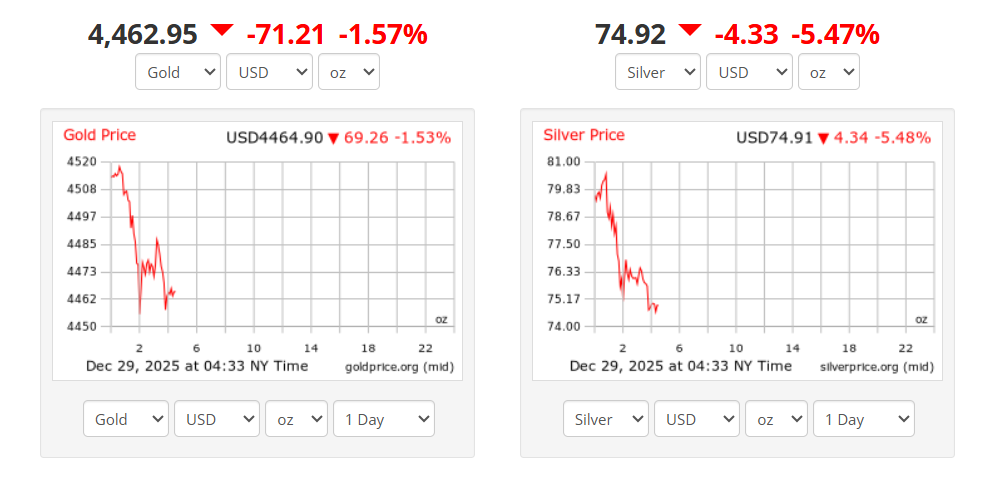

Meanwhile, physical assets like gold and silver are posting new all-time highs, suggesting a global rotation into hard stores of value. Traders are closely watching support near $87,000 and resistance at $88,600, but sentiment remains cautious.

With Bitcoin Hyper’s presale rapidly approaching its cap, early investors are positioning ahead of the next major market move.

Bitcoin Struggles to Regain Momentum Below $90K

Bitcoin’s current price of $89,400.77 reflects a modest 1.84% daily gain, but its underlying indicators remain mixed.

The 14-day RSI holds at 44.94, pointing to neutral momentum. More concerning, the trend remains technically bearish, with all major moving averages signaling SELL.

From the 50-day SMA at $91,536 to the 200-day EMA at $103,940, BTC remains locked beneath key trend lines. Short-term resistance has formed between $88,095 and $88,602, while the Fear & Greed Index lingers at 24, signaling extreme caution among retail traders.

Support is holding in the $87,000 zone, providing a critical base that has so far prevented deeper losses. Volume has surged to $31.64 billion, up over 130%, but analysts say this activity is primarily consolidation-driven rather than breakout buying.

Unless Bitcoin flips $90,000 convincingly, it risks repeating the 2019 structure – flat action followed by a macro-driven leg up months later. ChatGPT’s projection assumes the latter, tying future rallies to institutional accumulation, ETF demand, and a post-halving supply shock.

On-Chain Indicators Hint at Accumulation Phase

Despite technical pressure, long-term holders appear unfazed. Accumulation metrics suggest wallets holding for more than six months have increased their BTC balances, even as short-term traders remain sidelined.

Historically, similar patterns emerged before major bull runs in 2017 and 2020, both of which followed halving years. This cycle’s setup is almost identical: macro fear, price stagnation, and growing capital inflows into alternative stores of value.

Market volatility is currently at 2.15% (medium), while price has rebounded from a recent low near $83,745. Analysts are watching for a clean break above $88,600, which could open up a retest of the $96,800 level.

But with moving averages stacked against it, BTC needs a fundamental catalyst to shift the trend – such as ETF inflows, regulatory clarity, or a major liquidity event. ChatGPT’s 2026 prediction assumes one or more of those catalysts will materialize before year-end 2025.

Macro Tailwinds Build as Gold and Silver Continue to Rally

While crypto traders hesitate, traditional safe havens are showing strength. Gold is up 1.21% this week, trading at $4,482.50, its highest level of the year. Silver followed closely, holding at $2,415.16, with a recent high of $2,697.59.

These gains reflect growing anxiety around inflation, interest rates, and central bank policies. Analysts believe capital is moving into tangible assets – both physical and digital – in search of long-term protection.

Bitcoin has historically followed gold’s momentum with a short lag. In 2020, gold broke out weeks before Bitcoin surged to $40,000. The current correlation suggests that Bitcoin could mirror this trend again, particularly if price holds above its long-term support range.

ChatGPT’s forecast for $200K BTC in 2026 assumes continued hard-asset rotation as governments struggle to manage monetary policy and global debt levels.

Bitcoin Hyper Nears $30M Raised as Retail Looks for Early Exposure

While Bitcoin holds under major resistance, smaller investors are moving into high-upside altcoins. Bitcoin Hyper has now raised over $29.85 million, with just a few thousand dollars left before the next presale price increase.

The token is currently priced at $0.013495, and buyers are rushing in as the timer counts down on the current stage. With Web3Payments integration and multi-token purchase support, Bitcoin Hyper offers low-friction entry at a time when BTC feels inaccessible to many retail traders.

Presales often gain momentum when Bitcoin consolidates, especially if sentiment is low and traders seek asymmetric upside. ChatGPT’s bullish outlook on long-term crypto adoption echoes what early Bitcoin Hyper backers are betting on: that the next big rally will reward those who positioned early – before the breakouts begin.